Learning the friendly way

Dive into our resources, guides, and articles for all things money-related. Grow your financial confidence with our experts curated tips and articles for both experienced and new investors.

LATEST ARTICLEs

You might be familiar with buying and selling cryptocurrencies, but have you tapped into the world of crypto airdrops?

Airdrops are essentially marketing strategies that are designed to build awareness and interest in a blockchain-based crypto project. As we set out to provide more information and explain what these are, we will also touch on the benefits that airdrops can bring to participants.

What is a crypto airdrop?

A crypto airdrop is when a project gives out its native coins or tokens for free as a marketing tool to generate hype, grow its network and gain wider adoption. On occasion, the tokens require small tasks such as following social media pages, and other times they are entirely free of engagement.

These tokens are then transferred to current or potential users' wallets for free in the hopes of drawing in more business. Airdrops gained significant momentum during the DeFi summer of 2020 and have evolved considerably, with major distributions from Layer 2 networks and decentralised protocols becoming increasingly common throughout 2023 and 2024. While handed out for free, some airdrops have been known to fluctuate in value over time.

Through distributing tokens, projects aim to increase their number of holders (a positive metric for up-and-coming projects) as well as broaden decentralisation by spreading ownership across more community members. In practice, however, some distributions become concentrated among professional airdrop farmers.

How do cryptocurrency airdrops work?

Some airdrops are planned in advance and outlined in a project's tokenomics, while others (especially retroactive ones) are announced later as a surprise reward to early users. While airdrops can range from project to project, they typically involve amounts of cryptocurrencies being distributed to eligible wallets. These are often on Ethereum Layer 2 networks like Arbitrum or Optimism, or on high-performance chains such as Solana and Polygon.

These tokens are usually distributed for free, however, users may need to perform specific tasks related to platform usage (like making transactions, providing liquidity, or engaging with the protocol) or hold certain tokens in their wallet.

A successful airdrop will see its recipients becoming active community members and genuine users of the protocol beyond just receiving free tokens.

What is the difference between an ICO and an airdrop?

While both are related to new digital currency projects, the major difference between the two is that airdrops are when tokens are distributed for free, while ICOs require participants to purchase the project's tokens with an outlined purchase price.

ICOs were primarily a fundraising mechanism that peaked in 2017–2018, while airdrops serve as both marketing strategies and community reward systems. Note that ICOs have largely been replaced by other fundraising methods in today's crypto landscape.

What are the different types of airdrops?

As mentioned above, there are several different types of airdrops: exclusive, bounty, holder, and retroactive.

- Exclusive airdrops

These airdrops are centred around active members of the community or early adopters. In exclusive airdrops, tokens are only sent to designated wallets based on specific criteria.

Arbitrum's 2023 airdrop is a notable example, distributing ARB tokens to users who had bridged funds and actively used the network before a snapshot date.

- Bounty airdrops

Bounty airdrops are when users need to engage in specific activities to claim their tokens.

This typically involves social media engagement (following accounts, joining Discord servers, retweeting posts, etc.) or completing educational tasks.

Projects might require proof of completion before distributing the tokens.

- Holder airdrops

This type of airdrop rewards users already holding specific tokens to thank them for their loyalty. The project's team will take a snapshot of wallet balances at a certain time and reward all wallets that meet the minimum criteria.

Recent examples include various Layer 2 tokens being distributed to Ethereum holders or DeFi protocol tokens being given to users of related platforms.

- Retroactive airdrops

This has become one of the most popular airdrop types, where projects reward users who have already interacted with their protocol before the token launch. Users receive tokens based on their historical usage, transaction volume, or engagement with the platform.

Notable examples include Uniswap (2020) and dYdX (2021). Rumours of an OpenSea airdrop have circulated for years, though no official token has been released.

The downside to airdrops

Naturally, there are ill actors out there who take advantage and have created airdrop scams. These scams might involve a "project" airdropping tokens into a wallet, but when the holder attempts to interact with these tokens, malicious smart contracts can drain their wallet or compromise their security.

Another example of an airdrop scam is a project enticing you to sign up for the airdrop by connecting your wallet to a malicious website, only to gain unauthorised access to your funds. These are typically conducted through fake websites and imposter social media accounts on Twitter (X), Discord, and Telegram that look very similar to legitimate projects but are in fact phishing scams.

It's important to DYOR (do your own research) when engaging in an airdrop, and know that a legitimate project will never require you to send funds to "unlock" tokens, provide your seed phrase or private keys, or connect to suspicious websites. Always verify official project channels and be cautious of unsolicited airdrop announcements.

Another downside to airdrops is that projects can create an incorrect impression of adoption. If thousands of tokens are distributed to thousands of wallets, this might cause the project to appear more active and adopted than it actually is.

When evaluating a project, ensure that it has genuine trading volume and active usage that reflects the number of token holders. If there are many holders but minimal genuine activity, consider this a significant red flag.

Lastly, many airdrop recipients immediately sell their tokens upon receiving them, which can create significant selling pressure and price volatility for new projects. This "airdrop farming" behaviour has led some projects to implement more sophisticated distribution mechanisms and vesting schedules.

If you’re curious about how to approach crypto while keeping risk in check, you’re not alone. As more people fold digital assets into their traditional portfolios, it helps to understand the basics of portfolio management and how crypto markets move.

Much like with stocks or bonds, having a sense of different investment approaches and how they align with your own goals, style, and long-term plan can make all the difference.

With that in mind, here are five key concepts worth knowing when it comes to navigating the crypto market and managing risk (no technical analysis necessary). If you're already in the know, feel free to skip to the next part!

Understanding the basics of cryptocurrency investment

Cryptocurrency is a form of digital asset that exists on decentralised networks, secured by blockchain technology. Unlike traditional money, it isn’t issued or controlled by a single entity, which creates both opportunities and challenges for anyone exploring the space.

It’s helpful to distinguish between investing and trading. Trading typically involves frequent buying and selling to take advantage of short-term price movements, while investing usually focuses on holding digital assets over a longer period to capture potential growth. Understanding these approaches is essential when developing your own strategy.

Bitcoin continues to serve as the benchmark asset for the crypto market. Its widespread adoption, liquidity, and historical performance make it a reference point for comparing other digital currencies. That said, all cryptocurrencies carry unique risks and opportunities, from volatility and regulatory changes to innovations in blockchain technology.

Before buying any crypto, it’s important to do your own research. Explore the technology behind each asset, consider market trends, and assess your comfort with risk. Learning the fundamentals first provides a stronger foundation for navigating the market with confidence.

Top 5 tools for your crypto investment strategy

Here are five key things to keep in mind as you explore digital currencies. They can help you learn different crypto investment approaches and prevent common mistakes along the way.

Understanding liquidity

In crypto, liquidity is one of the most important concepts to understand. Simply put, liquidity measures how easily an asset can be turned into cash without losing much value. For traders, it’s about how quickly and reliably they can buy or sell at a fair price.

Bitcoin is a good example — it consistently has some of the highest liquidity in the market. In a volatile space like crypto, being able to enter or exit positions quickly can make a big difference. That depends on supply and demand: buyers willing to pay a fair price and sellers ready to trade.

A common way to gauge liquidity is by looking at trading volume (how much of a coin is being bought and sold) along with the level of interest from market participants.

Embrace volatility

The crypto market is well known for its sharp ups and downs. While volatility can create opportunities to profit when prices swing, it also brings risks, especially for long-term investors.

Over time, cryptocurrencies have matured, yet speculation and shifting market sentiment still drive sudden moves. Big swings are part of the risk, while smaller day-to-day fluctuations remain a constant trend across the market.

A good guide is to understand your own risk tolerance before jumping in. Keeping up with exchange activity, news, blockchain updates, and historical price data can help you spot patterns and stay informed about where the market might be heading.

The fundamental rule: only invest what you can afford

Possibly the most important crypto investment strategy: the golden rule of investing is never to invest more than you're willing to lose. If losing all of your crypto would put you in financial trouble, that’s a sign your allocation might be too high for your current money situation.

A practical guide is to think about your income, expenses, and overall financial picture when weighing risk. Some people also choose to talk with a professional financial advisor for extra clarity.

You’ll often see commentators mention small, single-digit allocations for beginners and higher allocations for more active participants. But there’s no one-size-fits-all approach; it really depends on your personal circumstances. These are just general examples for learning purposes, not personalised advice.

Profit-taking strategies

Some people in the crypto industry take a more systematic approach to profit-taking (but, again, there’s no single strategy that works for everyone).

When it comes to ownership of digital assets, investors often debate whether to cash out or hold through the swings. Some companies and individuals stick to the classic ‘hodl’ approach, while others sell portions of their gains and move into stablecoins, sometimes re-entering if prices drop.

This method can help secure profits while staying connected to the market, but predicting short-term economic trends and timing swings consistently remains one of the biggest challenges in crypto.

Diversification Revelation

The traditional wisdom of "don't put all your eggs in one basket" applies strongly to crypto portfolios and investment approaches. Building a thoughtful portfolio typically involves incorporating different types of coins and crypto projects, always after conducting thorough research.

Some market participants create diversity by exploring various established digital currencies alongside DeFi projects, coins associated with emerging technologies, or NFT-related tokens. Diversification allows crypto explorers to potentially balance lower-risk and higher-risk assets, though all crypto investments carry substantial risk.

Timing the market vs time in the market

One of the biggest challenges in crypto is timing price movements. Even experienced traders struggle to consistently predict when to buy low or sell high. The fast pace of the market, combined with global economic news and shifting industry trends, makes short-term timing extremely difficult.

That’s why many observers point to the benefits of “time in the market” rather than trying to “time the market.” Long-term strategies and consistent investing approaches often give participants a better chance of riding out volatility. A common case study is Bitcoin: while short-term traders sometimes caught profits during sudden spikes, many long-term holders benefited from simply staying invested through multiple cycles.

The key takeaway is balance. Knowledge, patience, and discipline often matter more than chasing the perfect entry or exit. Securing your assets, preventing avoidable risks, diversifying across different companies and projects, and doing thorough research before buying are all part of building resilience.

Markets will always fluctuate, but staying informed and engaged gives you the tools to adapt.

Trade with confidence

Another important element to consider when investing in cryptocurrencies is where to keep them. Ensure that you store your cryptocurrencies in a safe location, preferably on a regulated platform that holds insurance.

Looking ahead in 2025

As the crypto market continues to mature, some digital assets have demonstrated resilience over multiple market cycles. Market participants often view periods of lower prices as potential accumulation opportunities, though past performance doesn't guarantee future results.

These 5 crypto investing strategy concepts can serve as educational foundations for understanding the space. Remember that cryptocurrency markets remain highly volatile and speculative, and it's important to do your own research and consider consulting with qualified financial professionals before making investment decisions.

If you’re interested in staking Ethereum, you came to the right place. The largest liquid staking protocol in the crypto ecosystem, trusted by thousands of ETH holders who want rewards without losing liquidity, has a name: Lido DAO.

Ethereum's Leading Liquid Staking Protocol

How does it work?

Lido DAO is a decentralized autonomous organization that provides a liquid staking solution on the Ethereum 2.0 blockchain as well as other Proof of Stake (PoS) platforms like Solana (SOL), Polygon (MATIC), Polkadot (DOT), and Kusama (KSM).

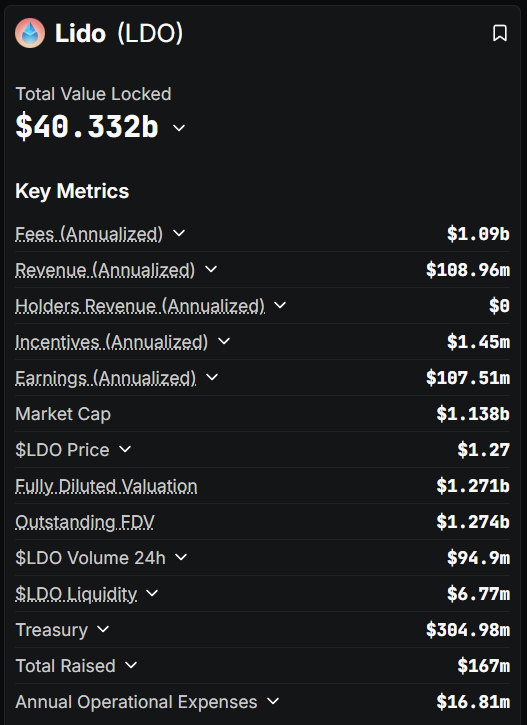

Instead of locking up funds, users stake ETH and receive stETH tokens in return, which represent their staked ETH plus accrued rewards. This allows users to continue trading, lending, or using their tokens across DeFi while still benefiting from staking yields. Since launching in 2020, Lido DAO has grown to manage more than $40.33B in Total Value Locked (TVL), with staking rewards currently averaging an annual percentage rate (APR) of 2.71%. The protocol is governed by holders of the LDO token, ensuring community-driven decision-making.

Where did it come from?

Lido DAO was co-founded by Kasper Rasmussen and Jordan Fish, also known as CryptoCobain. Behind the Lido DAO are a number of individuals and organizations that are well-regarded within the DeFi space. Since its inception in December 2020, shortly after ETH 2.0's release, the platform has been overseen by the Lido DAO, with several key members including Semantic VC, Chorus, ParaFi Capital, P2P Capital, Libertus Capital, Terra, StakeFish, Bitscale Capital, StakingFacilities, and KR1. Several of the highly esteemed angel investors include Stani Kulechov of Aave, Banteg of Yearn, Will Harborne of Deversifi, Julien Bouteloup from Stake Capital, and Kain Warwick from Synthetix.

Since then, Lido DAO has gained an impressive reputation for its liquid staking capabilities, and now boasts over $13 billion in staked assets. Its core focus is on Ethereum, yet its horizons are expanding to other blockchain networks including Terra and Solana, both of which launched staking capabilities in 2021, as well as several other layer 1 PoS blockchains.

Liquid Staking Made Simple

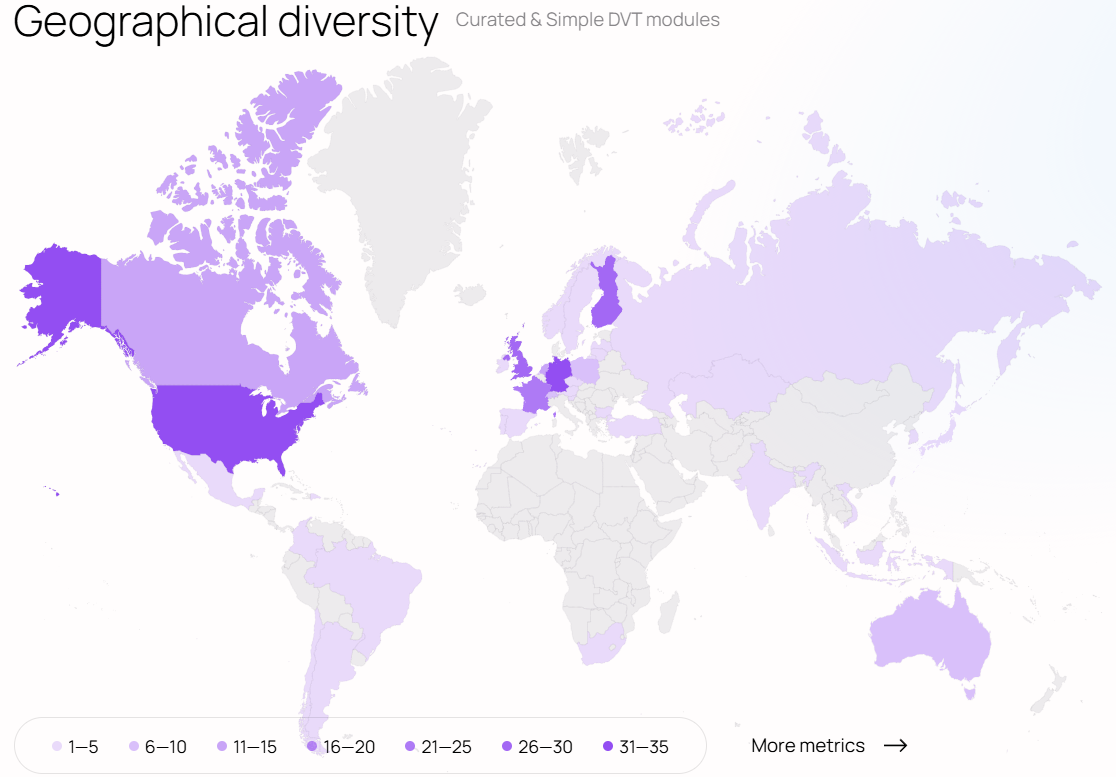

Lido DAO simplifies staking into a three-step process: deposit ETH, receive stETH, and start earning rewards automatically. When a user deposits ETH, the protocol delegates funds to a decentralized network of professional node operators. There are over 800 node operators worldwide, who manage validation securely and efficiently.

The stETH tokens received are liquid ERC-20 assets whose value increases over time as rewards accumulate. With one-click staking through Lido DAO’s interface, users can skip the hassle of running their own validator while enjoying a 98.2% validator performance.

How validator rewards are earned from staked assets

So, in order to stake ETH, become a validator and earn rewards for validating payments on the Ethereum platform, users are required to stake a minimum of 32 ETH tokens. What if I don’t have 32 ETH? You may ask. To bypass this minimum requirement and still earn rewards, Lido DAO allows users to stake a fraction of this amount and earn a proportionate amount of block rewards.

Users will then deposit ETH into the Lido smart contract and receive the same number of stETH. These tokens are minted once the funds have been received and are burned when the users withdraw their original ETH. The staked funds will then be distributed to the validators on the Lido network and deposited into the Ethereum Beacon Chain from where they will be secured in a smart contract.

The Lido DAO will then assign, onboard, support and enter the validators' addresses to the smart contract registry before being given a set of keys for the validation. All ETH that users have deposited on the Lido platform will be split into groups of 32 ETH among the active Lido node operators who will use this public validation key to validate transactions. The block rewards will then be shared proportionately.

Notably, this distribution process of sharing staked assets eliminates single-point-of-failure risks common among single-validator staking.

Your Liquid Staking Asset

At the center of Lido DAO’s system is stETH, the tokenized representation of staked ETH. stETH trades on major exchanges, offering deep liquidity and integration with several DeFi protocols. Staking rewards are earned automatically, so users never need to claim manually.

Users can stake any amount of ETH to the Beacon Chain without having to deal with lock-up requirements or withdrawal delays. This way Ethereum holders can enjoy both liquidity and yield simultaneously. For providing this staked ETH service, a 10% fee is collected by Lido for each process.

DeFi Integration Opportunities

For advanced users, stETH unlocks a wide range of yield optimization strategies. Lending platforms like AAVE accept stETH as collateral, while liquidity pools on CURVE and UNISWAP offer additional yield opportunities. Leveraged staking strategies also allow users to compound rewards further.

Proven Security

Security and safety are central to Lido DAO's success. Since the beginning, the protocol has undergone a dramatic array of independent audits, conducted by top-tier firms including Statemind, Certora, Hexens, Oxorio, MixBytes, and Ackee Blockchain.

Importantly, Lido DAO has never suffered a major protocol-wide hack. The protocol takes advantage of open-source code, multisig governance, and safeguards like GateSeal for emergency pauses, deposit security modules, and DAO oversight to anticipate and mitigate emerging threats. These layers of defense, combined with a multi-validator, geographically distributed network, reduce single points of failure.

What is Lido DAO token (LDO)?

Governance of the Lido DAO is powered by the LDO token, which grants voting rights to its holders. With a market capitalization of $1.14B and an all time high (ATH) price of $2.38 USD, LDO plays a central role in shaping the protocol’s future. Token holders vote on proposals, influence fee structures, and participate in selecting node operators. The governance community is highly active, with regular proposals and ongoing discussions that ensure the protocol evolves in a decentralized and transparent way.

How to buy Lido LDO?

Staking with Lido DAO is meant to be as accessible as possible. There are no minimum deposit requirements; end users can stake any amount of ETH. You can connect an Ethereum wallet, confirm the transaction, and receive stETH instantly.

If you're looking to expand your digital currencies portfolio, LDO tokens can be a potential addition. The Tap app provides an easy and secure way for anyone with an account to add these tokens to their portfolios in no time, making it one of the most effortless trading experiences around.

You can utilize the Tap app to access the Lido ecosystem by purchasing LDO tokens with either crypto or fiat currencies. End users can then choose to store their LDO tokens securely in the integrated crypto wallet or transfer them to the Lido platform and engage in the platform's earning potential. All you need to do to get started is download the app and create an account in minutes.

Despite radically reshaping the world’s financial landscape, the first ever cryptocurrency has limitations when interacting with newer blockchains. For example, Ethereum. Wrapped Bitcoin (WBTC) solves this limitation by allowing Bitcoin to function on the Ethereum network, enabling access to decentralized finance (DeFi) services.

WBTC is an ERC-20 token that represents Bitcoin 1:1 on the Ethereum blockchain, combining Bitcoin’s value with Ethereum’s smart contract power, and opening new opportunities for BTC holders in decentralized finance (DeFi). Unlike Bitcoin variants aiming to improve its technology, WBTC extends Bitcoin's utility without replacing it.

Join us in this deep dive on how WBTC works, its benefits, risks, and how it connects Bitcoin to the broader DeFi ecosystem.

Unlocking Bitcoin’s Power on Ethereum

Launched in January 2019, approximately 10 years after Bitcoin's initial release, WBTC was created as a collaborative effort between BitGo, Kyber Network, and Ren (formerly Republic Protocol), along with other major players in the DeFi space including MakerDAO, Dharma, and Set Protocol.

As an ERC-20 token, WBTC adheres to Ethereum's token standard, making it compatible with the entire Ethereum ecosystem, including its smart contracts, decentralized applications, and wallets.

In structure, WBTC bears similarities to stablecoins like USDC or USDT, which are backed by reserve assets. However, while stablecoins aim to maintain a stable value (usually pegged to a fiat currency like the US dollar), WBTC's value fluctuates with Bitcoin's market price.

Each WBTC token is backed by an equivalent amount of Bitcoin (BTC) held in reserve by a custodian, maintaining a strict 1:1 ratio, meaning 1 WBTC is always equivalent to 1 BTC in value.

Wrapped Bitcoin is now under the control of a Decentralized Autonomous Organization (DAO) called the WBTC DAO. This organization oversees the protocol, ensuring the integrity of the wrapping process and maintaining transparency in the system. Unlike Bitcoin's fully decentralized nature, WBTC relies on certain trusted entities to maintain the backing of the tokens, which creates an interesting balance between utility and trustworthiness.

WBTC belongs to a broader category of financial instruments known as "wrapped tokens." These are cryptocurrencies that are enclosed or "wrapped" in a digital vault and represented as another token on a different blockchain. While WBTC represents Bitcoin on Ethereum, there are other wrapped tokens in the cryptocurrency space, including Wrapped Ether (WETH) which, somewhat paradoxically, is a wrapped version of Ethereum's native token on its own blockchain that conforms more strictly to the ERC-20 standard.

Why Does Wrapped Bitcoin Exist?

Wrapped Bitcoin (WBTC) was created to bridge the gap between Bitcoin and newer blockchain platforms like Ethereum.

1. Bitcoin's limited smart contract functionality

Bitcoin prioritizes security over programmability, making it unsuitable for complex decentralized apps. In contrast, Ethereum supports smart contracts that power a wide range of automated financial services.

2. Access to DeFi for Bitcoin holders

Ethereum's DeFi ecosystem offers lending, trading, and yield farming, but Bitcoin holders couldn't participate without converting their BTC. WBTC solves this, letting them use Bitcoin's value within Ethereum-based applications.

3. Unlocking Bitcoin's liquidity

Bitcoin's vast market capitalization holds significant untapped liquidity. WBTC brings this capital into Ethereum's DeFi network, benefiting both Bitcoin holders and the broader ecosystem.

4. Faster, more flexible Bitcoin transactions

While Bitcoin transactions can be slow and costly, WBTC uses Ethereum's network for quicker, cheaper trades-ideal for active traders and DeFi users.

In short, WBTC enhances Bitcoin's utility without altering its core protocol, connecting it to the evolving world of decentralized finance.

How Does Wrapped Bitcoin Work? The Nuts and Bolts

Wrapped Bitcoin (WBTC) bridges Bitcoin and Ethereum through a secure, transparent process involving key participants and smart contracts.

1. Wrapping and unwrapping process:

Wrapping (BTC → WBTC): Users send Bitcoin to a custodian, who secures it and mints an equivalent amount of WBTC on Ethereum, sending it to the user's Ethereum wallet.

Unwrapping (WBTC → BTC): Users burn WBTC, prompting the custodian to release the equivalent Bitcoin back to their Bitcoin wallet.

This 1:1 pegging ensures WBTC is fully backed by Bitcoin reserves.

2. Key participants:

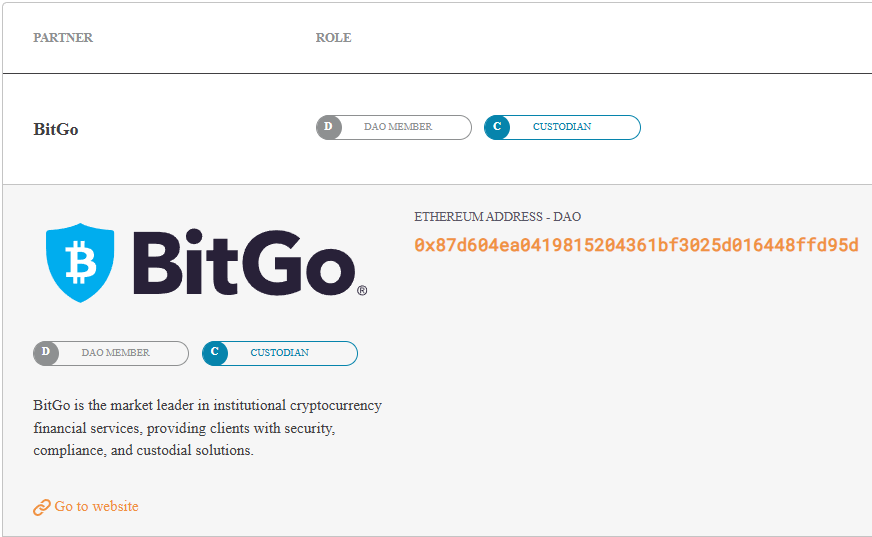

Custodians (e.g., BitGo): Hold and safeguard the Bitcoin backing WBTC.

Merchants: Authorized to request minting or burning of WBTC.

Users: Individuals or entities using WBTC in Ethereum's DeFi ecosystem.

WBTC DAO Members: Stakeholders who govern protocol decisions.

3. Transparency and verification:

Proof of reserves: Publicly verifiable Bitcoin addresses back every WBTC in circulation.

On-chain verification: Minting and burning are recorded on both blockchains.

Regular attestations: Independent checks confirm reserve accuracy.

4. Technical implementation:

WBTC is built as an ERC-20 token, Ethereum’s standard for fungible tokens. All ERC-20 tokens follow the same set of rules, which makes them interchangeable, easy to trade, and instantly compatible with most Ethereum wallets and DeFi apps.

This makes WBTC easily transferable, compatible with wallets, and usable in DeFi apps like lending platforms, decentralized exchanges, and yield farming protocols. It gives Bitcoin the same programmability and utility as Ethereum-native assets.

Showdown: Wrapped Bitcoin (WBTC) vs. Bitcoin (BTC)

Although WBTC and BTC share the same value, their use cases differ. Bitcoin is designed for security, immutability, and censorship resistance. WBTC, on the other hand, thrives in Ethereum’s ecosystem where smart contracts enable lending, borrowing, and trading.

For storing wealth long-term, Bitcoin remains the go-to. For generating yield or accessing DeFi, WBTC is the practical choice. Different uses for different needs.

How Wrapped Bitcoin Boosts Your Crypto

1. DeFi accessibility:

WBTC lets users leverage Bitcoin in DeFi platforms for:

Lending & borrowing: Use WBTC as collateral on platforms like Aave or Compound to earn interest or borrow assets.

Yield farming: Provide WBTC liquidity for rewards, often surpassing Bitcoin's passive holding returns.

Liquidity provision: Earn trading fees by adding WBTC to pools on exchanges like Uniswap.

Synthetic assets: Mint assets pegged to traditional markets using WBTC as collateral.

2. Enhanced liquidity:

WBTC boosts capital efficiency across Ethereum by:

Expanding DeFi liquidity: Unlocking Bitcoin's market value to strengthen liquidity pools.

Reducing slippage: Deeper markets enable smoother trades.

Providing stable collateral: Bitcoin-backed assets offer trusted options for DeFi protocols.

3. Transaction advantages:

Compared to Bitcoin, WBTC transactions on Ethereum benefit from:

Faster confirmations: Ethereum's ~12-second block times outpace Bitcoin's 10-minute average.

Predictable fees: Ethereum's fee structure can be more cost-effective in certain conditions.

Smart contract integration: WBTC supports complex transactions Bitcoin's network can't handle.

4. Broader utility:

Beyond DeFi, WBTC enhances user options by:

Accessing smart contracts: Participate in advanced applications without selling Bitcoin.

Composability: Use WBTC across multiple protocols simultaneously.

Simplified management: Store WBTC alongside other Ethereum assets in common wallets.

Gaming & NFTs: Spend WBTC in blockchain games or NFT marketplaces.

While WBTC offers significant opportunities, it comes with trade-offs regarding decentralization and security, as covered in the next section.

Navigating Wrapped Bitcoin: Risks and Challenges

Custodial risks

While WBTC brings Bitcoin into DeFi, it introduces centralization as well. WBTC depends on BitGo as the sole custodian to hold the backing Bitcoin, creating a central point of failure. Users must trust these custodians to safeguard funds, process redemptions, and comply with regulations that could freeze assets or restrict conversions.

BitGo, DAO member and sole custodian. Source.

Smart contract risks

WBTC relies on Ethereum smart contracts, which, despite audits, can still have vulnerabilities or coding flaws. It's also affected by Ethereum network issues like congestion, high gas fees, and risks from interacting with DeFi platforms.

Price and market risks

WBTC tracks Bitcoin's price and shares its volatility. In turbulent markets, it may trade slightly above or below Bitcoin's value. Large conversions can strain liquidity, making big trades harder without impacting price.

Operational challenges

Managing WBTC involves both Bitcoin and Ethereum blockchains, which can be complex for newcomers. High Ethereum gas fees and slow WBTC-to-Bitcoin conversions (especially for large transactions) are additional hurdles.

Alternatives with less trust required

Some users prefer fully decentralized options like native Bitcoin, though it lacks smart contract functionality. Other wrapped Bitcoin solutions use different technologies to reduce reliance on custodians.

Wrapping Up WBTC

WBTC represents a shift in the cryptocurrency space, bridging the gap between Bitcoin's unparalleled network security and store-of-value properties with Ethereum's programmability and vibrant DeFi landscape. Since its launch in 2019, WBTC has grown from a novel concept to a cornerstone of cross-chain interoperability, enabling countless new use cases for Bitcoin holders.

For users, WBTC allows exposure to Bitcoin while engaging with decentralized finance (DeFi) on Ethereum and other platforms, enabling participation in both without choosing between them. While for DeFi, Bitcoin's liquidity has fostered growth, stability and asset diversity. WBTC has also paved the way for other wrapped assets, making the crypto ecosystem more interconnected and efficient.

As blockchain technology evolves, solutions like WBTC will address limitations while retaining core utility. Its success shows how cryptocurrency innovation can build upon existing strengths without replacing them.

Other Wrapped Bitcoin alternatives

While WBTC is the most widely used Bitcoin representation on Ethereum, several alternatives have emerged, each with different approaches to the bridge between Bitcoin and other blockchains:

- renBTC

- tBTC

- sBTC (Synthetic BTC)

- HBTC

- pBTC

How Can I Buy Wrapped Bitcoin (WBTC)?

If you’re looking to bring Bitcoin into the world of Ethereum, Wrapped Bitcoin (WBTC) is the gateway you might be looking for. Through the Tap app, users can easily add WBTC to their portfolios, opening up access to Ethereum’s thriving DeFi ecosystem. Getting started is simple: just download the app, create an account, and start trading WBTC in minutes.

In this article, we're covering what transaction fees are and taking a look at which cryptocurrencies offer the lowest transaction fees in 2025.

While long-term traders are less likely to be affected by transaction fees, short-term traders and people actively using cryptocurrencies continue to be plagued by excessive fee structures.

This ongoing concern has accelerated the adoption of layer 2 solutions, where transactions can be executed more quickly and cost-effectively, as well as the development of new blockchain platforms entirely.

We've also seen increased focus on zero-fee alternatives and innovative consensus mechanisms that eliminate traditional mining costs. Sounds good, right? Let’s get into it.

What are transaction fees?

Transaction fees are fees paid to the miner or validator of the network to execute the transaction. While some networks differ in how they operate, transaction fees are consistent across the board (Proof of Work mechanisms use miners, while Proof of Stake ones use validators).

How transaction fees work on Proof of Work networks

Looking at Bitcoin as an example, when a user sends BTC the transaction is entered into a pool of pending transactions known as a mempool.

The miner will then pick up a batch of transactions and validate them, checking to see whether the original wallet does, in fact, have the funds to send and if the wallet addresses are valid. Once the transaction is executed, the data relevant to the transaction is added to a block, which is chronologically added to the blockchain.

As compensation to the miner for their time and electricity, they earn a small crypto transaction fee from each transaction, as well as a reward for adding the block, known as a miner's reward. This process also ensures the safety and integrity of the network.

When the networks are very busy, the cost of sending a transaction increases. Users can then choose to pay a higher crypto transaction fee in order to prioritise their transaction in the mempool.

How transaction fees work on Proof of Stake networks

Proof of Stake (PoS) networks operate differently from traditional Proof of Work systems like Bitcoin. In PoS networks, validators are chosen to propose and validate blocks based on their stake (the amount of crypto they hold and have locked up) rather than computational power. When you send a transaction on a PoS network, validators collect and validate these transactions in exchange for transaction fees and block rewards.

The key difference is that PoS networks typically consume much less energy since they don't require intensive computational work. This often results in lower transaction fees compared to Proof of Work networks, as validators don't need to cover the same electricity costs. Popular PoS networks include Ethereum (since its transition in 2022), Solana, Cardano, and Polkadot.

Like PoW networks, when networks are very busy, the cost of sending a transaction also typically increases. Users can then also choose to add a higher crypto transaction fee to prioritise their transaction in the mempool.

Transaction fees for smart contracts are mostly much higher, as they are based on how much electricity will be needed to complete the task.

Note: generally speaking, the terms “transaction fee” and “network fee” can be used interchangeably. They both refer to the transaction fee necessary by the network for the transaction to get processed.

Exchange fees refer to something else entirely. Exchange fees are fees charged by the exchange in order to conduct the service. Be sure to check before executing a transaction on an exchange, as you might be required to pay a transaction fee (or network fees) as well as exchange fees.

How to pay less for transaction fees

A transaction fee is imperative to your transaction getting executed on most networks, so it cannot be avoided entirely. However, there are several ways to reduce the amount you need to pay.

Transaction fees increase when networks are busy, so sending your transaction during quieter periods is a great way to reduce costs. Typically, busier periods occur during business hours in major trading regions like the United States and Asia.

Look out for the Lightning Network for Bitcoin, layer-2 scaling solutions for Ethereum (such as Polygon, Arbitrum, and Optimism), and consider cryptocurrencies with inherently low fees or zero-fee architectures. These provide cost-effective solutions to high transaction costs.

Which cryptocurrency has the lowest average transaction fee?

Let’s look at some of the lowest-fee cryptocurrencies and their average transaction costs at the time of writing in 2025.

Nano (NANO) - Near $0 per transaction

Nano stands out as a cryptocurrency with zero transaction fees, making it the most cost-effective option for users seeking to avoid transaction costs entirely. Thanks to its unique block-lattice structure that doesn't rely on miners, Nano provides almost instant transaction speeds while maintaining complete fee elimination. This makes it a common go-to for frequent micro-transactions and real-world payments where every cent counts.

Stellar (XLM) - $0.00001 per transaction

Stellar charges a tiny $0.00001 per transaction, commonly used for cheap international payments. Designed specifically for cross-border transactions and financial inclusion, Stellar's minimal fees and fast settlement times have made it a favourite among payment providers and individuals sending money globally.

XRP - $0.0002 per transaction

Ripple (XRP) charges $0.0002 fees with impressively fast global transfers. Developed by Ripple Labs, XRP remains optimised for fast, affordable cross-border payments, with a continued focus on serving financial institutions and remittance providers.

Its minimal costs and consistent 4-second transaction times have made it a common choice for users and institutions alike.

Solana (SOL) - $0.00025 per transaction

Solana is known for being one of the lowest gas fee cryptos, costing close to $0.00025 per transaction. The network stands out for its lightning-fast transactions, typically wrapping up in about 2.5 seconds.

Thanks to its scalable design, Solana can handle many transactions simultaneously, making it widely adopted by dapps and major blockchain projects. This efficiency has maintained Solana's position as a top-10 crypto by market cap throughout 2025.

Bitcoin Cash (BCH) - $0.01 per transaction

Bitcoin Cash maintains its position with an attractive $0.01 average transaction fee. As a Bitcoin fork, BCH continues to be engineered for faster, more affordable transfers via its larger block sizes.

The consistently low fees on Bitcoin Cash have helped BCH remain in use as a cost-effective blockchain and low-cost market entry option.

Litecoin (LTC) - $0.05 per transaction

Litecoin continues to stand out as one of the cheapest crypto options, maintaining its average cost of around $0.01 - $0.05 per transfer.

As an early pioneer in the space, Litecoin was designed with speedy 2.5-minute transaction times and affordable payments in mind, building upon and refining Bitcoin's underlying technology.

Dogecoin (DOGE) - $0.055 per transaction

Despite its meme origins, DOGE offers practical benefits for crypto users, particularly in terms of transaction costs. The average transaction fee for Dogecoin is approximately $0.055, making it an economical choice for small-scale and frequent transactions.

With fast 1-minute transaction times and continued community support, Dogecoin is often used for micro-transactions like tipping and donations.

Trade smart, trade with Tap

Users can trade all the tokens mentioned above with equally impressive low-cost exchange fees directly on the Tap app. Adding to the cost-effective nature of the platform, it also offers heightened security and added convenience.If you’re looking to trade these tokens, Tap offers low exchange fees with added security and convenience. Learn more in the Tap app.

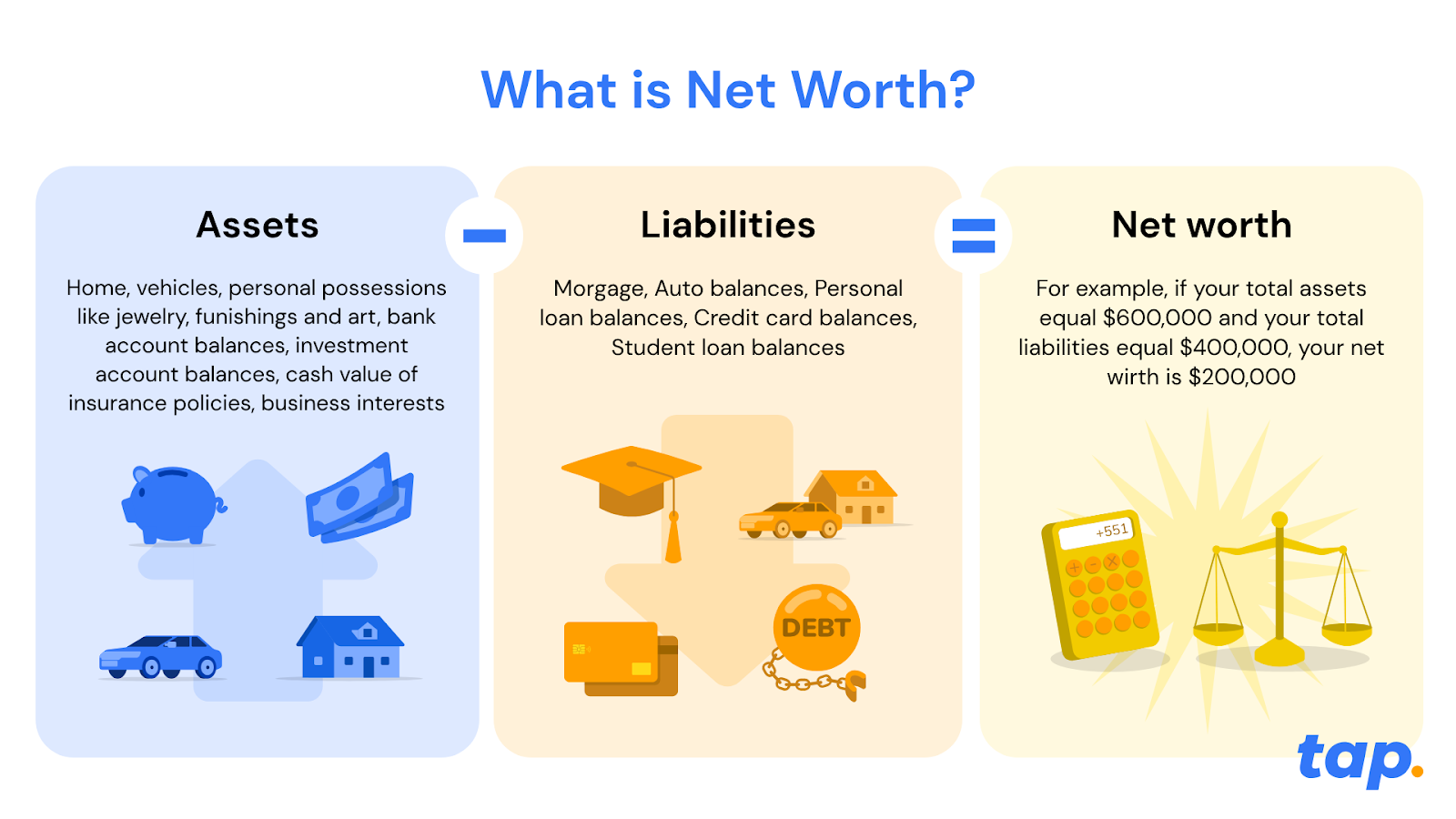

Ever wondered if you're winning or losing the money game? Your net worth holds the answer - and it's easier to calculate than you think.

What is net worth? (and why should you care?)

Think of net worth as your financial report card. It's the ultimate measure of your financial health - not how much you earn, but how much you're actually worth.

Here's the simple truth: net worth = what you own - what you owe

Unlike your salary (which just shows your monthly income), net worth gives you the big picture. It's like comparing a snapshot to a full movie of your financial life.

Why net worth beats income every time

You might earn $100,000 a year, but if you owe $150,000 in debt with only $20,000 in assets, your net worth is actually negative $130,000. Meanwhile, someone earning $50,000 with $200,000 in assets and $50,000 in debt has a net worth of $150,000. Who's really ahead?

The net worth formula

Assets (the good stuff you own)

- Real Estate: Your home, investment properties, land

- Investments: Stocks, bonds, mutual funds, crypto

- Retirement accounts: pension funds

- Cash & savings: Bank accounts, CDs, money market accounts

- Valuable possessions: Cars, jewellery, art, collectables

- Business interests: Ownership stakes, equipment

Liabilities (what's draining your wealth)

- Mortgages: Home loans, investment property loans

- Student loans: Education debt

- Credit cards: Outstanding balances

- Auto loans: Car payments

- Personal loans: Any other borrowed money

- Outstanding bills: Medical debt, taxes owed

How to calculate your net worth (3 simple steps)

Step 1: List your assets

Add up everything valuable you own. Be honest but don't undervalue quality items.

Step 2: Total your liabilities

List every debt, loan, and outstanding balance. Yes, even that store credit card.

Step 3: Do the maths

Assets - liabilities = your net worth

Real-world examples: Meet Sarah and Mark

Sarah's success story

Assets:

- Home: $400,000

- Savings: $50,000

- Investment Portfolio: $150,000

- 401(k): $200,000

- Vehicle: $20,000

- Total Assets: $820,000

Liabilities:

- Mortgage: $200,000

- Student Loan: $30,000

- Total Liabilities: $230,000

Sarah's net worth: $590,000

Sarah's doing great! Her assets significantly outweigh her debts.

Mark's comeback journey

Assets:

- Car: $10,000

- Personal Items: $5,000

- Total Assets: $15,000

Liabilities:

- Student Loans: $50,000

- Credit Cards: $8,000

- Medical Bills: $3,000

- Total Liabilities: $61,000

Mark's net worth: -$46,000

Mark has negative net worth, but this is his starting point, not his destiny.

6 reasons why it’s beneficial to grow your net worth

Financial security

Increasing your net worth provides a foundation of financial security. As your net worth grows, you have a greater buffer against unexpected expenses, job loss, or economic downturns. It offers a safety net to navigate through challenging times and helps you maintain stability in your financial life.

Achieving financial goals

A higher net worth enables you to achieve your financial goals and aspirations. Whether it's buying a home, starting a business, funding education, or retiring comfortably, a growing net worth provides the necessary resources and financial freedom to pursue your dreams.

Building wealth

Net worth is a measure of your wealth accumulation over time. By actively growing your net worth, you increase your overall wealth and improve your financial position. It allows you to build a stronger foundation for yourself and potentially leave a legacy for future generations.

Better financial opportunities

A higher net worth opens doors to better financial opportunities. It improves your borrowing capacity, allowing you to secure favourable loan terms and interest rates when needed. Additionally, a strong net worth can attract investment opportunities and partnerships that can further boost your wealth.

Flexibility and choices

Increasing your net worth provides you with more flexibility and choices in life. It affords you the freedom to make decisions based on what aligns with your long-term goals and values, rather than being constrained by financial limitations. A growing net worth expands your options and empowers you to take calculated risks or make life-changing decisions with confidence.

Peace of mind

Knowing that your net worth is growing can bring peace of mind. It reduces financial stress and anxiety, allowing you to focus on other aspects of your life. A positive net worth provides a sense of control over your financial well-being and offers peace of mind that you are on the right track towards a secure financial future.

Tips for increasing your net worth

Boost your income

- Level up your career: Ask for raises, pursue promotions, learn high-value skills

- Create side hustles: Freelancing, online businesses, passive income streams

- Invest in yourself: Education and skills that increase your earning power

Supercharge your assets

- Diversify smartly: Don't put all eggs in one basket

- Think long-term: Focus on assets that appreciate over time

- Get professional help: Financial advisors can spot opportunities you might miss

- Review regularly: Markets change - your strategy should too

Crush your debt

- Target high-interest debt first: Credit cards are wealth killers

- Consider consolidation: Lower interest rates = more money for you

- Create a payoff plan: Set deadlines and stick to them

- Avoid new debt: Unless it's for appreciating assets

Master the long game

- Emergency fund: 3-6 months of expenses (minimum!)

- Retirement planning: Start early, contribute consistently

- Professional guidance: Sometimes paying for advice saves you thousands

- Track progress: What gets measured gets improved

The bottom line: your financial transformation starts now

Your net worth isn't just a number; it's your financial GPS, showing exactly where you stand and where you're headed. Whether you're starting with negative net worth like Mark or building on a solid foundation like Sarah, the principles remain the same.

Remember: Every financial giant started with a single step. Your current net worth is just your starting line, not your finish line.

Start tracking your net worth today, and watch as this simple practice transforms not just your bank account, but your entire relationship with money. Your future self will thank you!

Ready to take control of your financial destiny? Calculate your net worth this week and set your first wealth-building goal. The journey to financial freedom starts with knowing where you stand.

TAP'S NEWS AND UPDATES

What’s a Rich Text element?

What’s a Rich Text element?The rich text element allows you to create and format headings, paragraphs, blockquotes, images, and video all in one place instead of having to add and format them individually. Just double-click and easily create content.

The rich text element allows you to create and format headings, paragraphs, blockquotes, images, and video all in one place instead of having to add and format them individually. Just double-click and easily create content.Static and dynamic content editing

Static and dynamic content editingA rich text element can be used with static or dynamic content. For static content, just drop it into any page and begin editing. For dynamic content, add a rich text field to any collection and then connect a rich text element to that field in the settings panel. Voila!

A rich text element can be used with static or dynamic content. For static content, just drop it into any page and begin editing. For dynamic content, add a rich text field to any collection and then connect a rich text element to that field in the settings panel. Voila!How to customize formatting for each rich text

How to customize formatting for each rich textHeadings, paragraphs, blockquotes, figures, images, and figure captions can all be styled after a class is added to the rich text element using the "When inside of" nested selector system.

Headings, paragraphs, blockquotes, figures, images, and figure captions can all be styled after a class is added to the rich text element using the "When inside of" nested selector system.What’s a Rich Text element?

What’s a Rich Text element?The rich text element allows you to create and format headings, paragraphs, blockquotes, images, and video all in one place instead of having to add and format them individually. Just double-click and easily create content.

The rich text element allows you to create and format headings, paragraphs, blockquotes, images, and video all in one place instead of having to add and format them individually. Just double-click and easily create content.Static and dynamic content editing

Static and dynamic content editingA rich text element can be used with static or dynamic content. For static content, just drop it into any page and begin editing. For dynamic content, add a rich text field to any collection and then connect a rich text element to that field in the settings panel. Voila!

A rich text element can be used with static or dynamic content. For static content, just drop it into any page and begin editing. For dynamic content, add a rich text field to any collection and then connect a rich text element to that field in the settings panel. Voila!How to customize formatting for each rich text

How to customize formatting for each rich textHeadings, paragraphs, blockquotes, figures, images, and figure captions can all be styled after a class is added to the rich text element using the "When inside of" nested selector system.

Headings, paragraphs, blockquotes, figures, images, and figure captions can all be styled after a class is added to the rich text element using the "When inside of" nested selector system.What’s a Rich Text element?

What’s a Rich Text element?The rich text element allows you to create and format headings, paragraphs, blockquotes, images, and video all in one place instead of having to add and format them individually. Just double-click and easily create content.

The rich text element allows you to create and format headings, paragraphs, blockquotes, images, and video all in one place instead of having to add and format them individually. Just double-click and easily create content.Static and dynamic content editing

Static and dynamic content editingA rich text element can be used with static or dynamic content. For static content, just drop it into any page and begin editing. For dynamic content, add a rich text field to any collection and then connect a rich text element to that field in the settings panel. Voila!

A rich text element can be used with static or dynamic content. For static content, just drop it into any page and begin editing. For dynamic content, add a rich text field to any collection and then connect a rich text element to that field in the settings panel. Voila!How to customize formatting for each rich text

How to customize formatting for each rich textHeadings, paragraphs, blockquotes, figures, images, and figure captions can all be styled after a class is added to the rich text element using the "When inside of" nested selector system.

Headings, paragraphs, blockquotes, figures, images, and figure captions can all be styled after a class is added to the rich text element using the "When inside of" nested selector system.What’s a Rich Text element?

What’s a Rich Text element?The rich text element allows you to create and format headings, paragraphs, blockquotes, images, and video all in one place instead of having to add and format them individually. Just double-click and easily create content.

The rich text element allows you to create and format headings, paragraphs, blockquotes, images, and video all in one place instead of having to add and format them individually. Just double-click and easily create content.Static and dynamic content editing

Static and dynamic content editingA rich text element can be used with static or dynamic content. For static content, just drop it into any page and begin editing. For dynamic content, add a rich text field to any collection and then connect a rich text element to that field in the settings panel. Voila!

A rich text element can be used with static or dynamic content. For static content, just drop it into any page and begin editing. For dynamic content, add a rich text field to any collection and then connect a rich text element to that field in the settings panel. Voila!How to customize formatting for each rich text

How to customize formatting for each rich textHeadings, paragraphs, blockquotes, figures, images, and figure captions can all be styled after a class is added to the rich text element using the "When inside of" nested selector system.

Headings, paragraphs, blockquotes, figures, images, and figure captions can all be styled after a class is added to the rich text element using the "When inside of" nested selector system.Kickstart your financial journey

Ready to take the first step? Join forward-thinking traders and savvy money users. Unlock new possibilities and start your path to success today.

Get started

.webp)

.webp)