Learning the friendly way

Dive into our resources, guides, and articles for all things money-related. Grow your financial confidence with our experts curated tips and articles for both experienced and new investors.

LATEST ARTICLEs

.svg)

Playing an important role in the adoption of Web3, Enjin provides a platform of software products designed to allow anyone to harness the power of NFTs (non-fungible tokens) through the development, trade, monetization, and marketing of blockchain assets.

The Enjin Coin (ENJ) is the native utility and governance token of the Enjin ecosystem. For gamers, developers and investors alike, ENJ matters because it bridges real-world value with digital goods, offering a means to turn in-game items into tradable assets. In this article you’ll learn what ENJ is, how it works, its key use-cases, how to buy it, its tokenomics, investment considerations and how it stacks up against other gaming tokens.

What Is the Enjin Platform?

The Enjin platform is an ecosystem of interconnected, blockchain-based gaming products designed for individuals, game developers and businesses to create, manage and trade virtual goods such as digital art, games, or virtual marketplaces using the Ethereum blockchain. Enjin aims to provide users with the tools to implement smart digital solutions for blockchain games within the gaming environment.

Through the platform's software development kits (SDKs) and APIs, users can build digital assets as well as seamlessly integrate them into their games and applications.

Under the Enjin umbrella is the Enjin Network, a community gaming platform that allows users to create websites, chat, and host virtual stores. Over the course of a decade, the Enjin platform has accumulated over 20 million users.

The ecosystem binds together gaming communities, game-asset markets and blockchain infrastructure. For example, a developer might create a limited edition in-game sword, mint it using ENJ as backing, list it on the marketplace, players trade it, and the underlying ENJ can be melted or reused. For developers, Enjin provides monetisation tools. For gamers, it provides ownership and portability of digital items.

Powering the ecosystem is the Enjin Coin (ENJ), a token used to back the value of NFTs and other assets minted on the platform. When an asset is minted it locks ENJ tokens into a smart contract and effectively removes the tokens from circulation.

It’s also worth noting that Witek Radomski, Enjin's co-founder and the brainchild behind the ERC-1155 Ethereum token standard, wrote the code for the first non-fungible token (NFT). By utilizing its cutting-edge technology, Enjin is revolutionizing the future of gaming and digital assets.

Who Created Enjin?

Enjin was originally founded in 2009 as a gaming community platform by Maxim Blagov and Witek Radomski. Blagov took on the responsibility of being CEO and in charge of the platform's creative direction while Radomski took on the role of CTO, leading the technical development of the platform's products.

Following Radomski's interest in Bitcoin in 2012, the platform explored incorporating blockchain technology into its business model and embraced the world of tokenized digital assets.

Radomski went on to write the ERC-1155 token standard in June 2018, a token standard used for minting both fungible, semi-fungible and non-fungible tokens using the Ethereum network. This token standard is a critical building block in the platform’s design.

In 2017, the Enjin platform launched an initial coin offering (ICO), raising $18.9 million through ENJ token sales. A year later the project went live and in September 2019, the Enjin Marketplace was launched.

How Does Enjin Work?

The primary goal of the Enjin network is to facilitate the management and storage of virtual goods for games, anything from in-game currencies to unique in-game items. So, how does Enjin work? The process of creating and destroying these tokens involves five steps:

- Purchase

Developers purchase Enjin Coin. - Minting

In-game items are designed and effectively minted with the appropriate amount of ENJ locked into a smart contract. - Utilization

Players use these tokens within the game. - Trading

Players trade the tokens between fellow players or on the internal or external marketplace. - Melting

Players sell the tokens for Enjin Coin, referred to as melting. The token is destroyed and Enjin Coin is released from the smart contract.

SDKs (software development kits) come into play here, with kits designed to fulfill certain functions, such as facilitating a payment platform or being wallet-focused. These kits are designed to minimize costs and simplify the process of creating these virtual goods. APIs (application programming interfaces) work alongside the SDKs to integrate these virtual goods (digital assets) into the game.

The Enjin platform utilizes JumpNet which is integrated with other products in the ecosystem, such as the Marketplace, Enjin Beam, and the Enjin Wallet to allow for gas-free transactions for ENJ and NFTs.

The Enjin ecosystem encompasses the Enjin smart wallet that allows players to store and trade their in-game items with ease. The Enjin wallet is designed to connect all the features, from managing inventory to conducting transactions and selling these tokenized digital assets for ENJ.

What is the Enjin Coin (ENJ)?

As we mentioned previously, Enjin Coin (ENJ) is the native token of the Enjin ecosystem. Built on the Ethereum blockchain and compatible with multiple gaming platforms, the Enjin Coin is an ERC-20 token that allows the in-game items created on the platform to be traded with real-world value. The ENJ token has a maximum supply of 1 billion coins.

The token also allows developers to mint these digital goods. The process requires the users to lock Enjin Coin (ENJ) into a smart contract that automatically assigns value to the in-game item. Players that later use these items can use them in the game, trade them or sell them for ENJ, equivalent to the original minting cost. Once sold, the item is destroyed (known as melting) and the ENJ that was locked in the smart contract is released to the seller.

How Can I Buy the Enjin Coin?

Anyone can tap into the Enjin ecosystem by acquiring ENJ tokens through the Tap mobile app. Simply create an account and complete the verification process in order to gain access to your unique Enjin wallet, from where you can buy, trade and sell Enjin Coin.

Fully licensed and regulated, Tap provides a secure and convenient means of managing your funds, allowing users to manage and store both crypto and fiat currencies in one location. With a wide range of supported currencies and services, Tap is revolutionizing the financial space.

Take advantage of the power of Enjin Coin on the Tap app - the ultimate platform to buy, sell or hold ENJ. With seamless integration and an intuitive interface, trading Enjin tokens has never been easier. Stay up-to-date with the latest market trends and keep your portfolio on track by monitoring the Enjin Coin price in real-time.

Bottom Line

Enjin Coin (ENJ) is more than just another cryptocurrency; it's the utility token powering a complete blockchain gaming ecosystem. It allows game studios to create, manage, and monetize digital assets, gives gamers true ownership and the ability to trade those assets, and offers investors exposure to where gaming, NFTs, and Web3 infrastructure converge.

That said, adoption rates, competition, and regulatory developments all play a role in ENJ’s future. If blockchain gaming, asset tokenization, and virtual economies interest you, ENJ presents a compelling option. Just make sure to do your research, evaluate the projects actually using it, and align any investment with your own goals and risk tolerance.

.webp)

In the colorful and often chaotic world of crypto, there exists a quirky corner dominated by what are affectionately known as “memecoins." These digital assets, born from the memes and trends that dominate online culture, are the playful jesters of the crypto kingdom. Despite their playful charm, memecoins are often caught up in pump-and-dump schemes and other scams, making them quite the rollercoaster ride. Their volatility is high, and the risk is real.

What draws people to these digital jokes? Simple, some memecoins have handed out enormous returns to those daring enough to dive in. However, while memecoins may gain popularity via social media, endorsements or fan communities, they often lack intrinsic utility. That makes them vulnerable to scams because of a low barrier to creation, hype-driven valuations, and little oversight. In many cases, the money made by early buyers or insiders comes directly from later retail investors in a negative-sum game. Because of this speculative nature, these tokens can attract opportunistic actors aiming to profit quickly at the expense of others.

So, with a whole galaxy of memecoins out there, how do you spot the stars from the scams? Stick around for some handy tips.

What Makes Memecoins Popular?

Memecoins, like the iconic Dogecoin or Shiba Inu, often start as jokes, are often associated with entertainment rather than usability, and often gain traction thanks to the power of community, social media, and, occasionally, celebrity endorsements.

Unlike more traditional cryptocurrencies such as Bitcoin or Ethereum, memecoins generally lack complex technology or specific use cases. They're not about solving grand technological challenges but rather are about capturing the spirit of the internet in a tokenised form. This means that their value is often driven by pure enthusiasm, online buzz, and the thrill of being part of a viral movement.

So why are these coins so popular? The appeal of memecoins lies in their accessibility and the sense of belonging they create. They're fun, easy to understand, and often tied to shared cultural experiences that resonate with a broad audience. The sense of community and the potential possibility of rapid gains draw people in, making some memecoins a fascinating aspect of the crypto landscape.

The Downside to Memecoin’s Popularity

Lately, memecoins have been the talk of the town, sparking a wave of enthusiasm, and unfortunately, a spike in scams too. Navigating the crypto market's more playful corner requires a keen eye. Before you leap into a memecoin, take a good look at the project and the brains behind it, as well as its development plan and the project’s overall transparency.

It's wise to tread carefully in these waters and resist the urge to jump in just because a memecoin is all the rage.

Common Types of Memecoin Scams

Scammers have refined their playbook to exploit FOMO, trust in influencers, and the general chaos of low-cap tokens. Some scams are obvious in hindsight, but many are sophisticated enough to fool even experienced traders. The key is knowing what to look for before you do anything. Whether it's a coordinated pump-and-dump or a malicious smart contract designed to trap your funds, these schemes all share common patterns. Let's break down the major scam types you're most likely to encounter, and the red flags that should make you think twice.

- Rug Pulls

Scammers launch a token, build hype, attract liquidity, then withdraw the funds (pull the rug) leaving the token worthless. - Pump-and-Dump Schemes

Coordinated groups inflate a token's price (often with influencer shilling), then dump it at a high. Late investors are left holding the bag. - Celebrity Scams

Scammers exploit trust by faking endorsements or hijacking social media accounts of well-known figures. - Fake Partnerships & Endorsements

Polished websites, vague whitepapers and purported brand deals are used to convey legitimacy, despite little substance. - Technical Exploits

Memecoins may embed malicious smart-contract code, honeypots or unlimited minting rights for the devs, enabling extraction of funds. - Insider Trading & Market Manipulation

Whales, early wallets and wash-trading inflate token value while retail buyers enter too late. Scam clusters often reuse contracts and patterns.

How to Spot a Memecoin from a Scam

- Beyond jokes and buzz

The initial charm of a memecoin may come from its humour, but lasting appeal requires more substance. Look for memecoins that offer real utility and a role within a broader ecosystem, these are signs of a coin that could stick around. - Transparency is key

Steer clear of memecoins shrouded in mystery, where details about the team and their updates are scarce. A trustworthy memecoin project is open about its progress and the people behind it. - Security measures

Given that memecoins often attract the attention of hackers, robust security is a must. A credible memecoin will have undergone thorough security audits and checks. If a coin lacks evidence of strong security measures, it's a red flag. - Community strength

A vibrant and active community is crucial for a memecoin's success. Memecoins that are driven by their communities tend to have a more promising future, thriving on the collective support and engagement of their members.

As memecoins continue to capture the imagination of the online world, they've also caught the eye of regulators. The wild, unregulated environment in which these coins thrive poses challenges for authorities trying to protect consumers from potential scams or market manipulation. Despite this, the decentralised nature of most memecoins makes regulation a complex issue, leaving this corner of the crypto world as something of a digital Wild West.

Who’s at Risk of Memecoin Scams?

Memecoins tend to pull in younger investors who are drawn by viral marketing, FOMO, and the thrill of high-risk bets. For many, it's less about fundamentals and more about the rush, the community, or simply being part of the next big thing. Investors with limited experience, shaky financial planning, or an appetite for risk seem to be especially susceptible. When you combine that with fast-moving markets and social media hype, it's easy to see why so many get caught up in the chaos.

Conclusion

Memecoins are the whimsical, unpredictable, and culturally significant players in the cryptocurrency arena. They bring together the lightheartedness of internet memes with the fast-paced world of digital assets, creating a unique blend of humour and speculation. Whether you're laughing with them or at them, memecoins have undeniably become a fascinating part of the crypto narrative.

However, the very traits that make memecoins so appealing (i.e. their viral nature and community-driven buzz) also make them a hotspot for speculative bubbles and financial mishaps. As they continue to captivate the imagination of the online masses, they also pose significant challenges and risks, often operating in the murky waters of regulatory oversight. This unregulated and often wild market dynamic invites both opportunistic gains and blatant scammers.

For enthusiasts and investors alike, navigating this landscape means staying informed, vigilant, and discerning. Understanding the signs of a genuine memecoin versus a scam is crucial. It's not just about the initial buzz or the humour; it's about the underlying value, security measures, transparency, and community engagement that support the token's longevity and potential growth.

Cryptocurrencies have gained a reputation for being largely volatile investments. While stocks too can have their moments (what with Peloton stocks dropping 20% every other day) the crypto market carries the brunt of it.

Thankfully, stablecoins have come to the rescue. While still functioning as digital currencies powered by blockchain technology, stablecoins are pegged to external assets such as fiat currencies or gold, thereby eradicating (most of) their volatility.

A Short History Of Stablecoins

After the advent of Bitcoin in 2009, it was only a few years later that a stable digital asset entered the market. Stablecoins came into existence in 2014 when a Hong-Kong based company named Tether Limited released a coin of the same name. The Tether coins' value was pegged to the US dollar, meaning that 1 USDT would always be worth $1.

In order to guarantee this value, the company held the dollar equivalent in bank accounts. Skip past the controversy surrounding their reserves and lack of financial analysis, and there are now plenty of other stablecoin options on the market.

Seeing the infinite benefits of digital currency transactions and blockchain technology, like speed, transparency and low fees, many companies around the world have created their own version of the stablecoin, mostly improving on the previous release. These coins have proven to be invaluable with businesses and retail merchants around the world.

Today, the two biggest stablecoins on the market are Tether (USDT) and USD Coin (USDC). One can argue whether these are "safe haven" assets, but one cannot deny that these tokens hold most of the advantages that digital currencies hold while considerably diminishing the unpredictable market swings.

In our attempt to better understand the concept, let's take a look at the two biggest stablecoins.

Tether (USDT) vs USD Coin (USDC)

Below we explore the two multi-billion-dollar market cap stablecoins, while they both provide the same service in terms of a digital currency, the companies behind them operate quite differently.

What Is Tether (USDT)?

As mentioned above, Tether is the first stablecoin to enter the market. Launched in 2014, the network was initially built on the Ethereum blockchain but is now compatible with a number of other networks.

Note that the Ethereum-based USDT cannot be traded as a TRON-based token, coins need to stick to their respective blockchain networks as this is how the transactions are processed.

It wasn't long before USDT was listed on the top exchanges, and included in dozens of trading pairs.

Tether Limited have since released a Euro-based stablecoin as well as Tether crypto coin pegged to the price of gold. The downside to Tether falls on the company's reputation surrounding transparency and reserve funds.

There have been several court cases where individuals and regulatory bodies have called for transparency surrounding the funds held in reserves. Tether has since provided access to this information but is yet to go through a third party audit. Regardless, Tether holds the third biggest market cap (at the time of writing).

What Is USDC (USD Coin)?

USD Coin is a stablecoin created by the Centre Consortium, an organisation made up of crypto trading platform Coinbase and Circle, a peer to peer payment platform. It launched in 2018 as an ERC-20 token and has since climbed the ranks to be in the top 5 biggest cryptocurrencies based on market cap. USD Coin is available on the Ethereum blockchain, as well as Solana, Polygon, Algorand and Binance Smart Chain networks.

The significant bonus that USDC holds over its biggest competitor, USDT, is that the coin is regularly audited by a third-party institution. These audits are made public, allowing any user to verify the authenticity of their USDC value each month. Since launching USDC, Coinbase has removed USDT from its platform.

USDT vs USDC: Head-to-Head Comparison

Adoption

With over a decade in circulation, USDT has achieved far greater adoption worldwide. It remains the dominant stablecoin in trading pairs and global liquidity, particularly in emerging markets. Winner: USDT

Transparency

Tether has historically struggled with transparency, though it now publishes quarterly attestations. By contrast, USDC provides monthly reports with independent verification, giving it the edge for investors who value oversight and regulatory clarity. Winner: USDC

Regulatory Compliance

Circle and Coinbase designed USDC with U.S. and international regulations in mind. USDC reserves are kept in regulated banks and Treasuries, and Circle is registered as a money transmitter in multiple jurisdictions. Tether claims compliance but lacks comparable transparency. Winner: USDC

Price Stability

Both USDT and USDC are pegged 1:1 to the U.S. dollar. While they occasionally experience small deviations, both have shown resilience and quickly return to their peg. Winner: Tie

Redemption Process

Redeeming USDT directly requires a minimum of 100,000 USDT plus fees, which makes it impractical for small investors. USDC allows redemptions starting at just $100, giving it an accessibility advantage. Winner: USDC

Incidents

Both stablecoins have faced brief de-pegging events. USDT dipped below $0.95 during market stress in 2022, while USDC fell to around $0.87 during the Silicon Valley Bank crisis. In both cases, prices stabilized quickly. Winner: Tie

Longevity

Tether has been around since 2014, giving it a proven track record and first-mover advantage. Winner: USDT

Which Stablecoin Should You Choose?

Due to the fact that these respective companies are holding the dollar-equivalent value in reserves, these two digital currencies are considered to be centralized, while the rest of the cryptocurrency market holds a decentralized nature. As the demand for digital currencies increases, it is likely that these two stablecoins will only continue to grow.

When looking for a stablecoin, these are two most recognised options. Choosing between USDT and USDC depends on what you value most as an investor or user.

- If you need deep liquidity, global adoption, and access across more blockchains, USDT remains the go-to option. Its size and reach are unmatched, making it the default stablecoin for many traders.

- If you prioritize regulatory compliance, transparency, and a lower barrier for redemptions, USDC is the safer bet. It continues to build trust among institutions and investors who want accountability.

Ultimately, both stablecoins play vital roles in today’s crypto ecosystem. Some traders even use a combination of USDT and USDC to balance adoption with transparency, hedging against risks specific to either coin.

Users can both buy and sell USDT and USDC directly through the Tap app. Simply create your account, complete the KYC process and deposit funds into your digital wallet. Manage your entire crypto (and fiat) portfolio from one convenient, secure location.

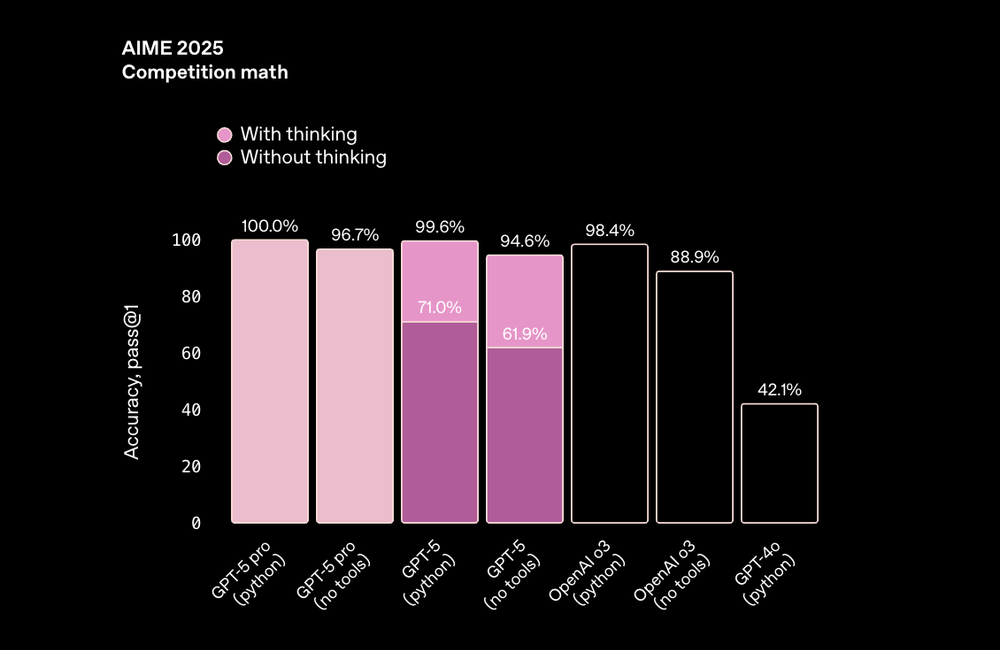

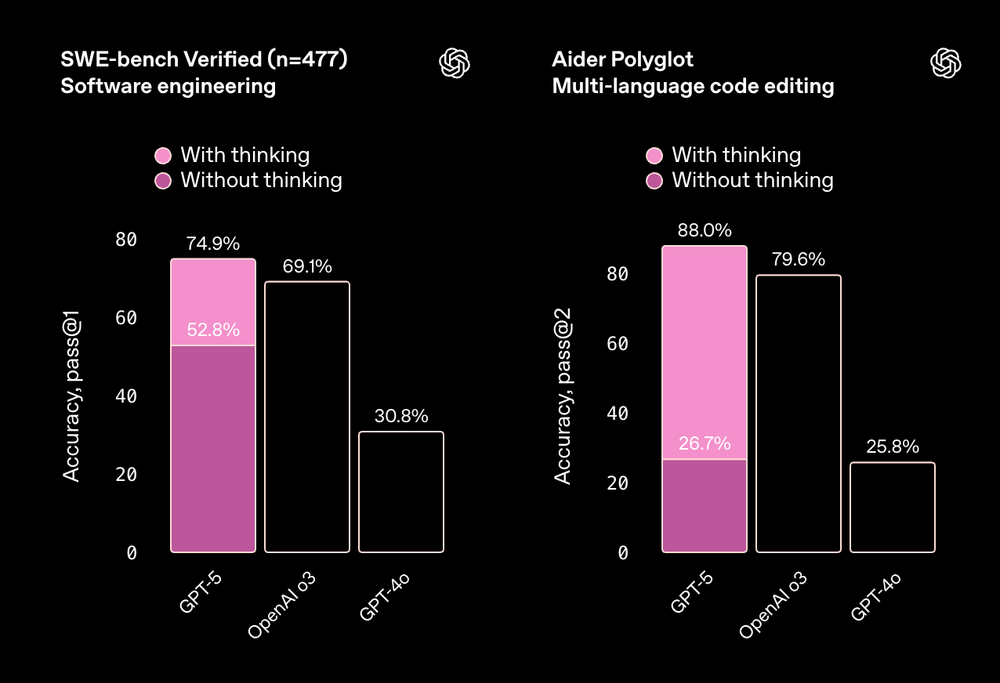

2025 has been a defining year for AI. OpenAI’s GPT-5 and Anthropic’s Claude Sonnet 4.5 have raised the bar once again, each one aiming to blend stronger reasoning, longer memory, and more autonomy into one seamless system. Both are built to handle coding, research, writing, and enterprise-scale tasks, yet their design philosophies differ sharply.

This breakdown explores how the two stack up across performance, reasoning, coding, math, efficiency, and cost, helping users and teams decide where each model truly shines.

A Quick Overview

Claude Sonnet 4.5 builds on Anthropic’s refined Claude family. It extends memory across sessions, handles million-token contexts via Amazon Bedrock and Vertex AI, and features smart context management that prevents sudden cut-offs. It can run autonomously for 30 hours on extended tasks, making it ideal for ongoing workflows.

Meanwhile, GPT-5 is OpenAI’s flagship successor to GPT-4, tuned for agentic reasoning, where the model plans, executes, and coordinates tools on its own. Its adaptive reasoning system dynamically chooses between shallow or deep “thinking” paths, letting users balance speed, cost, and depth per task. GPT-5 also offers specialized variants (Mini, Nano) for lighter workloads.

Reasoning and Analysis

Both models far exceed their 2024 counterparts, but they differ in how they reason.

GPT-5’s deep-reasoning mode significantly boosts performance in multi-step logic, scientific, and spatial tasks. It can break problems into chains, test sub-hypotheses, and self-correct mid-process. However, disabling this mode reduces accuracy sharply, it can be brilliant when “thinking deeply,” but more variable when not.

Claude Sonnet 4.5, by contrast, stays stable even without added configuration. It’s particularly strong in financial, policy, and business logic, where structure and coherence matter more than creative leaps. For enterprise Q&A or decision support, that predictability is valuable.

If you want an AI that reasons steadily, Claude takes the lead. If you need exploratory logic (i.e. complex hypothesis testing or cross-domain synthesis) GPT-5’s deeper path is unmatched.

Math and Structured Problem Solving

As seen in the benchmarks provided by Anthropic, Claude Sonnet 4.5 continues its consistency streak. Whether calculating directly or using Python tools, it achieves top-tier math accuracy. This means it handles structured logic even in constrained environments.

GPT-5 also reaches near-perfect accuracy, but only when tool use and reasoning depth are active. Disable them, and results drop noticeably. It relies heavily on its reasoning pipeline to stay sharp.

Verdict:

- Claude Sonnet 4.5: dependable out-of-the-box math solver.

- GPT-5: flexible but needs tuning to perform at its best.

Coding and Software Engineering

When it comes to coding, the two models diverge in style.

Claude Sonnet 4.5 delivers stable performance without special tuning. In tests resembling HumanEval+ and MBPP+, it maintains high accuracy across conditions, making it dependable for production pipelines. Its strength lies in consistency, results rarely fluctuate, which is crucial for enterprise use.

By contrast, GPT-5 achieves higher peak scores when its advanced reasoning is enabled, especially in multi-language or large-project contexts. In JavaScript and Python refactoring tasks, for instance, it outperformed Sonnet when its “high-reasoning” mode was active — though baseline runs without that mode varied more.

For agentic coding, where the AI calls external tools or terminals, Sonnet 4.5 often executes with fewer dropped commands. GPT-5, on the other hand, can chain more tool calls simultaneously, making it better for complex orchestration, provided you configure it carefully.

Verdict:

- Claude Sonnet 4.5: predictable, steady engineering partner.

- GPT-5: versatile powerhouse, but performance hinges on setup.

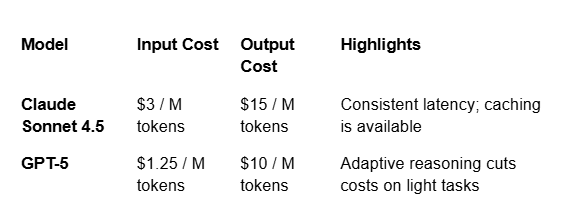

Cost and Efficiency

GPT-5 is clearly cheaper per token, particularly for large inputs. Its adaptive router also saves compute by running simple prompts on lighter paths.

Claude Sonnet 4.5 charges more but maintains predictable latency, a key factor for production environments that value reliability over marginal savings. For very large prompts, its cost rises faster than GPT-5’s, though batch discounts narrow the gap.

TL;DR: GPT-5 wins on price and scalability, whereas Claude wins on timing consistency and stability.

Pricing for Premium Plans

Beyond API access, both OpenAI and Anthropic offer premium subscriptions for individual users, which differ in features and pricing.

ChatGPT Plus, powered by GPT-5, is priced at $20 per month, giving users priority access to GPT-5, faster response times, and early access to new features and memory. OpenAI’s unified ChatGPT experience also includes file uploads, image generation, and custom GPTs.

Claude Pro, meanwhile, costs $20 per month as well and grants access to Claude Sonnet 4.5, offering faster responses, higher rate limits, and longer context windows. While it lacks built-in multimodal tools, Claude focuses on text clarity and structured reasoning, appealing to researchers, analysts, and writers seeking dependability over versatility.

TL;DR: both Plus plans are tied in price; what sets them apart, however, is their offering.

Different Strengths for Different Needs

It’s tempting to crown one “best,” but GPT-5 and Claude Sonnet 4.5 serve different priorities for different users and teams.

- Claude Sonnet 4.5: best for reliability and sustained performance. If you want consistent outputs and clear memory behavior, Claude delivers.

- GPT-5: best for depth, flexibility, and scalability. When configured properly, it surpasses rivals in creative reasoning, multimodal integration, and adaptive tool use.

Most teams may find the strongest setup is multi-model, using Claude where consistency matters most, and GPT-5 for data-intensive workflows.

Ultimately, these aren’t just chatbots anymore, they’re full-fledged digital collaborators, each with distinct personalities. Claude Sonnet 4.5 is your calm, methodical analyst. GPT-5 is your ambitious polymath. Which one you pick depends less on their individual benchmarks and more on your mission.

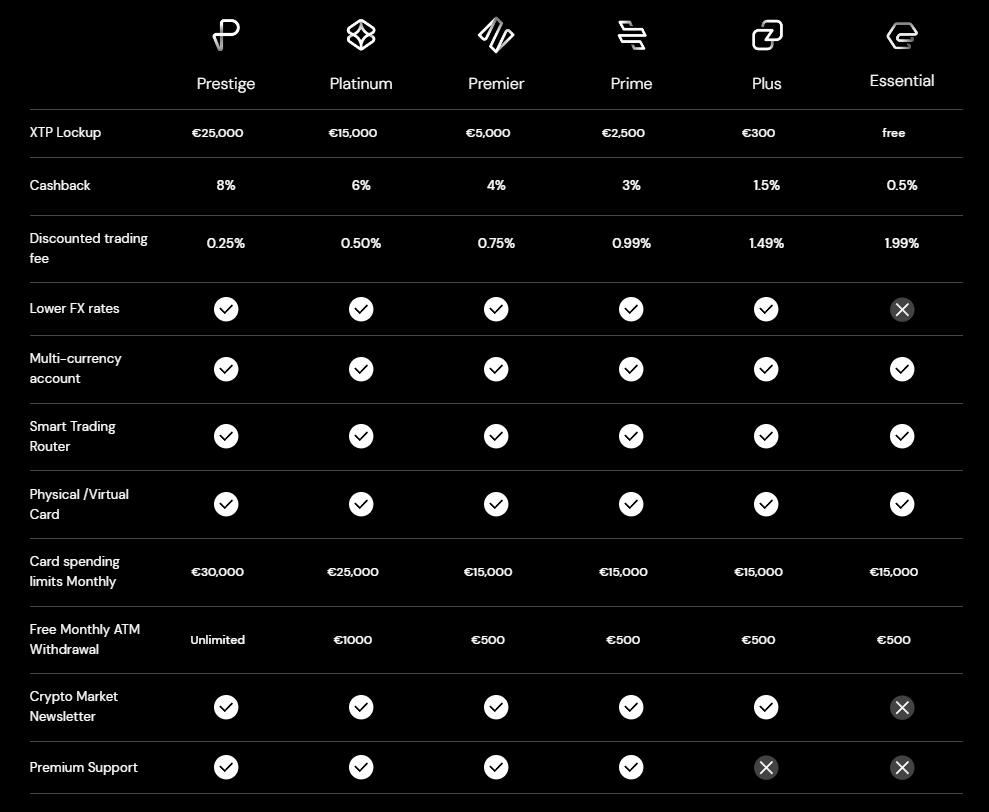

In a fast-changing world where money moves instantly and borders are fading, Tap stands out as a pioneering fintech platform that unites traditional banking with cryptocurrency management.

Founded in 2019, Tap’s goal is to simplify how people store, send, and spend both fiat money and digital assets, all from one secure, user-friendly app. The platform’s native ERC-20 token, XTP, powers an integrated ecosystem where users can trade, earn rewards, and unlock premium benefits.

More than a digital wallet or an exchange, Tap represents a bridge between two worlds: the speed of decentralized finance and the reliability of traditional finance. Whether you’re new to crypto or looking for smarter ways to manage global payments, Tap helps users stay in control without complexity.

XTP is what holds that bridge together. Here’s how.

How Does Tap Work?

At its core, Tap combines traditional money management and modern crypto services into a single, intuitive platform. Built for flexibility and ease, and as a solution to the founder's initial problem, our platform allows users to manage both fiat and digital currencies from a single interface, without needing multiple tools or accounts.

Once verified, users unlock access to Tap's multi-currency wallets, which support 60+ cryptocurrencies alongside major fiat currencies. Crypto can be bought using bank transfers or debit cards, and external wallets can be connected to bring funds into the platform. Users can also sell crypto and withdraw fiat directly to their bank account, or use any funds within the app to pay external bank accounts.

One of Tap's standout features is its Tap Mastercard, available in both physical and virtual formats. The card connects directly to your Tap wallet, letting you spend crypto or fiat in real time, taking care of currency conversions behind the scenes. It works globally for ATM withdrawals and in-store or online purchases, with competitive FX rates and no hidden surprises. Depending on the user’s tier, transactions can earn up to 8% Cashback, making Tap practical for daily use.

Last but not least, Tap allows for instant crypto-to-fiat conversion. That means no waiting, no manual exchanges, and no disruption at checkout ; your digital assets are as spendable as your local currency. All transactions are protected with advanced security features and encryption, keeping your money and data safe every step of the way.

Key Features That Make Tap Unique

Tap distinguishes itself in the crowded fintech landscape through several innovative features that address real-world financial challenges.

The platform's instant transfer capability within the Tap2Tap network allows users to send money and cryptocurrencies to other Tap users completely free of charge, honoring Bitcoin's initial peer-to-peer intention and making international remittances more accessible than ever before.

Real-time transaction alert system

The real-time transaction alert system ensures users maintain complete visibility over their financial activities. Every transaction, whether it's a crypto purchase, card payment, or fund transfer, triggers immediate notifications, providing peace of mind and enabling proactive account management.

Debit card directly linked to account

Global accessibility represents another cornerstone of Tap's unique value proposition. The integrated Mastercard enables ATM withdrawals and purchases worldwide, while the platform's foreign exchange conversion rates ensure users can spend confidently regardless of their location. This global functionality makes Tap particularly valuable for frequent travelers, digital nomads, and anyone conducting international business.

By holding and utilizing XTP tokens, users can access premium features including up to 8% Cashback on spending, reduced trading fees, decreased foreign exchange fees, higher card spending limits, and exclusive market insights. This tiered system creates tangible value for token holders while incentivizing platform engagement.

This sophisticated system scans multiple exchanges and liquidity providers in real-time, automatically finding the optimal available prices for crypto transactions. This feature ensures all users receive top rates without needing to manually compare prices across different platforms.

What Is the XTP Token Used for?

XTP is the native utility token of the Tap platform, built on Ethereum (ERC-20) and designed to enhance your experience across crypto and traditional finance.

- Reduced crypto trading and FX fees for token holders, including lower costs when converting between crypto and fiat currencies, allowing for a seamless on and off ramping experience.

- Unlock premium tiers with perks such as Cashback on purchases made with the Tap Mastercard, higher limits, and priority support.

- Instant, feeless peer-to-peer payments within the Tap network, ideal for remittances and cross-border transfers.

- Access to premium features such as increased limits, newsletters, and exclusive rewards.

By holding XTP, users not only save on fees but also gain deeper integration within Tap’s ecosystem, encouraging long-term participation.

Tap (XTP) Key Growth Factors

Tap's success directly correlates with user acquisition and platform engagement. Increased adoption of the Mastercard, growth in Tap2Tap network usage, and expansion into new geographic markets could positively impact demand for XTP.

Collaborations with financial institutions, crypto exchanges, and fintech companies could enhance platform utility and drive token value appreciation.

Favorable regulatory developments in key markets, particularly regarding crypto integration with traditional banking services, could significantly boost platform adoption and token utility.

Continued platform development, including enhanced security features, expanded crypto support, and improved user experience, supports long-term growth prospects.

How to Buy Tap (XTP)

You can buy XTP tokens in two main ways, whether you're new to crypto or already have some experience.

Buy XTP with crypto

If you already own Bitcoin, Ethereum, or stablecoins like USDT, you can swap them for XTP on exchanges like Uniswap or ProBit. Just create an account, deposit your crypto, and make the trade. Or alternatively, you can buy directly through the Tap app, where the smart trading engine scans multiple exchanges to find the top prices automatically.

Buy XTP with fiat money

Prefer using your debit card or bank account? Download the Tap app, complete verification, and buy XTP directly with traditional currency. It's the easiest route for beginners as everything happens in one place.

Pro tip for storage

While the Tap app works great for daily use, consider a hardware wallet like Ledger or Trezor if you're planning to hold larger amounts long-term. Think of it like keeping small bills in your regular wallet but storing larger amounts in a safe.

Tap's Ecosystem at a Glance

Tap brings together everything you need to manage money, whether crypto or fiat, into one seamless platform. Each feature is designed to solve everyday financial challenges, from spending to exchanging to sending money abroad.

Multi-currency wallet

Store and manage 60+ cryptocurrencies and major fiat currencies in one secure, easy-to-use wallet. Tap ensures safety with encryption and full regulatory compliance.

Tap Mastercard

Spend crypto or fiat anywhere Mastercard is accepted - online, in-store, or at ATMs. Choose a physical or virtual card and earn as much as 8% Cashback for premium users.

Trade any supported currency without limits. Tap's built-in smart engine scans multiple exchanges in real-time to find the optimal rates for trades automatically.

Community & Support

Join the active Telegram and X channels for updates, tips, and support. Premium users get access to exclusive market insights and help here.

A smarter alternative to traditional banking

While Tap isn't a bank, it offers many things banks can't - like instant crypto-to-fiat spending, global transfers with lower fees, and real-time access to digital assets. By combining these tools in one app, Tap simplifies money management for a new generation of digital natives.

Is XTP Worth Your Attention?

In a nutshell, Tap is a publicly listed and regulated fintech platform that integrates traditional banking features with crypto services. It offers secure asset storage, global spending via Mastercard, competitive exchange rates, and peer-to-peer transfers through its Tap2Tap network.

Appealing to a wide range of user groups, Tap offers travelers benefits like favourable currency exchange rates and card acceptance, cross-border users can enjoy free transfers between users in app, and crypto traders can make use of the seamless spending experience. While the interface and onboarding processes are made really accessible to both newcomers and active traders.

The XTP token serves a functional role within the ecosystem, supporting platform utility rather than speculation. However, users should consider the volatility of crypto markets, regulatory variability, and competition from both banks and fintech firms.

For those seeking an all-in-one platform that connects traditional finance with crypto, Tap presents a cheap, practical and user-friendly option.

What Are Fiat On-Ramps and Off-Ramps?

For many users, one of the biggest challenges in the crypto space is figuring out how to move between traditional money and digital currencies safely and easily. That’s where fiat on-ramps and off-ramps come in. These essential gateways allow users to convert their local currency (like US dollars, GB pounds, or euros) into crypto and back again, helping bridge two financial worlds.

In this guide, we’ll break down what each type of ramp means, how they work, and why they’re critical for expanding real-world crypto adoption.

What Is a Fiat On-Ramp?

A fiat on-ramp is a service that lets users buy cryptocurrencies using traditional fiat currencies such as USD, EUR, or GBP. In other words, it’s the entry point into the world of crypto. Exchanges, brokerage platforms, and payment services act as intermediaries, processing financial transactions and converting fiat money into assets like Bitcoin, Ethereum, or stablecoins.

Common examples include centralized exchanges or fintech apps that integrate blockchain functionality. On-ramps are regulated financial services that typically require Know Your Customer (KYC) verification to comply with laws on anti-money laundering and consumer protection.

When choosing a fiat on-ramp, users should evaluate fees, supported currencies, and security standards to ensure a smooth and safe experience.

The Advantages and Disadvantages of Fiat On-Ramps

Fiat on-ramps make entering the crypto market much easier, particularly for beginners. They simplify the process of buying digital assets without requiring technical expertise.

They also open the door to a diverse set of cryptocurrencies, letting users explore different projects and blockchain networks. Some on-ramps even offer instant payment methods through debit or credit cards, wire transfers, or mobile apps like Google Pay, enabling fast transactions and greater convenience.

From a business perspective, on-ramps support financial inclusion by connecting traditional banking systems to blockchain-based platforms, driving mainstream adoption and innovation across the fintech industry.

While fiat on-ramps are convenient, they also come with a few challenges. Users must comply with verification and regulatory requirements, which can take time. Another potential issue is exposure to fraudulent or unlicensed platforms, which can compromise data or funds. To minimize these risks, users should choose on-ramps that offer transparent pricing and operate in full compliance with financial regulations, like Tap.

In addition, on-ramps might charge higher transaction or processing fees, especially for card purchases or smaller amounts. To keep fees low and help users get the best crypto deals without platform hopping, Tap uses a top-of-the-line smart router.

What Is a Fiat Off-Ramp?

A fiat off-ramp performs the opposite function: it lets users sell cryptocurrency and receive fiat money in their bank account. Off-ramps provide liquidity and help people turn crypto assets into spendable cash.

Off-ramps operate through centralized exchanges, peer-to-peer platforms, or crypto debit cards that automatically convert digital assets into fiat currency at the point of sale. This process makes cryptocurrencies more practical for daily use, enabling real-world purchases, payments, and withdrawals.

How Fiat Off-Ramps Work

The off-ramping process generally involves a few simple steps:

- Transfer crypto from your wallet to an exchange or service that supports fiat withdrawals.

- Sell or convert your chosen cryptocurrency into your preferred fiat currency.

- Withdraw funds to your linked bank account or payment method (for example, a debit card).

Processing times vary by provider and banking network, usually ranging from a few minutes to a few business days. Many platforms require identity verification to meet anti-fraud and regulatory standards. Key factors influencing the experience include withdrawal limits, transaction fees, and the fiat currencies supported.

The Advantages and Disadvantages of Fiat Off-Ramps

The main advantage of off-ramping is, of course, liquidity: the ability to convert digital currencies into usable cash when needed. Whether users want to pay bills, make everyday purchases, or take profits from crypto investments, off-ramping makes that possible.

It also provides flexibility in managing risk. When markets are volatile, selling crypto for fiat can help stabilize personal finances. Additionally, off-ramping plays a role in promoting transparency and regulatory compliance by ensuring that transactions are traceable and aligned with local laws.

Off-ramping faces similar challenges to on-ramping, including variable fees, conversion delays, and regulatory hurdles. Some banks restrict transactions related to cryptocurrency exchanges, causing delays or rejections. Others may require additional verification steps for large transfers.

Users should check whether a platform offers low-cost conversions, and has clear customer support channels. As always, verifying a provider’s regulatory compliance and reputation helps avoid potential issues.

The Connection Between Fiat On-Ramps and Off-Ramps

Together, fiat on-ramps and off-ramps form the foundation of the crypto-fiat ecosystem. They create a two-way bridge that connects digital currencies to the traditional financial system, improving liquidity, usability, and accessibility.

Seamless on-ramping attracts new users by making it easy to enter the market, while efficient off-ramping gives confidence that assets can be converted back to fiat when needed. This balance is what enables broader adoption of cryptocurrencies across businesses, consumers, and financial services.

Platforms like Tap exemplify this connection by offering both on-ramp and off-ramp capabilities through secure infrastructure, compliance with financial regulations, and support for multiple digital assets. Users can buy, sell, and transfer between crypto and fiat currencies using a single account, without needing multiple intermediaries.

Security and Best Practices

Security should always come first when using any financial platform. Here are a few best practices:

- Verify regulation. Check whether the platform follows financial authority standards and offers transparent reporting.

- Use two-factor authentication. This adds an extra layer of protection to your account.

- Confirm wallet and withdrawal addresses. Mistyped addresses are one of the most common causes of lost funds.

- Start with small transactions. Test the service before transferring large amounts.

- Keep records. Store transaction data securely for personal reference or tax reporting.

Following these measures helps maintain data integrity and protects against common cyber risks in digital finance.

Common Challenges and How to Overcome Them

Here are a few recurring challenges users may face:

- Banking restrictions on crypto-related transactions.

- High conversion fees that can reduce profit margins.

- Processing delays during peak trading hours.

- Strict verification procedures that slow onboarding.

The best way to overcome these obstacles is to work with reputable, user-friendly well-established providers that maintain transparent communication and have strong partnerships with trusted financial institutions, such as Tap.

In Conclusion

Now that we've explored what a fiat on-ramp and off-ramp are, it becomes clear how essential it is for cryptocurrency users and investors to understand these processes as they provide liquidity, investment opportunities, and the ability to realize profits (in fiat currency).

Looking ahead, the future of fiat on-ramps and off-ramps appears promising. As the cryptocurrency landscape continues to evolve, we can anticipate exciting advancements in these gateways, making crypto assets more accessible and further driving their adoption into mainstream use.

TAP'S NEWS AND UPDATES

What’s a Rich Text element?

What’s a Rich Text element?The rich text element allows you to create and format headings, paragraphs, blockquotes, images, and video all in one place instead of having to add and format them individually. Just double-click and easily create content.

The rich text element allows you to create and format headings, paragraphs, blockquotes, images, and video all in one place instead of having to add and format them individually. Just double-click and easily create content.Static and dynamic content editing

Static and dynamic content editingA rich text element can be used with static or dynamic content. For static content, just drop it into any page and begin editing. For dynamic content, add a rich text field to any collection and then connect a rich text element to that field in the settings panel. Voila!

A rich text element can be used with static or dynamic content. For static content, just drop it into any page and begin editing. For dynamic content, add a rich text field to any collection and then connect a rich text element to that field in the settings panel. Voila!How to customize formatting for each rich text

How to customize formatting for each rich textHeadings, paragraphs, blockquotes, figures, images, and figure captions can all be styled after a class is added to the rich text element using the "When inside of" nested selector system.

Headings, paragraphs, blockquotes, figures, images, and figure captions can all be styled after a class is added to the rich text element using the "When inside of" nested selector system.What’s a Rich Text element?

What’s a Rich Text element?The rich text element allows you to create and format headings, paragraphs, blockquotes, images, and video all in one place instead of having to add and format them individually. Just double-click and easily create content.

The rich text element allows you to create and format headings, paragraphs, blockquotes, images, and video all in one place instead of having to add and format them individually. Just double-click and easily create content.Static and dynamic content editing

Static and dynamic content editingA rich text element can be used with static or dynamic content. For static content, just drop it into any page and begin editing. For dynamic content, add a rich text field to any collection and then connect a rich text element to that field in the settings panel. Voila!

A rich text element can be used with static or dynamic content. For static content, just drop it into any page and begin editing. For dynamic content, add a rich text field to any collection and then connect a rich text element to that field in the settings panel. Voila!How to customize formatting for each rich text

How to customize formatting for each rich textHeadings, paragraphs, blockquotes, figures, images, and figure captions can all be styled after a class is added to the rich text element using the "When inside of" nested selector system.

Headings, paragraphs, blockquotes, figures, images, and figure captions can all be styled after a class is added to the rich text element using the "When inside of" nested selector system.What’s a Rich Text element?

What’s a Rich Text element?The rich text element allows you to create and format headings, paragraphs, blockquotes, images, and video all in one place instead of having to add and format them individually. Just double-click and easily create content.

The rich text element allows you to create and format headings, paragraphs, blockquotes, images, and video all in one place instead of having to add and format them individually. Just double-click and easily create content.Static and dynamic content editing

Static and dynamic content editingA rich text element can be used with static or dynamic content. For static content, just drop it into any page and begin editing. For dynamic content, add a rich text field to any collection and then connect a rich text element to that field in the settings panel. Voila!

A rich text element can be used with static or dynamic content. For static content, just drop it into any page and begin editing. For dynamic content, add a rich text field to any collection and then connect a rich text element to that field in the settings panel. Voila!How to customize formatting for each rich text

How to customize formatting for each rich textHeadings, paragraphs, blockquotes, figures, images, and figure captions can all be styled after a class is added to the rich text element using the "When inside of" nested selector system.

Headings, paragraphs, blockquotes, figures, images, and figure captions can all be styled after a class is added to the rich text element using the "When inside of" nested selector system.What’s a Rich Text element?

What’s a Rich Text element?The rich text element allows you to create and format headings, paragraphs, blockquotes, images, and video all in one place instead of having to add and format them individually. Just double-click and easily create content.

The rich text element allows you to create and format headings, paragraphs, blockquotes, images, and video all in one place instead of having to add and format them individually. Just double-click and easily create content.Static and dynamic content editing

Static and dynamic content editingA rich text element can be used with static or dynamic content. For static content, just drop it into any page and begin editing. For dynamic content, add a rich text field to any collection and then connect a rich text element to that field in the settings panel. Voila!

A rich text element can be used with static or dynamic content. For static content, just drop it into any page and begin editing. For dynamic content, add a rich text field to any collection and then connect a rich text element to that field in the settings panel. Voila!How to customize formatting for each rich text

How to customize formatting for each rich textHeadings, paragraphs, blockquotes, figures, images, and figure captions can all be styled after a class is added to the rich text element using the "When inside of" nested selector system.

Headings, paragraphs, blockquotes, figures, images, and figure captions can all be styled after a class is added to the rich text element using the "When inside of" nested selector system.Kickstart your financial journey

Ready to take the first step? Join forward-thinking traders and savvy money users. Unlock new possibilities and start your path to success today.

Get started

.webp)

.webp)