Aprender, de forma sencilla

Explora nuestros recursos, guías y artículos sobre todo lo relacionado con el dinero. Gana confianza financiera con contenidos seleccionados por nuestros expertos, tanto si estás empezando como si ya tienes experiencia.

Últimos artículos

Imagina salir del supermercado y darte cuenta de que te han pagado por hacer la compra semanal. No con cupones ni puntos que caducan, sino con dinero real. Eso es el Cashback.

Por ejemplo, si gastas 200 $ en un supermercado con una tarjeta que ofrece un 2% de Cashback, recibes 4 $ de vuelta. En pocas palabras, es un reembolso sobre tus compras diarias, ya sea en un supermercado, restaurante o tienda online.

Vamos a ver paso a paso cómo funciona el Cashback, los distintos tipos de tarjetas que existen, cómo calcular tus recompensas y cuál puede ser la mejor opción para ti.

¿Cómo funciona el Cashback?

El proceso es sencillo:

- Realizas una compra con tu tarjeta de crédito.

- El comercio procesa el pago a través de una red como Visa o American Express.

- El banco emisor calcula la recompensa según el porcentaje de tu tarjeta.

- La recompensa se acumula en tu cuenta.

Normalmente, el Cashback no se recibe al instante. Las recompensas suelen reflejarse al cerrar el ciclo mensual de facturación. Si gastas 500 $ en un mes con una tarjeta al 2%, ganarás 10 $ (500 × 2% = 10 $), que aparecerán tras el cierre del extracto.

Cashback vs. anticipo de efectivo

Aunque suenen parecido, no son lo mismo:

- Cashback es una recompensa.

- Anticipo de efectivo (cash advance) es un préstamo sobre tu línea de crédito, generalmente con comisión inmediata y alto interés.

Confundirlos puede resultar caro. El anticipo genera intereses desde el primer día, mientras que el Cashback reduce tu gasto efectivo.

Cashback vs. puntos

Algunas tarjetas anuncian “cashback” pero en realidad otorgan puntos. Estos pueden convertirse a una tasa fija (por ejemplo, 1 punto = 1 céntimo) o tener valor variable según cómo los uses (viajes, tarjetas regalo, compras online). Siempre revisa las condiciones para entender el valor real.

Tipos de tarjetas con Cashback

No todas funcionan igual. Estos son los modelos más habituales:

Tarjetas de tasa fija

Ofrecen el mismo porcentaje en todas las compras, normalmente entre el 1,5% y el 2%.

Si gastas 1.000 $ al mes con una tarjeta al 2%, ganarás 20 $ (1.000 × 2% = 20 $), sin importar el tipo de gasto.

Son ideales para quienes buscan simplicidad.

Tarjetas por categorías fijas o escalonadas

Ofrecen mayor porcentaje en categorías específicas (supermercados, gasolineras, restaurantes, viajes) y un porcentaje más bajo (generalmente 1%) en el resto.

Ejemplo:

- 3% en supermercados → 500 $ × 3% = 15 $

- 1% en otros gastos → 500 $ × 1% = 5 $

- Total = 20 $

El banco define qué comercios califican, por lo que conviene revisar las condiciones.

Son adecuadas para quienes tienen patrones de gasto constantes.

Tarjetas con categorías rotativas

Ofrecen un 5% en categorías que cambian cada trimestre, normalmente con límite de gasto.

Ejemplo:

Si el límite trimestral es 1.500 $ y gastas esa cantidad al 5%, ganarás 75 $ (1.500 × 5% = 75 $). Después del límite, suele aplicarse el 1%.

Es necesario activar la categoría cada trimestre. Si no lo haces, solo se aplica el porcentaje base.

Son ideales para usuarios atentos y organizados.

Tarjetas con categoría elegible

Permiten seleccionar la categoría de bonificación cada mes o aplican automáticamente el mayor porcentaje a la categoría donde más gastas.

Si eliges restaurantes al 3% y gastas 400 $, ganarás 12 $ (400 × 3% = 12 $).

Son adecuadas para estilos de vida cambiantes.

Cómo calcular tu Cashback

La fórmula es simple:

Importe gastado × porcentaje de Cashback = recompensa

Ejemplos:

- 100 $ × 1% = 1 $

- 1.000 $ × 1,5% = 15 $

- 500 $ × 5% = 25 $

- 2.000 $ × 5% = 100 $

Ten en cuenta los límites de gasto y condiciones de categoría, que pueden reducir el porcentaje efectivo.

¿Merece la pena una tarjeta con Cashback?

Funciona mejor si pagas el saldo completo cada mes. Si mantienes deuda, los intereses (a veces superiores al 20% anual) pueden superar fácilmente las recompensas.

Ventajas

- Ganas un porcentaje sobre gastos habituales.

- Valor fijo en dinero, a diferencia de sistemas de millas variables.

- Algunas tarjetas no tienen comisión anual.

- Con el tiempo, puede compensar gastos reales.

Por ejemplo, gastar 2.000 $ al mes al 2% genera 40 $ mensuales (2.000 × 2% = 40 $), es decir, 480 $ al año.

Desventajas

- Mantener saldo genera intereses que superan las recompensas.

- Algunas tarjetas tienen cuota anual.

- Las categorías rotativas requieren gestión activa.

- Solicitar varias tarjetas puede afectar temporalmente a tu puntuación crediticia.

También conviene considerar la diferencia entre crédito y débito. La tarjeta de débito utiliza tu propio dinero y evita intereses. La de crédito ofrece recompensas y posibilidad de construir historial crediticio, pero implica riesgo si gastas más de lo que puedes pagar.

El Cashback es un incentivo, no dinero gratis. Funciona mejor cuando forma parte de una planificación financiera disciplinada.

Consejos para maximizar el Cashback

- Elige la tarjeta según tus gastos reales. Revisa tus extractos antes de decidir.

- Paga siempre el saldo completo.

- Activa las categorías rotativas a tiempo.

- Planifica compras grandes estratégicamente.

- Combina tarjetas: una de tasa fija para gastos generales y otra por categorías puede aumentar tus recompensas.

- Complementa con apps o webs de Cashback independientes.

- Evalúa bien los bonos de bienvenida para asegurarte de que el gasto requerido encaja con tu presupuesto habitual.

Obtén Cashback sin caer en la trampa del crédito

Las tarjetas de crédito con Cashback pueden parecer atractivas, pero si mantienes saldo pendiente, los intereses pueden eliminar cualquier beneficio.

Existe una alternativa: el Cashback cripto con tarjeta de débito. La tarjeta de débito de Tap te permite obtener recompensas sin endeudarte. Ganas Cashback en compras cotidianas (supermercado, café, viajes, restaurantes) sin pedir dinero prestado, sin intereses y sin riesgo de sobreendeudamiento.

Las recompensas se pagan en el token XTP y se depositan directamente en tu wallet según la cantidad de XTP que tengas bloqueada (staked). Las tasas de Cashback van del 0,5% al 8%, dependiendo del nivel. Cuantos más XTP bloquees, mayor será tu recompensa.

Si valoras la disciplina financiera y quieres obtener recompensas por tus gastos, la tarjeta de débito cripto de Tap puede ser una alternativa interesante.

¿Listo para ganar Cashback de forma más inteligente? Descarga la app de Tap y empieza a convertir tus compras en recompensas cripto hoy mismo.

Probablemente hayas oído hablar de MakerDAO, el protocolo detrás de MKR y la stablecoin DAI. Ahora llega su siguiente etapa: Sky.

Sky es la nueva identidad del ecosistema MakerDAO, uno de los proyectos más consolidados de las finanzas descentralizadas (DeFi). Lanzado en 2024, representa la evolución del sistema de stablecoin y gobernanza de Maker, con un enfoque más claro en accesibilidad, usabilidad y experiencia del usuario.

Sky mantiene el papel histórico de MakerDAO en DeFi, pero introduce un ecosistema renovado centrado en gobernanza y control descentralizado de activos digitales.

Sky vs. Skycoin: aclarando la confusión

A pesar de la similitud en el nombre, Sky (SKY) y Skycoin (SKY) son proyectos de criptomonedas completamente diferentes. Sky es el ecosistema renombrado de MakerDAO, centrado en finanzas descentralizadas, stablecoins y gobernanza en Ethereum. Skycoin, por otro lado, es un proyecto blockchain independiente con su propia plataforma de computación, economía de tokens y equipo de desarrollo.

Difieren en caso de uso, valor de mercado, tecnología y comunidad. La función principal de Sky es facilitar el ahorro descentralizado, los préstamos y la gobernanza a través de USDS y SKY, mientras que Skycoin se enfoca en la arquitectura de red y una infraestructura blockchain alternativa. Sus precios, capitalización bursátil y volumen de negociación tampoco guardan relación alguna.

Entender esta distinción es importante tanto para inversores como para usuarios finales a fin de evitar confusiones al investigar en exchanges, tendencias de mercado u oportunidades de inversión.

¿Cómo funciona Sky? Características principales

Sky opera como un servicio de finanzas descentralizadas sin ninguna autoridad central que controle los fondos de los usuarios. Una de sus funciones principales es el staking de USDS, mediante el cual los usuarios depositan USDS en el protocolo para obtener rendimiento a través de mecanismos como la Tasa de Ahorro de Sky y las Recompensas en Token Sky. Esto permite a los usuarios generar intereses sobre una divisa digital anclada al dólar manteniendo el control total de sus activos.

La gobernanza se gestiona a través del token SKY. Los titulares del token participan en la votación sobre actualizaciones del protocolo, ajustes de comisiones, políticas de colateral y decisiones de gestión de riesgos. Este proceso de votación garantiza la transparencia y una toma de decisiones liderada por la comunidad en todo el ecosistema.

Sky también presenta una estructura modular conocida como Sky Stars, proyectos independientes que operan dentro del ecosistema más amplio manteniendo su autonomía. Este diseño favorece la innovación, la escalabilidad y un desarrollo más ágil, todo ello manteniendo la alineación con los servicios financieros centrales de Sky.

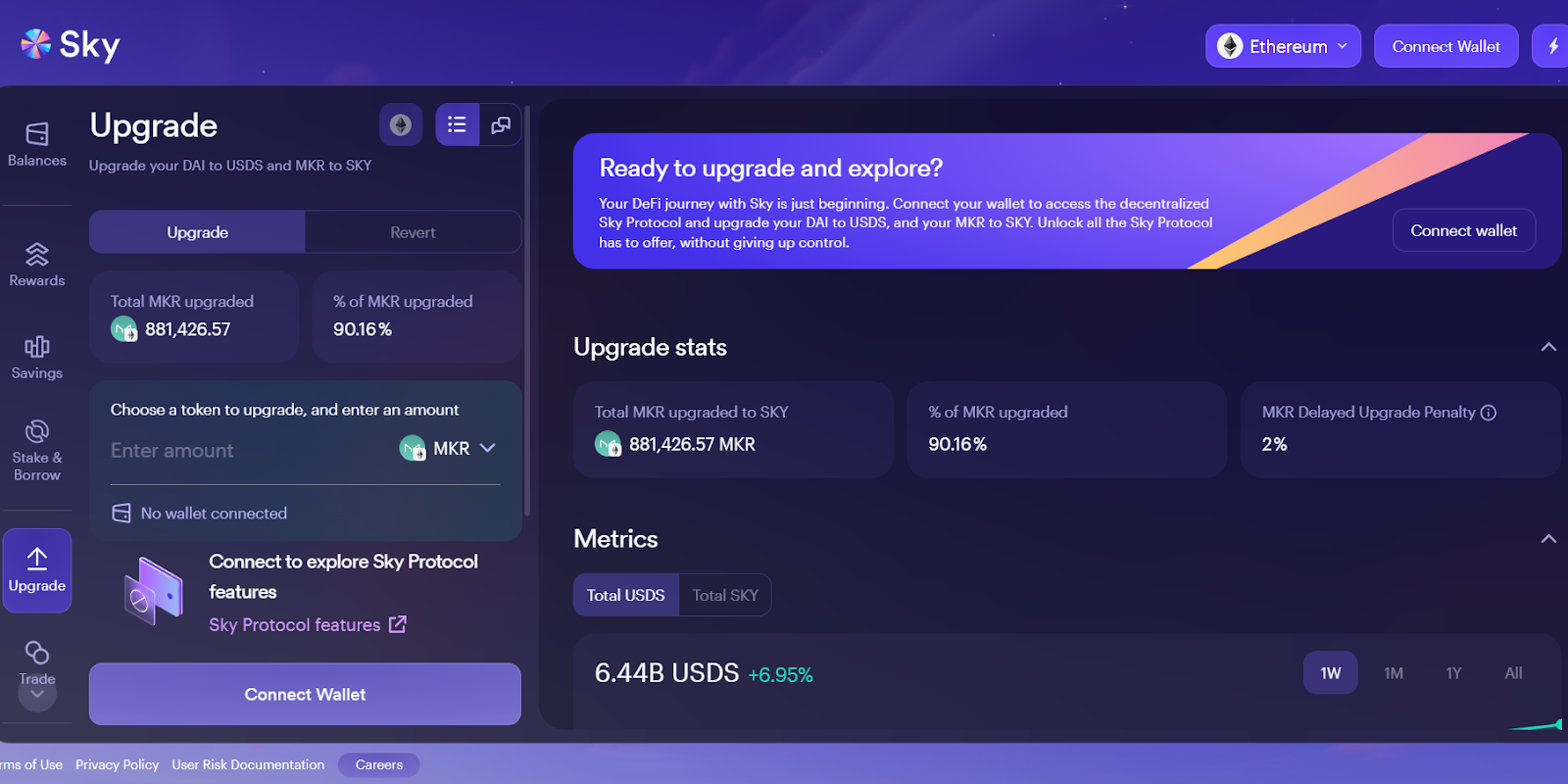

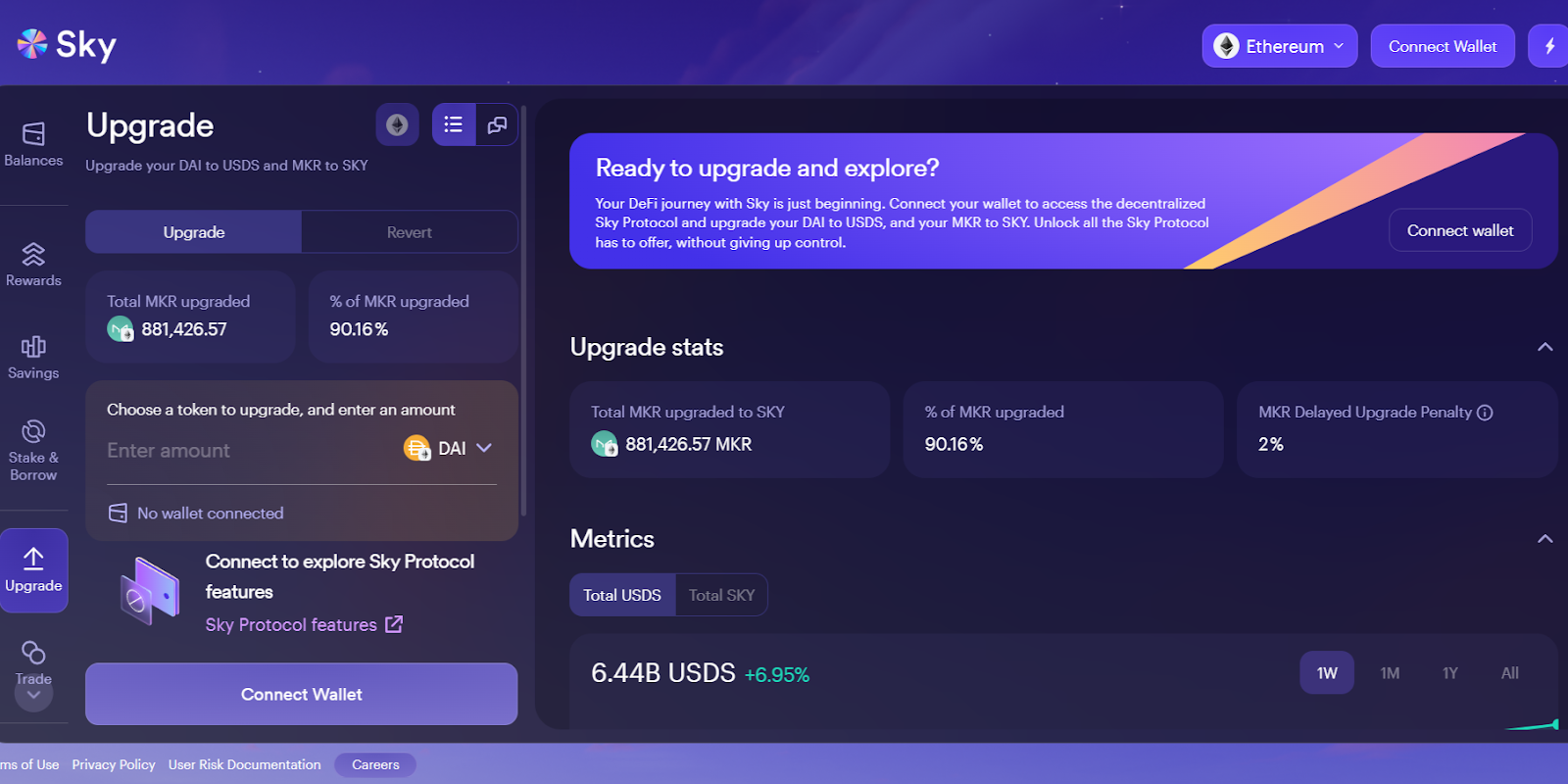

Cómo actualizar de MKR a SKY

Como parte del cambio de marca de MakerDAO, MKR ha sido reemplazado por SKY como el único token de gobernanza del Protocolo Sky. Si bien MKR podría seguir negociándose en mercados secundarios, solo SKY otorga acceso a la gobernanza, al staking y a la participación en el ecosistema Sky.

El proceso de actualización se gestiona directamente a través del sitio web oficial de Sky, garantizando una experiencia no custodiada y controlada por el usuario. Los usuarios simplemente conectan su monedero de Ethereum, inician la actualización y convierten MKR a SKY con la proporción fija de 1 MKR = 24.000 SKY. Durante todo el proceso, los usuarios mantienen el control total de sus activos.

Se recomienda encarecidamente la actualización a cualquier persona que desee seguir votando, delegando o interactuando con los mecanismos de gobernanza y recompensas de Sky. Poseer SKY desbloquea funcionalidades como la votación en el protocolo, la participación en la toma de decisiones y el acceso a funcionalidades relacionadas con el staking vinculadas al ecosistema Sky.

También es importante señalar que el protocolo introduce una penalización temporal por actualizaciones demoradas. A partir del 18 de septiembre de 2025, la cantidad de SKY recibida por cada MKR disminuirá gradualmente, comenzando con una reducción del 1% y aumentando con el tiempo. Actualizar antes de esta fecha garantiza que los usuarios reciban el valor de conversión completo sin penalización alguna.

En resumen, aunque MKR sigue siendo un activo reconocible, SKY es el token que impulsará el ecosistema Sky en el futuro, y la actualización es la vía recomendada para quienes deseen mantenerse alineados con el desarrollo futuro del protocolo.

Valor actual del token SKY y desempeño de mercado

El token SKY desempeña un papel central en la gobernanza y en los incentivos del protocolo. Tras el cambio de marca, MKR se convirtió en SKY con una proporción de 1:24.000, lo que redujo significativamente el precio unitario y mejoró la accesibilidad para los participantes individuales.

En el momento de redactar este artículo, su capitalización bursátil la sitúa entre las 50 criptomonedas principales, junto a tokens de gobernanza DeFi bien consolidados. Sin embargo, como todas las criptomonedas, SKY experimenta volatilidad de precios influenciada por las condiciones generales del mercado y las tendencias de adopción de DeFi.

Conclusión

Sky es el siguiente capítulo de MakerDAO, reinventado para ofrecer un ecosistema de finanzas descentralizadas más accesible y escalable. Al combinar USDS para ahorros y transacciones con SKY para la gobernanza y la toma de decisiones, Sky pretende empoderar a los usuarios con un mayor control, transparencia y autonomía financiera.

Creada como la evolución natural de DAI, USDS es una stablecoin que opera dentro del ecosistema Sky Protocol (anteriormente MakerDAO) y busca combinar estabilidad de precio, transparencia y descentralización en un único activo digital.

A medida que las stablecoins desempeñan un papel cada vez más importante en las finanzas globales, USDS ofrece una alternativa a las opciones centralizadas mediante el uso de colateral respaldado por criptoactivos y smart contracts automatizados, en lugar de depender de una única empresa emisora. Más allá de la estabilidad de precio, USDS está diseñada para integrarse sin fricciones en aplicaciones de finanzas descentralizadas, ofrecer oportunidades de rendimiento a través de incentivos del protocolo y respaldar un futuro multi-chain. Para quienes buscan un dólar digital estable sin control centralizado, USDS representa un enfoque moderno para el almacenamiento y la transferencia de valor.

¿Qué es USDS?

USDS es una stablecoin respaldada por criptoactivos y vinculada al dólar estadounidense, lo que significa que su precio objetivo es aproximadamente 1 dólar en todo momento. A diferencia de los dólares digitales tradicionales emitidos por empresas centralizadas, USDS está gobernada por smart contracts y por un proceso de toma de decisiones descentralizado, en lugar de una autoridad única.

La base de USDS se sustenta en tres principios fundamentales. Primero, la estabilidad: el protocolo está diseñado para mantener a USDS cerca de su paridad con el dólar incluso en periodos de volatilidad del mercado. Segundo, la descentralización: ninguna empresa o gobierno controla su emisión, congelación o redención. Tercero, la colateralización: cada USDS en circulación está respaldado por activos cripto como ETH, USDC y activos tokenizados del mundo real depositados dentro del Sky Protocol.

En comparación con stablecoins centralizadas como USDT o USDC, USDS no depende de reservas bancarias corporativas ni de custodios off-chain. En comparación con DAI, USDS está diseñada para ofrecer mayor escalabilidad y funcionalidad multi-chain. Y a diferencia de las stablecoins puramente algorítmicas, USDS se apoya en colateral tangible en lugar de depender únicamente de incentivos de mercado. Su propósito es proporcionar un dólar digital transparente y resiliente alineado con los valores de las finanzas descentralizadas.

Cómo funciona USDS

Creación a través de Sky Vaults

USDS se crea mediante un sistema conocido como Sky Vaults. Los usuarios depositan activos de colateral aprobados en smart contracts automatizados y, a cambio, acuñan USDS. Una forma sencilla de entenderlo es imaginar que se depositan activos valiosos en una bóveda digital segura y se recibe a cambio un recibo vinculado al dólar que puede gastarse o transferirse.

El colateral aceptado incluye criptomonedas como ETH, activos estables como USDC y ciertos activos tokenizados del mundo real. Cada bóveda opera bajo reglas predefinidas que garantizan coherencia y seguridad en todo el sistema.

Estabilidad y sobrecolateralización

Para proteger la paridad con el dólar, USDS está sobrecolateralizada. Esto significa que los usuarios deben depositar más valor del que generan en USDS. Si el valor del colateral cae por debajo de ciertos umbrales, el sistema vende automáticamente parte de los activos mediante un proceso de liquidación para proteger la estabilidad general. Este margen de seguridad es una de las razones por las que USDS puede mantener su paridad sin depender de un emisor central.

Papel dentro del Sky Protocol

USDS funciona como la stablecoin central del ecosistema Sky Protocol. Da soporte a préstamos, ahorro, pagos y procesos de gobernanza dentro de la plataforma. Aunque las decisiones de gobernanza se gestionan por separado, USDS está profundamente integrada en la arquitectura y el sistema de incentivos de Sky.

Actualización de DAI a USDS

La transición de DAI a USDS está diseñada como un proceso sencillo y centrado en el usuario, alineado con las mejores prácticas de las finanzas descentralizadas modernas y la tecnología de la información. A través del sitio web oficial de Sky, los usuarios pueden conectar una wallet compatible y actualizar sus DAI a USDS mediante smart contracts.

Desde la perspectiva de la experiencia de usuario, el proceso enfatiza accesibilidad, transparencia y eficiencia. Ninguna autoridad central, banco o intermediario controla la transacción, y los usuarios conservan la plena propiedad de sus datos y activos digitales en todo momento.

Una vez completada la actualización, los holders de USDS pueden acceder de inmediato a herramientas adicionales dentro del ecosistema Sky, incluidos mecanismos de ahorro e incentivos. Para usuarios en Estados Unidos y a nivel global, esta actualización no es solo un cambio técnico, sino una mejora en cómo los productos de stablecoins descentralizadas ofrecen valor, escalabilidad y usabilidad.

USDS vs. DAI: ¿Qué ha cambiado?

USDS y DAI comparten una historia común en el sistema MakerDAO, ahora bajo el Sky Protocol. Ambas son stablecoins descentralizadas vinculadas al dólar y respaldadas por colateral on-chain. Sin embargo, USDS representa una evolución arquitectónica y estratégica centrada en escalabilidad, gobernanza e incentivos mejorados para el usuario final.

DAI fue un producto fundacional en DeFi, permitiendo a los usuarios bloquear activos cripto en smart contracts para generar una moneda digital estable. USDS perfecciona ese modelo mediante mejoras tecnológicas, compatibilidad multi-chain ampliada y nuevas estructuras de recompensas que aumentan la eficiencia del capital y la participación de los usuarios.

Desde una perspectiva de gestión de riesgos y políticas, USDS está diseñada para alinearse mejor con expectativas regulatorias sin perder su carácter descentralizado. Incorpora lecciones aprendidas de la volatilidad del mercado, crisis anteriores y desafíos en el diseño de stablecoins. En resumen, DAI sentó las bases; USDS aplica mecanismos actualizados de diseño, gobernanza e incentivos para responder a las necesidades actuales de DeFi.

USDS frente a otras stablecoins

USDS se diferencia principalmente en cómo gestiona el control, el respaldo y la transparencia.

Las stablecoins centralizadas como USDT y USDC son emitidas por empresas que gestionan reservas fiat y pueden congelar fondos si la normativa lo exige. Las stablecoins algorítmicas dependen principalmente de incentivos de mercado y ajustes de oferta basados en código, lo que puede introducir mayor riesgo sistémico.

USDS, por el contrario, es descentralizada y respaldada por colateral. Sus reservas son visibles on-chain y ninguna entidad individual tiene autoridad unilateral sobre los fondos de los usuarios. Esto reduce el riesgo de censura y mejora la transparencia, aunque también hace que el sistema sea algo más complejo que las alternativas centralizadas. En conjunto, USDS se sitúa entre las stablecoins institucionales y los diseños algorítmicos experimentales, ofreciendo un equilibrio entre estabilidad y descentralización.

Cómo obtener y utilizar USDS

Existen varias formas de adquirir y usar USDS, dependiendo del nivel de experiencia del usuario.

La forma más sencilla es comprar USDS en un exchange descentralizado utilizando otra criptomoneda, opción generalmente adecuada para principiantes. Los holders de DAI pueden convertir DAI a USDS en una proporción uno a uno a través de plataformas compatibles. Los usuarios más avanzados pueden acuñar USDS directamente depositando colateral en los Sky Vaults.

Una vez adquirida, USDS puede utilizarse como reserva estable de valor, como par de trading en mercados DeFi o como medio de pago para transferir valor sin exposición a la volatilidad de precios. También desempeña un papel en la provisión de liquidez y en protocolos de préstamo dentro del ecosistema DeFi.

Generar rendimiento con USDS

USDS ofrece oportunidades de rendimiento dentro del Sky Protocol. Una opción es la Sky Savings Rate, que permite bloquear USDS en un smart contract para obtener recompensas variables con el tiempo. Este enfoque es similar a una cuenta de ahorro, aunque los rendimientos fluctúan según las condiciones del protocolo.

Otro mecanismo son las Sky Token Rewards, que proporcionan incentivos adicionales a los usuarios que participan activamente en el ecosistema. Estas recompensas pueden cambiar y no están garantizadas, pero añaden una capa adicional de valor para usuarios comprometidos. Como ocurre con todos los mecanismos de rendimiento en DeFi, los retornos dependen de las condiciones de mercado y de decisiones de gobernanza.

USDS dentro del ecosistema Sky Protocol

Sky Protocol es una plataforma de finanzas descentralizadas construida sobre el legado de MakerDAO. Dentro de este ecosistema, USDS actúa como unidad principal de transferencia de valor. Interactúa con procesos de gobernanza, programas de incentivos y otras aplicaciones descentralizadas compatibles con Sky.

Aunque los tokens de gobernanza y las actualizaciones del protocolo operan en segundo plano, los usuarios no necesitan conocimientos técnicos profundos para beneficiarse de USDS. Su diseño prioriza la usabilidad manteniéndose fiel a principios descentralizados y a una arquitectura transparente.

Conclusión

USDS es una stablecoin descentralizada diseñada para ofrecer un dólar digital fiable sin control centralizado. Como sucesora de DAI, se apoya en un modelo probado al tiempo que introduce mejoras en escalabilidad e integración dentro del Sky Protocol.

Al combinar colateral respaldado por criptoactivos, gestión de riesgos automatizada y transparencia on-chain, USDS ofrece una alternativa tanto a las stablecoins centralizadas como a las algorítmicas. A medida que DeFi continúa evolucionando, USDS representa una opción práctica para usuarios que buscan estabilidad de precio con gobernanza descentralizada.

Al operar en los mercados, la liquidez ofrece una medida de la rapidez con la que un activo puede convertirse en efectivo. Cuanta más liquidez tenga un activo, más fácil será intercambiarlo por dinero. Esto influye directamente en su precio: cuanto más negociable es un activo, menor será el impacto de la operación en su cotización.

Otros factores a tener en cuenta incluyen el volumen de negociación, los indicadores técnicos y la volatilidad. La liquidez es importante en todos los ámbitos, desde los mercados bursátiles y de activos digitales hasta la liquidez de una empresa, siendo siempre preferibles los activos líquidos. Veamos primero qué es la liquidez, cuáles son los activos más líquidos y los puntos clave a los que se refiere este concepto.

¿Qué significa exactamente liquidez?

En su forma más simple, la liquidez analiza lo fácil y rápido que un activo puede convertirse en otro (comprarse o venderse) sin afectar a su precio. En ocasiones, la liquidez también se denomina ratio de caja o valores negociables. Un ratio de liquidez ayuda a los inversores a determinar si un activo es líquido y cuán sencillo será convertirlo.

Cuando un activo tiene buena liquidez de mercado, puede intercambiarse fácilmente por efectivo u otros activos sin afectar a su precio de mercado. A estos se les llama activos líquidos e incluyen divisas, valores negociables e instrumentos del mercado monetario. Esto aporta tranquilidad a los inversores con otras obligaciones financieras.

Por el contrario, una baja liquidez significa que el activo no puede comprarse o venderse con facilidad y que cualquier transacción afectará a su precio. El sector inmobiliario, los objetos raros o los coches exóticos son ejemplos de activos ilíquidos, que pueden tardar más en venderse y no siempre al precio esperado.

¿Cuál es el activo más líquido?

En términos de liquidez financiera, el efectivo se considera el activo más líquido.

Piensa en la liquidez como un espectro: en un extremo está el efectivo (altamente líquido) y en el otro los objetos raros. Ubicar un activo en este espectro ayuda a entender su nivel de liquidez.

Tipos de liquidez

De forma general, existen dos tipos de liquidez: la liquidez de mercado y la liquidez contable, utilizada para medir el ratio actual de un activo o empresa.

¿Qué es la liquidez de mercado?

La liquidez de mercado se define como la facilidad con la que un activo financiero puede comprarse y venderse a precios justos, es decir, cercanos a su valor real o intrínseco.

El valor intrínseco se refiere al precio mínimo que un vendedor está dispuesto a aceptar (ask) y al precio máximo que un comprador está dispuesto a pagar (bid). La diferencia entre ambos se conoce como diferencial bid-ask o spread. Cuanto menor es este diferencial, mayor es la liquidez del activo.

¿Qué es la liquidez contable?

La liquidez contable describe la capacidad de una empresa para hacer frente a sus deudas y obligaciones a corto plazo con sus activos corrientes y flujo de caja. En otras palabras, refleja la salud financiera de la empresa: cuanto mayor es la liquidez contable, más líquido es su capital.

Normalmente, la liquidez contable se menciona en relación con empresas y su balance. Tiene menos que ver con activos individuales y más con la situación financiera global de la compañía.

¿Qué es el diferencial bid-ask?

El diferencial bid-ask es la diferencia entre la mejor oferta de compra y la mejor oferta de venta. En mercados líquidos, se prefiere un diferencial bajo, ya que indica que hay suficiente liquidez y que compradores y vendedores equilibran continuamente los precios.

Un diferencial amplio suele indicar iliquidez y una gran diferencia entre lo que los compradores están dispuestos a pagar y lo que los vendedores quieren recibir.

Este diferencial es especialmente relevante para los traders de arbitraje, que intentan aprovechar pequeñas diferencias repetidamente. Aunque obtienen beneficios, su actividad ayuda a reducir el diferencial y mejora la ejecución de operaciones para otros participantes.

Los traders de arbitraje también contribuyen a que los mismos pares de mercado no presenten grandes diferencias de precio entre distintas plataformas. Por ejemplo, el precio de Bitcoin suele ser similar en los mercados más líquidos, en gran parte gracias a estos traders que aprovechan pequeñas variaciones entre plataformas.

Por qué la liquidez es clave en los mercados

Las acciones de grandes empresas y las principales monedas digitales suelen tener mercados más líquidos debido a su mayor volumen de negociación y eficiencia.

El volumen diario negociado varía según el mercado: algunos mueven solo miles de euros, mientras que otros alcanzan miles de millones. Los activos de grandes compañías no suelen tener problemas de liquidez porque hay muchos compradores y vendedores. Esto no ocurre con activos menos negociados, que a menudo carecen de liquidez suficiente.

Al construir tu cartera, conviene incluir mercados líquidos para asegurarte de que, si necesitas vender, podrás hacerlo a un buen precio. En activos pequeños, puede que no logres salir al precio deseado, quedándote con un activo difícil de vender o a un precio muy inferior.

Esto se conoce como slippage o deslizamiento, y ocurre al intentar ejecutar una orden grande en un mercado ilíquido. El deslizamiento es la diferencia entre el precio al que pretendías vender y el precio real de ejecución. Un deslizamiento elevado indica que la operación se ejecutó a un precio muy distinto al esperado, generalmente por falta de órdenes cercanas en el libro. Puede evitarse usando órdenes limitadas, aunque existe el riesgo de que no se ejecuten.

Las condiciones del mercado influyen significativamente en la liquidez. En una crisis financiera, por ejemplo, algunos participantes pueden vender activos mientras otros retiran efectivo, afectando a la fluidez del mercado.

Reflexiones finales

En los mercados, la liquidez se refiere a la facilidad para operar. Los traders suelen preferir mercados líquidos porque permiten entrar y salir de posiciones con mayor comodidad. El nivel de liquidez influye en la eficiencia y efectividad de las estrategias de trading. Según tus preferencias, incluir activos altamente líquidos en tu cartera puede aportar flexibilidad y mejores condiciones de ejecución.

Adéntrate en el mundo de los mercados bajistas, un escenario donde reina la incertidumbre, los precios caen y la confianza de los inversores y el sentimiento del mercado se debilitan.

Tanto si eres un inversor experimentado como si estás dando tus primeros pasos en el mundo financiero, comprender los mercados bajistas es clave para proteger tus inversiones y tomar decisiones acertadas en momentos complicados. Un mercado bajista puede entenderse como una fase del ciclo de mercado en la que los precios descienden de forma persistente en distintas clases de activos como acciones, bonos o materias primas. Es como navegar en aguas turbulentas, con pesimismo en el ambiente y retos económicos por delante.

En este artículo explicamos las características que definen a los mercados bajistas, los factores que provocan su caída y algunas estrategias prácticas para afrontar estos periodos. El objetivo es darte las herramientas necesarias para moverte con mayor seguridad, tanto si inviertes en bolsa como en criptomonedas.

¿Qué es un mercado bajista?

Un mercado bajista se refiere a una fase del ciclo de mercado caracterizada por descensos prolongados de precios en diferentes clases de activos, como acciones, bonos, criptomonedas o materias primas. Es lo opuesto a un mercado alcista, donde predominan el optimismo y las subidas de precios.

Durante un mercado bajista, el sentimiento inversor está dominado por el pesimismo y la incertidumbre. Los precios siguen una tendencia descendente sostenida, que suele implicar caídas del 20% o más desde los máximos anteriores. Un mercado bajista puede durar desde unos meses hasta varios años.

Suele aparecer en contextos de debilidad económica o desaceleración, y puede verse provocado por factores como malos resultados empresariales, tensiones geopolíticas, crisis financieras o indicadores macroeconómicos negativos.

Mercado bajista vs mercado alcista

A diferencia de los mercados alcistas, donde las subidas generan oportunidades de ganancias, un mercado bajista plantea importantes retos. Los inversores suelen enfrentarse a caídas en el valor de sus carteras y posibles pérdidas, por lo que adoptan una actitud más cautelosa, priorizando la preservación del capital y estrategias defensivas.

Cómo moverse en territorio de mercado bajista

Invertir en un mercado bajista requiere un enfoque distinto al de un mercado alcista. Es habitual reducir la exposición a activos de alto riesgo, reasignar hacia inversiones más seguras como bonos o liquidez, y utilizar estrategias de cobertura. Algunos inversores aprovechan estos periodos para buscar activos infravalorados, seleccionar valores concretos o invertir en sectores defensivos como utilities, consumo básico o metales preciosos.

Aunque son periodos difíciles, los mercados bajistas también ofrecen oportunidades. Los inversores con una visión a largo plazo pueden encontrar buenos puntos de entrada para adquirir activos de calidad a precios reducidos. Eso sí, es fundamental investigar bien y mantener una gestión del riesgo disciplinada.

¿A qué se refiere el término “bear”?

En este contexto, el término “bear” (oso) simboliza la forma en que un oso ataca, golpeando hacia abajo con sus patas. Representa un mercado en caída, con precios descendentes y un sentimiento negativo generalizado.

Características de los mercados bajistas

Los mercados bajistas presentan rasgos distintivos que los diferencian de los alcistas:

- Sentimiento negativo de los inversores: predominan el miedo y la aversión al riesgo.

- Caídas prolongadas de precios: descensos sostenidos en distintas clases de activos.

- Alta volatilidad y presión vendedora: mayores oscilaciones y ventas intensas.

- Dificultades económicas: suelen coincidir con desaceleraciones o recesiones.

- Menor participación en el mercado: los inversores reducen su actividad.

- Mejor comportamiento de sectores defensivos: como salud, consumo básico o utilities.

- Oportunidades para la inversión en valor: activos infravalorados con potencial de recuperación.

Comprender estas características ayuda a ajustar estrategias y proteger la cartera. Una herramienta común para gestionar estas fases es el dollar cost averaging, que consiste en invertir de forma periódica independientemente del precio.

Los beneficios de un mercado bajista

Aunque presentan desafíos, los mercados bajistas también ofrecen ventajas:

- Oportunidades de compra a precios reducidos.

- Mayor rentabilidad por dividendo al caer los precios de las acciones.

- Estabilidad relativa de sectores defensivos.

- Inversión en valor a largo plazo.

- Aprendizaje y crecimiento del inversor, tanto a nivel técnico como emocional.

Con una visión a largo plazo y estrategias prudentes, estos periodos pueden aprovecharse de forma constructiva.

Los riesgos de un mercado bajista

También es importante tener en cuenta los riesgos:

- Caídas de cartera y pérdidas.

- Alta volatilidad y estrés emocional.

- Incertidumbre económica y laboral.

- Deterioro de beneficios empresariales.

- Sesgos psicológicos y comportamiento de manada.

- Dificultad para acertar con el timing del mercado.

La disciplina, la diversificación y una gestión del riesgo adecuada son clave para afrontarlos.

Mercados bajistas anteriores

Ejemplos históricos como la crisis financiera de 2008 o el estallido de la burbuja puntocom muestran la importancia de diversificar, pensar a largo plazo y mantenerse informado. Estudiar estos episodios ayuda a tomar mejores decisiones en el futuro.

Conclusión: ¿qué es un mercado bajista?

Un mercado bajista es un periodo de caídas de precios y sentimiento negativo. Aunque conlleva riesgos como pérdidas y volatilidad, también ofrece oportunidades para invertir a precios atractivos. Aprender de la historia, diversificar y mantener una estrategia disciplinada permite gestionar mejor estos periodos y salir de ellos con mayor fortaleza y resiliencia financiera.

Puede que hayas oído hablar de mercados bajistas (bear) y alcistas (bull), ambos referidos a condiciones económicas dentro de un mercado. Piensa en cómo ataca un toro, levantando con los cuernos.

Un mercado alcista o bullish market describe una situación en un mercado financiero en la que los precios están subiendo o se espera que suban. El término “mercado alcista” se utiliza con mayor frecuencia para referirse a los mercados financieros, pero también puede aplicarse a cualquier activo negociable, como bonos, inmuebles, materias primas y divisas. Los mercados alcistas indican confianza y optimismo por parte de los inversores, así como expectativas de que los buenos resultados continúen durante un periodo prolongado.

¿Qué es un mercado alcista?

Un mercado alcista se refiere a una condición del mercado financiero en la que los precios de los valores o activos están subiendo o se espera que suban durante un periodo extendido. En un mercado alcista, los inversores son optimistas sobre las perspectivas futuras y están dispuestos a comprar activos, impulsando los precios al alza.

Los mercados alcistas suelen asociarse con crecimiento económico, sólidos beneficios empresariales y bajas tasas de desempleo. En estas condiciones, los inversores confían en que las empresas seguirán rindiendo bien y que la economía continuará expandiéndose, lo que se traduce en precios más altos.

Cómo reconocer un mercado alcista

Para reconocer un mercado alcista, los inversores deben observar un periodo sostenido de subidas de precios en el mercado en general o en una clase de activos específica. Este periodo puede durar desde unos meses hasta varios años.

Otra forma de identificar un mercado alcista es mediante el análisis técnico. Los analistas técnicos estudian gráficos e indicadores para detectar patrones que señalan una tendencia. En un mercado alcista, suelen buscar máximos y mínimos cada vez más altos en la evolución de los precios.

Impacto de un mercado alcista

Un mercado alcista puede tener un impacto significativo en la economía, las empresas y los inversores. Cuando la bolsa funciona bien, las empresas suelen tener un acceso más fácil a capital y crédito, lo que puede impulsar la inversión y el crecimiento.

También puede aumentar la confianza de los consumidores, ya que los inversores se sienten más optimistas sobre la economía y su futuro financiero. Esto puede traducirse en un mayor gasto, que a su vez alimenta el crecimiento económico.

Por otro lado, un mercado alcista prolongado puede dar lugar a una burbuja, en la que los precios se inflan en exceso y se vuelven insostenibles. Esto puede desembocar en una corrección del mercado, con caídas significativas de precios y posibles pérdidas para los inversores.

Conclusión

Los mercados alcistas pueden influir de forma notable en la economía, las empresas y los inversores. Reconocerlos y comprender su impacto ayuda a tomar decisiones de inversión más informadas. No obstante, es fundamental mantenerse alerta y no invertir únicamente guiándose por la tendencia, ya que las burbujas pueden provocar pérdidas importantes.

Ante un mercado alcista, algunos optan por vender activos para asegurar beneficios, mientras que otros prefieren mantenerlos con la esperanza de nuevas subidas. También es posible comprar más activos, aunque muchos no recomiendan hacerlo cuando los precios ya están en máximos.

TAP'S NEWS AND UPDATES

Empieza tu camino financiero

¿Listo para empezar? Únete a personas que ya gestionan y operan su dinero de forma inteligente. Descubre nuevas posibilidades y empieza hoy mismo.

Kom igång