Learning the friendly way

Dive into our resources, guides, and articles for all things money-related. Grow your financial confidence with our experts curated tips and articles for both experienced and new investors.

LATEST ARTICLEs

Durante milenios, los humanos han definido el valor a través de lo tangible: el oro que podías sostener, la tierra que podías pisar y, más tarde, los billetes respaldados por promesas gubernamentales. Pero en poco más de una década, las criptomonedas han desafiado de forma radical estas convenciones ancestrales, introduciendo una idea revolucionaria: ¿y si el valor pudiera existir únicamente como información, protegida no por autoridades centrales sino por matemáticas y consenso colectivo?

Piénsalo así: las criptomonedas no son solo una innovación financiera; representan una revolución filosófica, cultural y psicológica en la forma en que conceptualizamos el valor. Mientras que economistas tradicionales y entusiastas cripto pueden ver los criptoactivos como instrumentos especulativos, pasan por alto la transformación más profunda que ocurre bajo los gráficos de precios: una reconstrucción completa de nuestra relación con el dinero, la confianza y la participación económica.

Como veremos, este cambio va mucho más allá del trading y la inversión. Está redefiniendo cómo generaciones enteras piensan en la preservación de la riqueza, cuestionando supuestos históricos sobre la autoridad institucional y ampliando el acceso financiero a poblaciones previamente excluidas. Desde el modelo deflacionario de Bitcoin hasta los complejos ecosistemas de las finanzas descentralizadas, las criptomonedas están reescribiendo el lenguaje del valor en la era digital.

De lo tangible a lo digital: la evolución de la percepción del valor

“¿Dónde está exactamente tu Bitcoin?”. Esta pregunta aparentemente simple revela el profundo cambio en nuestra comprensión colectiva de la riqueza. Durante siglos, almacenar valor implicaba posesión física: lingotes de oro en bóvedas, efectivo en carteras o escrituras en archivos. La materialidad ofrecía una sensación de seguridad; podías tocar tu riqueza.

Las criptomonedas rompen esa asociación entre lo físico y el valor. Cuando alguien posee Bitcoin, no tiene una moneda digital en el sentido tradicional. Controla el acceso a una posición en un libro contable inmutable, un concepto tan abstracto que requiere un ajuste cognitivo significativo para muchos inversores tradicionales.

Desde el punto de vista conductual, la dificultad para aceptar las criptomonedas proviene en parte de nuestra programación evolutiva: el cerebro humano aprendió a valorar recursos tangibles como alimentos, refugio y herramientas. Las representaciones abstractas del valor exigen mayor procesamiento cognitivo, lo que explica por qué muchas personas entienden el concepto de cripto de forma intelectual, pero no emocional.

Esta transición recuerda otros cambios históricos. Cuando el dinero en papel reemplazó a las monedas de oro, hubo resistencia; muchos sostenían que el valor no podía existir en simples promesas impresas. El paso actual de monedas emitidas por gobiernos a la escasez algorítmica sigue un patrón similar de resistencia inicial y normalización gradual.

Lo que hace único este cambio es su ruptura total con lo físico. Bitcoin, Ethereum y miles de activos digitales existen solo como información, protegida por criptografía, distribuida en miles de ordenadores y accesible mediante claves digitales. No es un cambio incremental, sino un salto conceptual en cómo entendemos la propiedad y el almacenamiento de valor.

Descentralización: redefiniendo la confianza y la autoridad

Quizá el aspecto más revolucionario de las criptomonedas no sea su naturaleza digital, sino su estructura descentralizada. Durante siglos hemos delegado la confianza en instituciones centralizadas: bancos que custodian depósitos, gobiernos que controlan la oferta monetaria y agencias que validan identidades financieras.

Las criptomonedas proponen una alternativa: ¿y si la confianza pudiera codificarse en reglas de protocolo, distribuirse en redes y verificarse mediante matemáticas en lugar de autoridades humanas?

Cuando Satoshi Nakamoto creó Bitcoin, no lanzó solo un nuevo activo, sino un desafío directo al monopolio de la creación de dinero. Al resolver el problema del doble gasto sin una autoridad central, la tecnología blockchain digitalizó la confianza.

Las implicaciones son profundas:

- Banca sin bancos: las personas pueden almacenar, transferir y gestionar valor sin intermediarios que cobren comisiones o impongan condiciones.

- Resistencia a la censura: en redes distribuidas es extremadamente difícil que una sola entidad congele fondos o bloquee transacciones.

- Acceso global: las redes descentralizadas operan sin fronteras políticas o geográficas, permitiendo la participación global con solo acceso a internet.

En mercados emergentes, este paso de la confianza institucional a la algorítmica ha sido especialmente rápido. Cuando Venezuela sufrió hiperinflación superior al 1.000.000 % en 2018, muchos ciudadanos recurrieron a Bitcoin no como inversión, sino como necesidad práctica: un depósito de valor más estable que su moneda nacional. Patrones similares aparecen en países con políticas monetarias inestables o controles de capital estrictos.

Para muchos, la descentralización no es una preferencia tecnológica, sino una respuesta a fallos institucionales. Cuando gobiernos y bancos centrales gestionan mal la política monetaria, buscar alternativas que no puedan inflarse o confiscarse arbitrariamente resulta natural.

Escasez, seguridad y la psicología del hodling

A diferencia de las monedas fiat, que pueden crearse sin límite, Bitcoin introdujo la escasez digital absoluta: solo existirán 21 millones. Este suministro fijo transformó la relación entre dinero, inflación y tiempo.

El término “HODL” (un error tipográfico de “hold”) evolucionó de jerga cripto a filosofía. Los hodlers ven las criptomonedas como un depósito de valor a largo plazo, incluso generacional.

El economista Saifedean Ammous sostiene que Bitcoin marca un regreso al “dinero duro”. Durante gran parte de la historia, el dinero estuvo vinculado a recursos escasos como el oro. En su visión, las monedas fiat elásticas del siglo XX son una anomalía histórica. Bitcoin, con oferta fija, reintroduce una forma de dinero resistente a la devaluación.

Esta mentalidad basada en la escasez ha cambiado los hábitos de ahorro, especialmente entre generaciones jóvenes. Mientras la asesoría tradicional recomienda diversificación y reservas de emergencia moderadas, muchos adoptantes cripto mantienen mayores reservas en activos digitales, viendo el fiat como depreciable.

La seguridad psicológica de una escasez matemática genera fuertes vínculos emocionales. Para muchos hodlers, las criptomonedas representan más que un activo financiero: son una convicción ideológica. Esto explica la disposición a soportar caídas del 70–80 % sin vender, algo que desafía modelos económicos clásicos.

Soberanía financiera y los no bancarizados

Para aproximadamente 1.700 millones de adultos sin acceso a servicios bancarios, las criptomonedas ofrecen inclusión financiera sin permiso institucional. Este impacto, menos visible en titulares, es uno de los más profundos.

En regiones con infraestructura bancaria limitada, permiten actividades antes inaccesibles:

- Remesas internacionales sin comisiones abusivas ni demoras prolongadas

- Protección del ahorro frente a la depreciación de monedas locales

- Acceso a microfinanzas mediante plataformas de préstamos en blockchain

Ser “tu propio banco” no significa lo mismo en Manhattan que en una zona rural de Kenia. Para unos es una postura filosófica; para otros, la primera oportunidad real de participar en la economía global.

Incluso en economías desarrolladas, las criptomonedas ofrecen soberanía a quienes enfrentan censura financiera. Aunque esto plantea preocupaciones legítimas, también evidencia el poder de sistemas sin intermediarios.

Riesgo, recompensa y una nueva ética de inversión

Las criptomonedas han introducido una relación distinta con el riesgo. La inversión tradicional prioriza estabilidad y mitigación; el ecosistema cripto ha normalizado la volatilidad extrema y la experimentación financiera.

Las plataformas DeFi permiten prestar, pedir prestado y operar mediante contratos inteligentes, a menudo con rendimientos superiores a los tradicionales, pero con riesgos equivalentes. Bloquear capital en código experimental refleja un cambio profundo en la tolerancia al riesgo.

Para muchos participantes, aceptar volatilidad a corto plazo es racional si creen que la adopción tecnológica generará crecimiento exponencial a largo plazo.

El futuro del valor: identidad, datos y el metaverso

A medida que evoluciona, el impacto de las criptomonedas se extiende a la identidad digital, la propiedad de datos y las economías virtuales. La blockchain permite nuevas formas de representar valor más allá del dinero.

Tendencias emergentes:

- Identidad digital como activo, con credenciales verificables y controladas por el usuario

- Propiedad de datos, donde los usuarios deciden cómo se usan y se monetizan

- Propiedad virtual en entornos digitales y metaversos

La integración de inteligencia artificial con blockchain abre posibilidades aún más radicales, como agentes económicos autónomos capaces de poseer activos y realizar transacciones.

De cara a 2035–2045, podríamos ver:

- La atención humana compensada mediante micropagos

- Reputaciones algorítmicas como formas de capital

- Activos físicos y digitales cada vez más intercambiables

La distinción entre valor “real” y “virtual” ya se está desvaneciendo. Para los nativos digitales, poseer un objeto virtual raro puede ser tan significativo como un bien físico.

Conclusión: la revolución del valor ya comenzó

La verdadera revolución de las criptomonedas no es financiera, sino conceptual. Más allá de crear riqueza o desafiar instituciones, amplían la definición de dinero mediante escasez matemática, activos programables y gobernanza comunitaria.

Este cambio redefine nuestra relación con la propiedad, la confianza y la participación económica. A medida que se difuminan las fronteras entre lo digital y lo físico, surgen tanto oportunidades como desafíos. Participes o no, comprender este cambio de paradigma será clave para navegar un futuro donde el valor se define cada vez más por consenso que por decreto.

Cuando encuentras una plataforma que hace que todo sea fácil es normal querer recomendarla. Con el Programa de Referidos de Tap, ese gesto se convierte en recompensas: ayudas a tus amigos a desbloquear funciones premium mientras tú ganas cada vez que se unen y operan. Un auténtico win-win.

Resumen rápido:

- Tanto tú como tu amigo recibís recompensas cuando él pasa de Essential a un nivel superior

- Tu recompensa está disponible de inmediato, mientras que la de tu amigo queda bloqueada durante 12 meses (fomentando una visión a largo plazo)

- Tus amigos tienen 60 días tras completar la verificación para mejorar su cuenta y optar a la recompensa

- El importe del bonus depende del nivel premium que elija tu amigo

¿Por qué compartir Tap con tus amigos?

Piensa en la última vez que una recomendación de un amigo mejoró de verdad tu vida. Quizá fue un servicio que te ahorró tiempo o una herramienta que simplificó algo complejo. Con las plataformas financieras ocurre lo mismo: cuando algo funciona bien, merece la pena compartirlo.

Y seamos sinceros, el mundo de los activos digitales puede resultar abrumador para quienes empiezan. Entre elegir la plataforma adecuada, entender los distintos niveles de servicio y cumplir con los requisitos de seguridad, muchas personas se quedan en cuentas básicas. Ahí es donde tu recomendación marca la diferencia.

Tus amigos confiarán en tu criterio porque tú ya has probado la plataforma, conoces las funciones premium y puedes explicar de primera mano la diferencia entre el nivel Essential y las opciones superiores de Tap.

Entendiendo los niveles de usuario en Tap

Uno de los aspectos que diferencia a Tap es su sistema de niveles. En lugar de ofrecer la misma experiencia a todos, cada nivel desbloquea funciones que se adaptan mejor a las necesidades de cada usuario:

- Essential – El punto de partida para todos los nuevos usuarios

- Plus – Funciones mejoradas para carteras en crecimiento

- Prime – Herramientas avanzadas para usuarios más activos

- Premier – Capacidades de nivel profesional

- Platinum – Acceso premium con enfoque institucional

- Prestige – El nivel más alto, pensado para usuarios avanzados

Cuando tus amigos empiezan con una cuenta Essential, tienen una primera toma de contacto con Tap. Pero el verdadero valor aparece al subir de nivel, accediendo a funciones que pueden marcar una diferencia real en la gestión de sus activos digitales.

Cómo funciona el programa de referidos de Tap

El proceso es sencillo y transparente:

Paso 1: Comparte tu enlace único

Cada usuario verificado de Tap tiene un enlace personal de referidos dentro de la app. Ese enlace permite identificar a las personas que se registran gracias a tu recomendación. Solo tienes que abrir la app, tocar tu foto de perfil y seleccionar Invitar a un amigo.

Paso 2: Tu amigo crea su cuenta

Usando tu enlace, tu amigo deberá registrarse y completar el proceso de verificación KYC (Know Your Customer), un estándar habitual en plataformas financieras.

Paso 3: La ventana de 60 días

Una vez aprobada la verificación, tu amigo dispone de 60 días para pasar de Essential a cualquier nivel superior (Plus, Prime, Premier, Platinum o Prestige).

Este plazo anima a los nuevos usuarios a explorar la plataforma con calma y decidir qué nivel se ajusta mejor a sus necesidades.

Paso 4: Se asignan las recompensas

Cuando tu amigo mejora su cuenta, ambos recibís el bonus correspondiente. El tuyo está disponible de inmediato; el suyo queda bloqueado durante 12 meses como incentivo para una relación a largo plazo con la plataforma. El importe varía según el nivel elegido.

Paso 5: Reclama tu recompensa

Tu bonus no se añade automáticamente. Debes reclamarlo desde la app: vuelve a la sección donde encontraste el enlace de referidos y selecciona Tus recompensas.

Detalles importantes del programa

Requisitos de elegibilidad:

- Tener una cuenta verificada y en regla

- Que ambas partes completen el KYC

- Cumplir con los términos y condiciones de Tap

Disponibilidad geográfica:

- Disponible actualmente para clientes de Tap a nivel global

- El acceso para clientes de EE. UU. se anunciará más adelante

¿Listo para empezar a invitar?

El programa de referidos de Tap te permite ganar recompensas simplemente presentando a tus amigos las funciones premium que tú ya utilizas. Al compartir tu experiencia, no solo ayudas a otros a descubrir herramientas más completas, sino que les das un atajo hacia una mejor gestión de activos digitales.

Recuerda: tu recomendación tiene más valor porque es real y se basa en tu propia experiencia con los niveles premium de Tap. Cuando recomiendas de forma honesta a personas que realmente pueden beneficiarse, todos ganan: tú obtienes recompensas, tus amigos mejoran su experiencia y Tap crece con usuarios que saben lo que quieren.

Así que nada de spam: comparte con cabeza. Las buenas recomendaciones siempre generan mejores resultados.

.webp)

¿Listo para dejar atrás las barreras de la banca tradicional y entrar de lleno en el mundo de los pagos con criptomonedas? Desde comprar falafel en tu cafetería local hasta pagar equipaje en una tienda de Japón, los pagos cripto son rápidos, eficientes y mucho más sencillos de lo que imaginas.

En esta guía te explicamos paso a paso cómo pagar con criptomonedas: desde crear tu cuenta hasta realizar tu primera transacción. Al final, tendrás la confianza necesaria para pagar con cripto en cualquier lugar y en cualquier momento.

¿Es legal pagar con criptomonedas?

Empecemos por lo más importante. Pagar con criptomonedas es legal en la mayoría de los grandes mercados, incluidos Estados Unidos, la Unión Europea, Canadá y el Reino Unido. Sin embargo, algunos países como China e India tienen restricciones sobre las transacciones cripto.

Panorama global:

Legal: Estados Unidos, Unión Europea, Reino Unido, Canadá, Australia, Singapur, Suiza

Restringido o prohibido: China, India (uso limitado), Rusia (regulación compleja)

Zonas grises: algunos países en desarrollo con marcos regulatorios en evolución

¿Por qué es importante? Operar dentro de los límites legales te protege de problemas de cumplimiento y evita que tus transacciones sean bloqueadas o revertidas. Tap solo opera en jurisdicciones donde los pagos con cripto cumplen plenamente la normativa.

Cómo funcionan los pagos con criptomonedas

Pagar con cripto es como enviar un correo electrónico en lugar de una carta tradicional. El mensaje va directamente del emisor al receptor a través de internet.

De la misma forma, un pago cripto viaja directamente desde tu wallet al wallet del comercio a través de una red blockchain, sin bancos ni intermediarios financieros.

Lo que ocurre en segundo plano:

La transacción se registra en un libro contable descentralizado (blockchain)

Múltiples nodos verifican la operación

Una vez confirmada, la transacción es permanente e irreversible

El proceso suele tardar minutos, no días

Este sistema elimina intermediarios, reduce comisiones y funciona 24/7 a nivel global.

Métodos de pago más comunes

Existen varias formas de pagar con criptomonedas, cada una adecuada para distintas situaciones. Las más populares son:

Transferencias on-chain desde wallets, que consisten en escanear un código QR o copiar una dirección para enviar fondos directamente de tu wallet a la del receptor. Es ideal para pagos entre personas o en tiendas físicas. Como extra, los usuarios de Tap disfrutan de transferencias gratuitas entre usuarios, en cualquier parte del mundo.

Tarjeta de débito respaldada por cripto de Tap, que te permite gastar tus criptomonedas en cualquier lugar donde se acepten Mastercard y Visa. La tarjeta convierte automáticamente tu cripto a moneda fiat en el momento del pago.

Cómo configurar tu cuenta en Tap

Empezar es muy sencillo:

- Descarga la app y crea tu cuenta.

- Completa la verificación de identidad. Tap está regulado, por lo que pedimos una verificación básica, como cualquier fintech de confianza. Solo lleva unos minutos.

- Una vez aprobada, ya puedes empezar. Tendrás acceso al ecosistema cripto.

Solicita tu tarjeta Tap.

Ve a la pestaña “Card” en la app (entre Hub y Cash) y sigue los pasos. La tarjeta llegará en unos días, según tu ubicación.

Añade fondos a tu wallet.

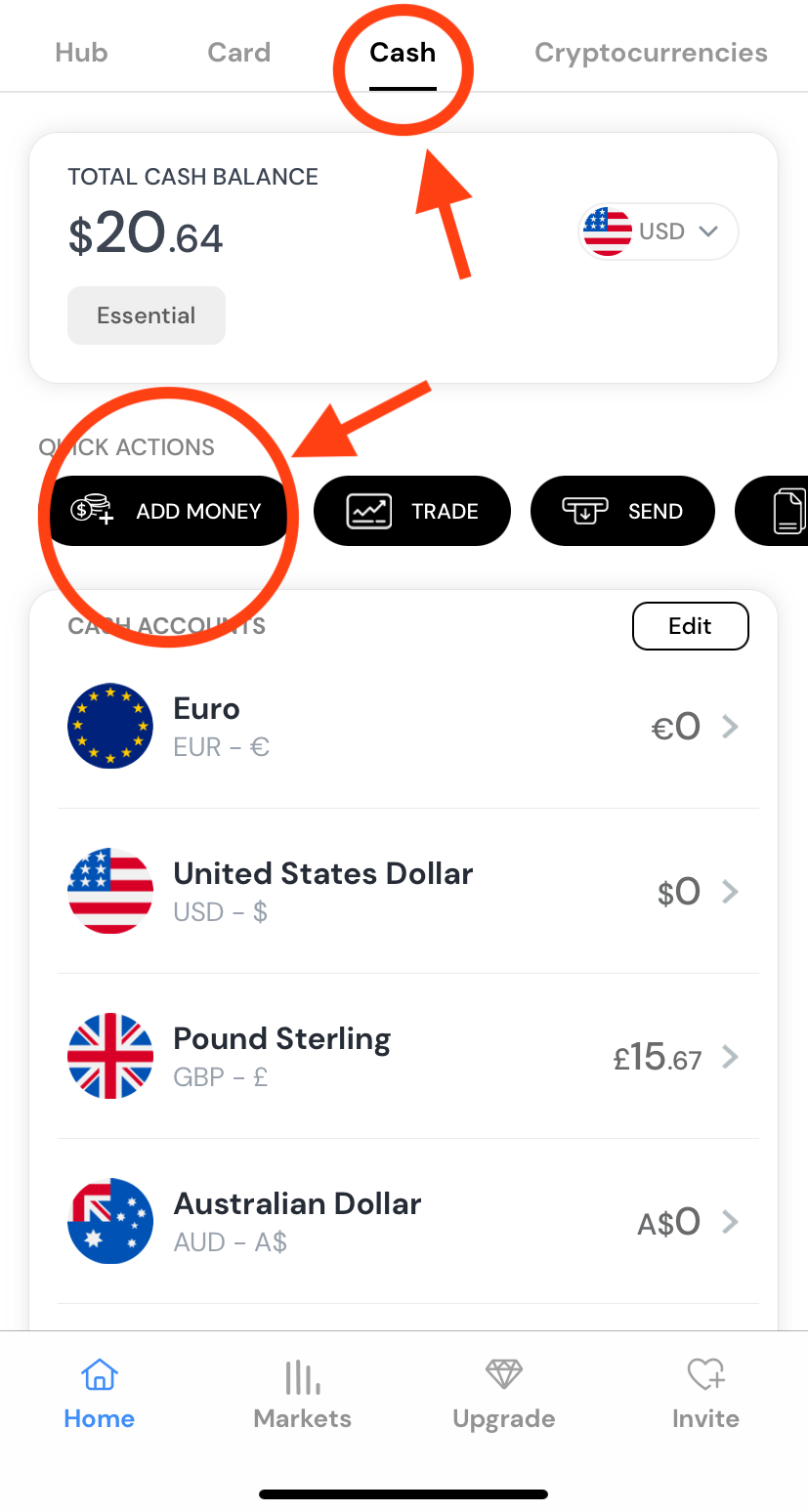

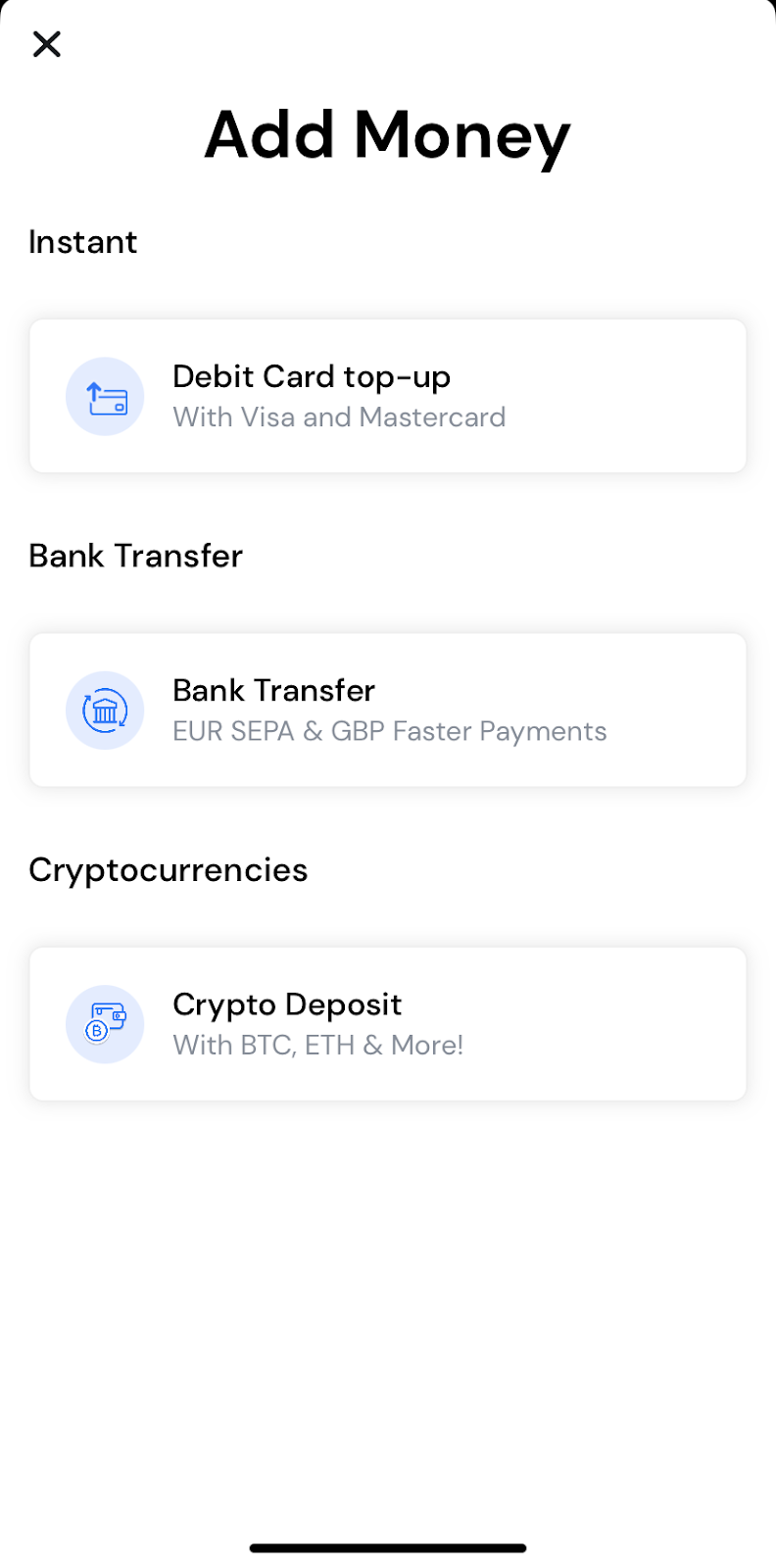

Para cargar dinero fiat (USD, EUR, GBP, AUD, CAD, CHF, JPY), entra en “Cash” y pulsa el botón negro “Add Money”. Elige el método y sigue las instrucciones.

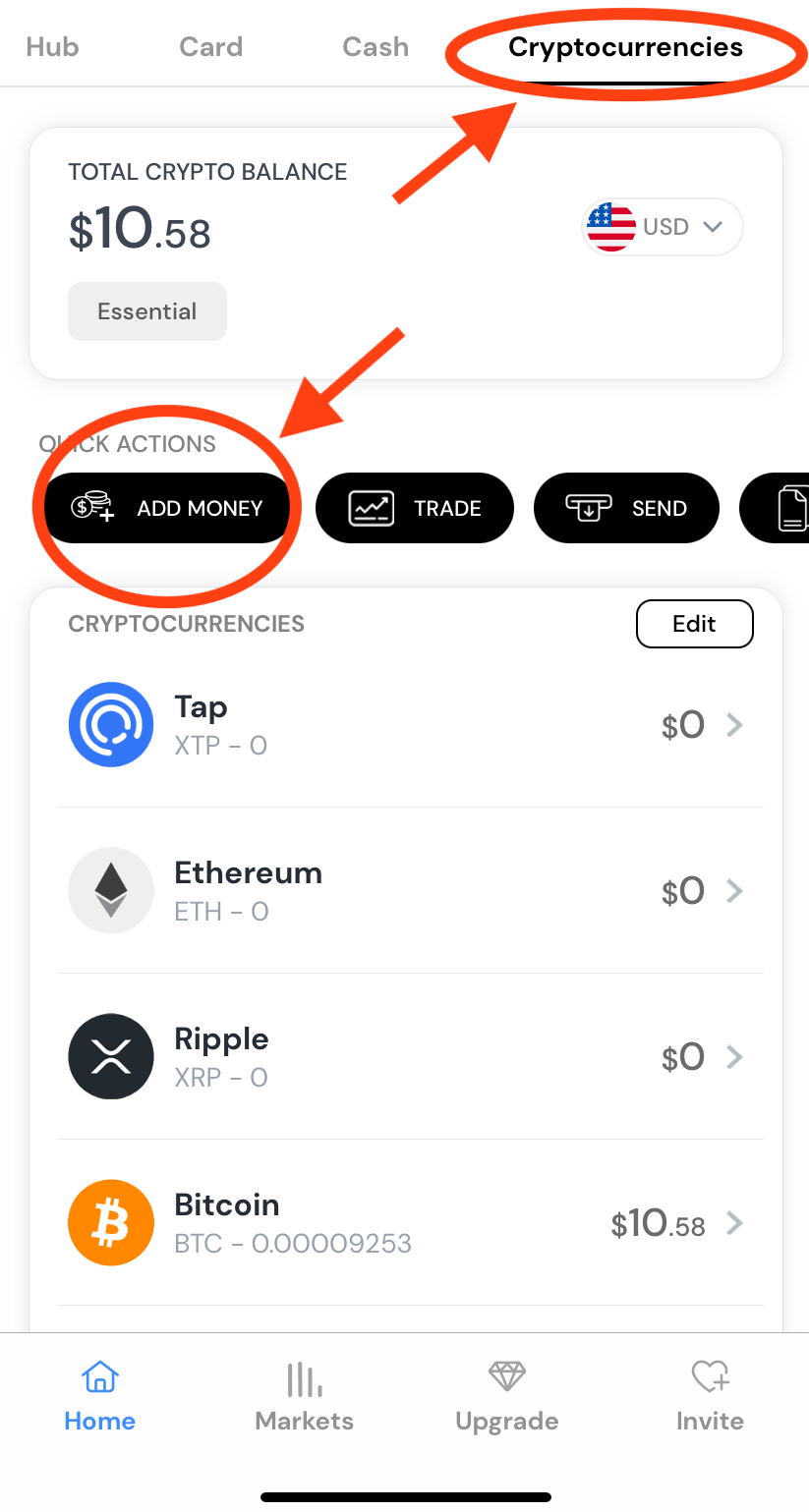

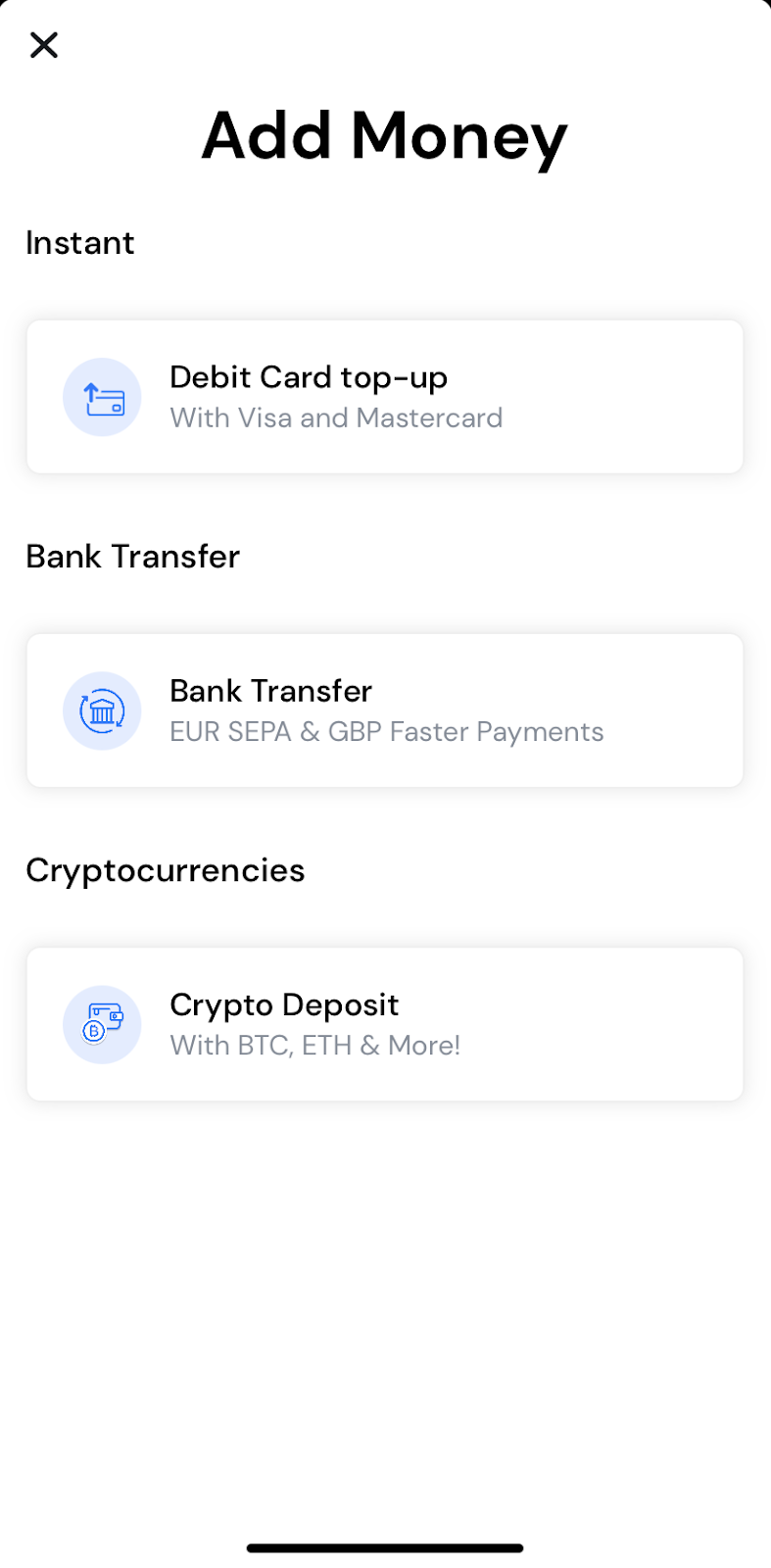

Si ya tienes criptomonedas, selecciona “Cryptocurrencies” en el menú superior, luego “Add Money” y finalmente “Crypto Deposit”. El proceso puede tardar unos minutos, según la red.

Cuando llegue tu tarjeta, mueve fondos a la sección “Card” de tu wallet y listo.

Paso a paso: cómo pagar con cripto usando Tap

¿Listo para tu primer pago?

Paso 1: Saca tu tarjeta Tap de la cartera.

Paso 2: Acércala o deslízala en el comercio.

Eso es todo. Así de simple.

Cómo hacer un pago cripto desde la app

Si aún no tienes la tarjeta o estás esperando a que llegue, puedes pagar directamente desde la app:

Paso 1: Ve a la sección “Cryptocurrencies”.

Paso 2: Pulsa “Send”.

Paso 3: Elige “Crypto Withdrawal”.

Paso 4: Selecciona la criptomoneda que quieres usar.

Paso 5: Pulsa el icono azul “+ New” en la esquina superior derecha.

Paso 6: Elige “External Beneficiary” e introduce con cuidado la dirección del wallet.

Paso 7: Selecciona el beneficiario que acabas de añadir y confirma el envío.

La mayoría de los pagos se confirman en minutos, aunque algunas redes pueden tardar más en momentos de alta congestión.

Convertir cripto a fiat y usar tarjetas cripto

No todos los comercios aceptan cripto directamente, pero eso no limita tu capacidad de pago. Tap ofrece opciones de conversión instantánea entre cripto y fiat.

Puedes convertir tus criptomonedas a monedas tradicionales dentro de la app. Selecciona el importe, elige la divisa de destino y confirma. Los fondos convertidos aparecen al instante en tu saldo fiat.

La tarjeta Tap va un paso más allá, permitiéndote pagar con cripto en cualquier lugar donde se acepten Mastercard o Visa. En cada compra, la tarjeta convierte automáticamente el importe necesario de tu saldo cripto a fiat con tipos de cambio competitivos. Funciona para compras online, en tiendas físicas y retiradas en cajeros.

La conversión es en tiempo real, por lo que siempre obtienes el precio actual del mercado. Para consultar tipos de cambio en tiempo real, toca tu foto de perfil en la pantalla principal y baja hasta “FX Calculator”.

Comisiones, velocidad y elección de red

Conocer las comisiones te ayuda a pagar de forma más eficiente. Hay dos tipos principales:

Comisiones de red, que van a los validadores de la blockchain y varían según la red. No dependen de Tap.

En horas punta, Bitcoin puede costar entre 10 y 50 dólares por transacción, mientras que redes como Polygon suelen costar menos de 0,01 dólares. Lightning Network suele costar menos de un céntimo.

Comisiones de Tap, que son transparentes y competitivas. Cobramos un pequeño porcentaje por conversiones y funciones premium, pero las transferencias básicas entre usuarios de Tap son gratuitas.

Tiempos de confirmación aproximados:

Lightning Network: instantáneo

Ethereum: 1–5 minutos

Bitcoin: 10–60 minutos

Polygon: menos de 1 minuto

Recomendación: para pagos pequeños y cotidianos, usa redes rápidas y baratas como Lightning o Polygon. Para transacciones grandes donde la seguridad es clave, la red principal de Bitcoin ofrece máxima seguridad, aunque con mayores comisiones.

Seguridad y errores comunes

Los pagos con criptomonedas son irreversibles, por lo que la seguridad es fundamental.

Errores de dirección son la principal causa de pérdidas. Verifica siempre la dirección del destinatario y usa códigos QR cuando sea posible.

Phishing: desconfía de enlaces en correos o mensajes. Accede siempre a sitios oficiales y verifica la URL.

Estafas y proyectos fraudulentos prometen retornos irreales. Usa criptomonedas consolidadas y comercios verificados.

Tap incluye medidas de seguridad como autenticación de dos factores y controles automáticos AML que detectan transacciones sospechosas.

Impuestos y obligaciones fiscales

Un punto que muchos pasan por alto: gastar criptomonedas suele ser un evento fiscal. Al pagar con cripto, estás vendiendo ese activo y puedes generar una ganancia o pérdida de capital.

Ejemplo: si compraste Bitcoin a 30.000 $ y lo gastas cuando vale 40.000 $, deberás tributar por la ganancia de 10.000 $, aunque no hayas convertido a efectivo.

Llevar un buen registro es clave. Guarda información sobre fechas de compra, fechas de uso, importes y ganancias o pérdidas.

Aspectos regionales:

- Estados Unidos: el gasto en cripto genera impuestos sobre ganancias de capital

- Unión Europea: el IVA aplica a compras, pero el tratamiento de ganancias varía por país

- Otros países: consulta con un asesor fiscal local

Recomendamos hablar con un contador especializado en cripto para cumplir correctamente con tus obligaciones.

Por qué elegir Tap para pagar con cripto

Tap está diseñado para resolver los principales problemas de los pagos con criptomonedas:

Liquidación instantánea, para que los comercios reciban el pago de inmediato, sin esperar confirmaciones largas.

Soporte multichain, con Bitcoin, Ethereum, stablecoins y más de 60 criptomonedas en una sola plataforma.

Cumplimiento integrado, gestionando automáticamente KYC y AML dentro de marcos regulatorios claros.

Alcance global sin la complejidad de la banca internacional. Acepta pagos desde cualquier lugar y liquida en la divisa que prefieras.

¿Listo para empezar a pagar con criptomonedas? Descarga la app de Tap y forma parte del futuro de los pagos digitales.

El apalancamiento en el trading de criptomonedas es como añadir combustible de cohete a tu cartera: puede disparar tus beneficios o convertir tu inversión en un espectáculo de fuegos artificiales que termina en cenizas. Si te preguntas si el trading con apalancamiento es para ti, vas por buen camino. La respuesta no es un simple sí o no, depende de tu experiencia, tu tolerancia al riesgo y tu estrategia.

Vamos a profundizar en el mundo del apalancamiento en cripto para que tomes una decisión informada y evites lamentarte frente a una cartera vacía.

¿Qué es el apalancamiento en el trading de criptomonedas?

El apalancamiento te permite controlar una posición mayor de lo que permitiría tu saldo real. Es, en esencia, pedir dinero prestado al exchange para amplificar tu poder de trading. Con un apalancamiento de 10x, por ejemplo, puedes operar con 10.000 $ aportando solo 1.000 $ propios.

Es importante distinguir entre apalancamiento y margen. El apalancamiento es la proporción (2x, 5x, 100x), mientras que el margen es la garantía que aportas. Para abrir una posición de 5.000 $ con 5x, necesitarías 1.000 $ de margen.

Los ratios de apalancamiento pueden ir desde conservadores 2x hasta extremos 100x o incluso 125x en algunas plataformas. A mayor apalancamiento, mayor potencial de ganancia, pero también un riesgo mucho mayor de liquidación.

¿Cómo funciona el trading con apalancamiento en cripto?

Al abrir una posición apalancada, el exchange te presta fondos para aumentar tu exposición al mercado. Tu margen queda como garantía y se te cobra una comisión o tasa de financiación por usar ese capital.

El mecanismo es simple: depositas el colateral, eliges el apalancamiento y abres la posición. El exchange monitoriza constantemente tu saldo. Si las pérdidas se acercan al valor de tu margen, se produce la liquidación, cerrando automáticamente la posición para evitar que pierdas más de lo aportado.

El apalancamiento suele operar a través de futuros, swaps perpetuos u opciones. Los swaps perpetuos son los más populares, ya que no tienen vencimiento y siguen de cerca el precio del activo subyacente mediante tasas de financiación.

Ejemplos reales de operaciones apalancadas

Veamos algunos escenarios concretos. Supón que abres una posición en Bitcoin de 1.000 $ con apalancamiento 10x cuando BTC cotiza a 50.000 $. Tu exposición real es de 10.000 $, controlando 0,2 BTC.

Escenario 1: Bitcoin sube a 55.000 $ (un 10 %). Tu posición gana 1.000 $, duplicando tu inversión inicial.

Escenario 2: Bitcoin baja a 45.000 $ (un 10 %). Tu posición pierde 1.000 $ y es liquidada, perdiendo todo tu margen.

Nota: algunas plataformas liquidan antes de una caída completa del 10 % debido al margen de mantenimiento y comisiones, a menudo alrededor de una caída del 8–9 % con apalancamiento 10x.

En un ejemplo más conservador, con apalancamiento 5x en Ethereum y 500 $ de margen a un precio de 3.000 $, controlas 2.500 $ en ETH. Una caída del 15 % hasta 2.550 $ supondría una pérdida de 375 $, dejándote con 125 $ y muy cerca de la liquidación.

Estos ejemplos muestran cómo pequeños movimientos del mercado pueden tener grandes efectos en tu cartera cuando usas apalancamiento.

Tipos de margen: aislado vs. cruzado

Entender los tipos de margen es clave para gestionar el riesgo.

El margen aislado limita el riesgo a una posición concreta. Si una operación sale mal, no afecta al resto de tu cuenta. Solo puedes perder el margen asignado a esa posición.

El margen cruzado utiliza todo el saldo disponible como garantía para todas las posiciones. Puede ayudar a evitar liquidaciones al añadir margen automáticamente, pero un solo error puede borrar toda la cuenta.

El margen aislado suele ser más seguro para principiantes, ya que limita las pérdidas por operación. El margen cruzado ofrece más flexibilidad, pero requiere una gestión del riesgo más avanzada.

¿Cuáles son los riesgos de usar apalancamiento?

El mayor riesgo es la liquidación, y los mercados cripto son extremadamente volátiles. Bitcoin puede moverse fácilmente un 5–10 % en un solo día. Con apalancamiento 10x, un movimiento adverso del 10 % equivale a perder el 100 % del margen.

El sobreapalancamiento es uno de los errores más comunes. La tentación de usar el máximo apalancamiento es grande, pero cuanto mayor es, menor es el margen de error.

El trading emocional se intensifica con apalancamiento. El estrés puede llevar a malas decisiones, a operar por revancha y al llamado “riesgo de ruina”, cuando las pérdidas impiden seguir operando de forma efectiva.

En resumen, la volatilidad del mercado cripto, combinada con apalancamiento, crea una tormenta perfecta para destruir cuentas rápidamente.

¿Cuáles son las ventajas del apalancamiento?

A pesar de los riesgos, el apalancamiento tiene ventajas para traders experimentados. La principal es la amplificación de retornos: una subida del 5 % puede convertirse en un 50 % con apalancamiento 10x. Esto permite eficiencia de capital y mantener fondos libres para otras oportunidades.

También facilita estrategias avanzadas como cobertura y ventas en corto. Puedes beneficiarte de mercados bajistas o proteger posiciones spot con posiciones opuestas.

Para quienes tienen poco capital, el apalancamiento permite acceder a exposiciones relevantes sin grandes inversiones iniciales.

¿Deberían los principiantes usar apalancamiento?

Para la mayoría de principiantes, la respuesta es no. El apalancamiento exige comprensión del mercado, gestión del riesgo y control emocional, habilidades que se desarrollan con el tiempo.

Si aun así quieres probar, hazlo con extrema cautela. Usa apalancamiento bajo, como 2x o 3x, y solo arriesga capital que puedas perder por completo. Utiliza margen aislado y no arriesgues más del 1–2 % de tu capital en una sola operación.

La regla de oro: domina primero el trading spot. Aprende análisis de mercado y disciplina antes de añadir apalancamiento. Es una herramienta avanzada, no un atajo.

Cómo gestionar el riesgo al usar apalancamiento

La gestión del riesgo es la diferencia entre sobrevivir y quemar la cuenta.

El tamaño de la posición es crucial. Nunca arriesgues más de lo que puedes perder. Muchos traders siguen la regla del 1 %.

Los stop-loss son imprescindibles. Deben establecerse antes de entrar en la operación. Calcula también la relación riesgo-beneficio; muchos traders buscan al menos 2:1.

La diversificación es aún más importante con apalancamiento. No concentres todo en un solo activo o sector.

¿Es legal el trading con apalancamiento en cripto?

La regulación varía según el país. En Estados Unidos, el apalancamiento está muy restringido. En otros países, los traders pueden acceder a ratios más altos, pero con menor protección regulatoria.

Siempre verifica la normativa local antes de operar con apalancamiento.

Veredicto final

¿Deberías usar apalancamiento al operar con criptomonedas? Depende de si estás preparado para manejar una herramienta de doble filo.

Tiene sentido si ya eres rentable en spot, tienes una gestión del riesgo sólida y puedes tolerar grandes fluctuaciones. No es una solución mágica.

Evítalo si eres nuevo, operas por impulso o usas dinero que necesitas para gastos básicos. El mercado seguirá ahí cuando estés listo.

La conclusión es clara: el cripto ofrece oportunidades sin necesidad de apalancamiento. Domina primero los fundamentos y considera el apalancamiento como un instrumento de precisión, no como un boleto de lotería. El objetivo es mantenerse en el juego el tiempo suficiente para hacer crecer tus habilidades y tu capital.

En un mercado donde la volatilidad es la norma y los titulares cambian a diario, no sorprende que muchos inversores estén cambiando la especulación de alto riesgo por la seguridad financiera a largo plazo. Las inversiones seguras a largo plazo no consisten en “jugar pequeño”, sino en jugar de forma inteligente.

En esencia, este tipo de inversiones busca preservar el capital, ofrecer rendimientos constantes y reducir la toma de decisiones emocionales. Pero seamos claros: “seguro” no significa riesgo cero, significa riesgo más bajo y predecible. “Largo plazo” implica mantener las inversiones al menos cinco años, dándoles tiempo para recuperarse de caídas puntuales y beneficiarse del interés compuesto.

¿Por qué funciona este enfoque? Porque construye resiliencia. Proteges tu patrimonio frente a la inflación, diversificas entre clases de activos estables y evitas el pánico del “market timing”. Con el tiempo, esta estrategia suele superar a la inversión reactiva, especialmente cuando se combina con aportaciones regulares y objetivos financieros bien definidos.

En 2025, invertir de forma segura no se limita a los bonos gubernamentales tradicionales, aunque siguen siendo relevantes. También incluye acciones de alta calidad que pagan dividendos, valores ligados a la inflación, ETFs de sectores defensivos y, cada vez más, carteras gestionadas profesionalmente mediante robo-advisors que priorizan el crecimiento estable y de bajo riesgo.

Si quieres hacer crecer tu dinero sin subirte a la montaña rusa emocional del mercado, estas son algunas estrategias probadas por los inversores más prudentes. Porque invertir bien no es adivinar, es construir un plan que funcione incluso cuando el mercado no lo hace.

¿Qué hace que una inversión sea “segura” a largo plazo?

Al hablar de inversiones seguras, buscamos características que han demostrado fiabilidad durante décadas. La preservación del capital es la prioridad: tu inversión inicial debe estar protegida frente a pérdidas significativas. No se trata de garantizar beneficios, sino de reducir la probabilidad de grandes caídas.

Los rendimientos predecibles importan más que los espectaculares.

Una inversión que ofrece un 6 % anual constante suele ser mejor que otra que alterna subidas del 20 % con caídas del 15 %. La consistencia permite planificar y dormir tranquilo.

La protección contra la inflación es clave.

Una inversión que rinde un 3 % cuando la inflación es del 4 % en realidad te hace perder poder adquisitivo. Por eso muchos inversores buscan opciones que superen la inflación o se ajusten a ella.

La relación riesgo–beneficio sigue siendo fundamental.

Las inversiones más seguras suelen ofrecer retornos más bajos, pero a cambio brindan previsibilidad. Este equilibrio es especialmente atractivo si se considera el coste psicológico de la volatilidad y el poder del interés compuesto.

La diversificación no es opcional, es esencial.

Repartir inversiones entre distintas clases de activos, sectores e incluso países reduce el impacto del mal desempeño de una sola posición.

Principales opciones de inversión segura a largo plazo (edición 2025)

A continuación, algunas alternativas habituales entre inversores con horizontes de largo plazo:

Bonos del Tesoro de EE. UU. y TIPS

Los bonos del Tesoro están respaldados por el gobierno estadounidense y ofrecen distintos plazos mediante letras, notas y bonos.

Los TIPS ajustan su valor principal según la inflación, abordando una de las principales debilidades de los bonos tradicionales. El riesgo principal es el coste de oportunidad, no la pérdida de capital.

Cuentas de ahorro de alto rendimiento y depósitos a plazo

El seguro de depósitos convierte a estas opciones en las más seguras disponibles. Ofrecen liquidez o tasas fijas según el producto, aunque su potencial de retorno suele ser limitado frente a la inflación.

Bonos con grado de inversión y fondos de bonos

Bonos corporativos y municipales con calificación BBB o superior ofrecen mayor rendimiento que los bonos gubernamentales con riesgo relativamente bajo. Los fondos y ETFs aportan diversificación inmediata.

Acciones que pagan dividendos

Empresas sólidas con historiales largos de dividendos pueden ofrecer ingresos estables y apreciación del capital. Los llamados “Dividend Aristocrats” destacan por su fiabilidad y crecimiento de dividendos a largo plazo.

Fondos indexados y ETFs

Los fondos que replican índices amplios ofrecen exposición diversificada con comisiones bajas. A largo plazo, han demostrado rendimientos sólidos pese a la volatilidad anual.

Fondos de jubilación con fecha objetivo

Ajustan automáticamente la asignación de activos conforme se acerca la fecha de retiro, reduciendo riesgo de forma progresiva. Son ideales para quienes prefieren un enfoque automatizado.

Inversión inmobiliaria y REITs

El sector inmobiliario puede generar ingresos y apreciarse con el tiempo. Los REITs permiten acceso a bienes raíces sin gestionar propiedades directamente y ofrecen liquidez similar a las acciones.

Robo-advisors para carteras conservadoras

Estas plataformas crean carteras diversificadas según tu perfil de riesgo, con rebalanceo automático y, en algunos casos, optimización fiscal. Son una opción eficiente para quienes buscan gestión profesional a bajo coste.

Anualidades para inversores enfocados en la jubilación

Las anualidades fijas ofrecen ingresos garantizados, eliminando el riesgo de longevidad. Son adecuadas para quienes priorizan estabilidad sobre crecimiento, aunque sacrifican liquidez.

Comparación de opciones de inversión según seguridad, rentabilidad y liquidez

Tipo de inversión |

Nivel de seguridad | Potencial de retorno | Liquidez | Ideal para |

|---|---|---|---|---|

|

Bonos del Tesoro

|

Muy alto

|

Bajo

|

Alta

|

Inversionistas ultra conservadores

|

|

Cuentas de ahorro de alto rendimiento

|

Muy alto

|

Bajo | Muy alta | Fondos de emergencia |

|

Bonos de grado de inversión

|

Alto | Moderado | Moderada | Inversionistas enfocados en ingresos |

|

Acciones con dividendos

|

Moderado | Moderado-Alto | Alta | Buscadores de ingresos y crecimiento |

|

Fondos indexados

|

Moderado | Moderado-Alto | Alta | Inversionistas de crecimiento a largo plazo |

|

REITs

|

Moderado | Moderado-Alto | Alta | Buscadores de diversificación |

|

Fondos con fecha objetivo

|

Moderado | Moderado | Alta | Inversionistas que prefieren una gestión automática |

| Anualidades | Alto | Bajo-Moderado | Baja | Personas que buscan ingresos garantizados |

Esta comparación destaca las ventajas y desventajas fundamentales de la inversión. Cabe destacar que ninguna inversión destaca en todas las categorías; por ello, la diversificación entre diferentes tipos suele ser una buena opción para la mayoría de los inversores.

Errores comunes que debes evitar

Incluso la inversión conservadora tiene trampas. Concentrarse demasiado en un solo tipo de activo elimina los beneficios de la diversificación.

- Ignorar la inflación puede erosionar el poder adquisitivo a largo plazo.

- Perseguir rendimientos altos suele implicar riesgos ocultos.

- No rebalancear permite que la cartera se desvíe de su objetivo inicial.

- Y, sobre todo, dejarse llevar por las emociones puede arruinar una estrategia sólida.

Conclusión: construir una cartera resiliente

Invertir de forma segura a largo plazo no consiste en batir al mercado, sino en construir patrimonio según tus propias reglas, con el menor riesgo innecesario posible. Es una estrategia basada en la constancia, no en la complejidad.

La verdadera ventaja es el interés compuesto, aplicado con paciencia durante años. Una cartera sólida equilibra crecimiento y protección, acceso y disciplina a largo plazo. No existe una fórmula única, pero los principios son claros: protege tu capital, invierte con intención y dale tiempo a tu dinero para crecer.

Tu comportamiento importa más que elegir el fondo “perfecto”. Empezar pronto (o empezar ahora), aportar de forma regular y mantener el rumbo cuando el mercado se vuelve ruidoso es lo que marca la diferencia entre el éxito y la frustración a largo plazo.

Esta guía presenta opciones de inversión de menor riesgo para explorar estrategias alineadas con objetivos financieros a largo plazo. Recuerda que cada situación es única y que una estrategia personalizada, idealmente con apoyo profesional, siempre superará al consejo genérico.

Los security tokens son representaciones digitales de activos del mundo real como acciones, bonos y bienes raíces que existen en la blockchain. Piénsalos como el puente entre los activos tradicionales de Wall Street y el potencial de trading global, sin fronteras y 24/7 del ecosistema cripto.

Y el impulso detrás de ellos es innegable. Mientras las criptomonedas acaparan titulares con movimientos de precio extremos y memecoins, los security tokens han estado construyendo silenciosamente la infraestructura de algo mucho más grande: la digitalización completa de la propiedad de activos.

Hablamos de mercados de billones de dólares siendo tokenizados, inversores institucionales sintiéndose finalmente cómodos con blockchain y personas comunes accediendo a oportunidades de inversión que antes estaban reservadas solo para los ultra ricos.

Pero seamos claros: esto no es otro ciclo de hype cripto. Los security tokens vienen acompañados de marcos regulatorios sólidos, requisitos de cumplimiento y complejidades técnicas que los separan del “salvaje oeste” del cripto temprano. Representan la maduración de la tecnología blockchain, donde la innovación se cruza con la regulación de una forma que realmente tiene sentido.

Esto es lo que necesitas saber: tanto si eres un profesional financiero que quiere entender la siguiente evolución de la gestión de activos como si estás dando tus primeros pasos en cripto, los security tokens están redefiniendo cómo entendemos la propiedad y la inversión.

¿Qué es un security token?

Un security token es, esencialmente, un certificado digital de propiedad que representa una participación en activos del mundo real. Acciones, bonos, bienes raíces, materias primas o incluso arte: todo viviendo en blockchain, con smart contracts haciendo el trabajo pesado.

En lugar de certificados en papel o registros en bases de datos tradicionales, estos tokens existen en libros contables distribuidos que cualquiera puede verificar. Es como tener un recibo de propiedad a prueba de manipulaciones que el mundo entero puede validar.

Lo realmente interesante aparece cuando piensas en accesibilidad. ¿Un edificio comercial de 50 millones de dólares en Manhattan? Con security tokens, podrías poseer una fracción con unos cientos de dólares. Las barreras que históricamente excluían a los inversores minoristas de activos premium empiezan a desaparecer.

Nota aclaratoria: el término “security token” también se usa en ciberseguridad para dispositivos o apps de autenticación. No es de eso de lo que hablamos aquí, pero vale la pena aclararlo.

¿Cómo funcionan los security tokens?

El proceso de tokenización

Imagina que tienes un activo del mundo real, por ejemplo, un edificio residencial de lujo valorado en 10 millones de dólares. En las finanzas tradicionales, invertir en algo así requiere grandes sumas de capital, estructuras legales complejas y acceso exclusivo. Los security tokens cambian por completo ese guion.

El activo se estructura legalmente para que los derechos de propiedad se representen mediante tokens en blockchain. Cada token equivale a una participación fraccionada, con derechos sobre ingresos, apreciación del valor y votación en decisiones clave.

No es solo una transformación técnica, es un cambio fundamental. Activos que antes eran ilíquidos y exclusivos pasan a ser negociables, divisibles y accesibles a nivel global.

Blockchain y smart contracts

Los smart contracts son el motor de todo este sistema. No son simples acuerdos digitales, sino programas autoejecutables que gestionan automáticamente el cumplimiento normativo, las distribuciones y las transferencias según reglas predefinidas.

Por ejemplo, los dividendos pueden distribuirse automáticamente cuando se generan beneficios, o los derechos de voto activarse en función de los tokens que posees. Sin intermediarios, sin procesos manuales y sin esperas innecesarias. La blockchain se encarga de todo con precisión matemática.

Además, la transparencia es total. Cada transacción, cada cambio de propiedad y cada verificación de cumplimiento queda registrada en un libro inmutable.

Security tokens vs criptomonedas

Aquí es donde suele haber confusión: no todos los activos digitales son iguales.

Diferencias de propósito y regulación

Criptomonedas como Bitcoin o Ethereum nacieron como dinero digital o como plataformas para aplicaciones descentralizadas. Funcionan, en gran medida, al margen de los sistemas financieros tradicionales y con menor supervisión regulatoria.

Los security tokens juegan con reglas distintas. Están sujetos a las mismas regulaciones que las acciones o los bonos tradicionales, incluyendo supervisión de organismos como la Securities and Exchange Commission, protecciones para inversores y requisitos de cumplimiento estrictos.

Lejos de ser una desventaja, esta regulación es uno de sus mayores atractivos. Muchos inversores institucionales, reticentes al cripto por su volatilidad e incertidumbre legal, están entrando en los security tokens precisamente por este marco claro y familiar.

Malentendidos comunes

Un error frecuente es pensar que los security tokens son simplemente “cripto aburrido”. En realidad, son el puente que conecta activos tradicionales de billones de dólares con el ecosistema blockchain global y permanente.

Otro mito es que la regulación frena la innovación. En la práctica, la claridad regulatoria está acelerando la adopción institucional y habilitando flujos de capital a gran escala.

Tipos de security tokens

Security tokens respaldados por activos

Los equity tokens representan participaciones en empresas, incluyendo derechos de voto y distribución de beneficios.

Los tokens inmobiliarios permiten fraccionar propiedades comerciales o residenciales, facilitando la creación de carteras diversificadas con menores requisitos de capital.

Los debt tokens representan bonos o instrumentos de deuda, ofreciendo oportunidades de ingresos fijos con la eficiencia y transparencia de blockchain.

Los commodity tokens digitalizan activos físicos como oro o petróleo, normalmente respaldados por reservas reales.

Utility tokens vs security tokens

La diferencia clave suele definirse mediante el Test de Howey. Si compras un token con la expectativa de obtener beneficios por el trabajo de otros, probablemente sea un security token y requiera cumplimiento regulatorio.

Los utility tokens, en cambio, se diseñan para dar acceso a un servicio o plataforma, no como vehículos de inversión.

Beneficios de los security tokens

La propiedad fraccionada reduce barreras históricas de entrada, permitiendo a más personas acceder a activos premium.

El acceso global elimina limitaciones geográficas y de horario: los mercados tokenizados pueden operar 24/7.

La automatización del cumplimiento mediante smart contracts reduce costes y errores humanos.

La liquidez transforma activos tradicionalmente difíciles de vender en instrumentos negociables en mercados secundarios.

La eficiencia de costes elimina intermediarios y simplifica procesos.

Plataformas como Polymesh están llevando estos beneficios aún más lejos con cumplimiento on-chain y permisos programables orientados a adopción institucional.

Consideraciones regulatorias

SEC y el Test de Howey

La SEC utiliza el Test de Howey para determinar qué constituye un valor. La mayoría de los security tokens cumplen estos criterios, lo que activa obligaciones de registro, divulgación y protección al inversor.

Esta claridad regulatoria, lejos de frenar el mercado, genera confianza y atrae capital institucional.

Diferencias por jurisdicción

Estados Unidos adopta un enfoque centrado en valores. La Unión Europea avanza con MiCA, creando reglas armonizadas. En Asia-Pacífico, países como Singapur y Suiza destacan por su claridad regulatoria.

Security Token Offerings (STOs)

¿Qué es un STO?

Un STO es similar a una oferta pública inicial, pero utilizando blockchain y valores tokenizados. Incluye cumplimiento regulatorio desde el inicio y atrae capital institucional gracias a su estructura legal sólida.

Ejemplos reales de security tokens

tZERO ha tokenizado participaciones en su propia plataforma.

La tokenización inmobiliaria permite invertir en propiedades globales con bajo capital.

Polymesh ofrece infraestructura de nivel institucional.

Tokens como bNVDA muestran cómo acciones tradicionales pueden beneficiarse de la tecnología blockchain.

Riesgos y desafíos

Persisten retos como la incertidumbre regulatoria, la madurez limitada del mercado, riesgos tecnológicos y amenazas de fraude o custodia.

Reflexión final

Los security tokens representan la evolución de blockchain hacia una infraestructura financiera legítima. Están resolviendo problemas históricos de liquidez, acceso y eficiencia, y todo apunta a que formarán parte estándar del sistema financiero global, no como un experimento, sino como una transformación estructural.

TAP'S NEWS AND UPDATES

Redo att ta första steget?

Gå med i nästa generations smarta investerare och pengaanvändare. Lås upp nya möjligheter och börja din resa mot ekonomisk frihet redan idag.

Kom igång