Learning the friendly way

Dive into our resources, guides, and articles for all things money-related. Grow your financial confidence with our experts curated tips and articles for both experienced and new investors.

LATEST ARTICLEs

In today's digital-first economy, businesses across all sectors are seeking innovative financial solutions to drive efficiency, enhance customer experiences, and unlock new revenue streams. One compelling strategy is the implementation of co-branded credit cards, which have been shown to significantly boost customer loyalty and spending.

Notably, 75% of financially stable consumers prefer co-branded cards for their rewards and benefits, indicating a strong alignment between these card programs and consumer desires.

By collaborating with financial institutions to offer co-branded cards, businesses can create tailored payment solutions that meet customer expectations and reinforce brand loyalty. This approach transforms the payment infrastructure from a mere operational necessity into a strategic asset that fuels growth.

For instance, the co-branded credit card market is projected to grow from $13.41 billion in 2023 to $25.72 billion by 2030, reflecting a compound annual growth rate (CAGR) of 9.74%.

Whether you're in retail, SaaS, or manufacturing, a tailored card program could be the key to transforming how your business engages with customers—and how you scale.

What is card program management?

Card program management encompasses the end-to-end process of designing, implementing, and optimising payment card solutions tailored to your business. From corporate expense cards that streamline internal processes to branded payment cards that enhance customer loyalty, these programs offer versatility that can benefit virtually any organisation looking to modernise its financial operations.

As businesses continue to navigate increasingly complex markets, those equipped with flexible financial tools gain a significant competitive advantage. The right card program doesn't just process payments—it generates valuable data, reduces administrative burden, and creates opportunities for deeper engagement with both employees and customers.

Why it matters

At its core, card program management involves overseeing all aspects of a payment card ecosystem—from issuing and distribution to transaction processing, reporting, and compliance. Modern card program management platforms provide businesses with the infrastructure to create customised payment solutions while maintaining visibility and control.

This matters because traditional payment methods often create friction points that slow business growth. Manual expense reporting, limited payment visibility, and rigid financial systems can drain resources and limit innovation.

However, a well-managed card program addresses these pain points by automating processes, enhancing security, and providing greater flexibility.

Key benefits for businesses across sectors

Streamlined operations

Card programs dramatically reduce administrative overhead by automating expense tracking, simplifying reconciliation, and eliminating paper-based processes. This operational efficiency translates directly to cost savings and allows your team to focus on strategic initiatives rather than transaction management.

Enhanced Customer Experience

For businesses that implement customer-facing card programs, the benefits extend to experience enhancement. Branded payment cards can strengthen loyalty, while instant issuance capabilities meet modern expectations for immediacy.

From hospitality to healthcare, organisations are using card programs to differentiate their service offerings.

Data-driven insights

Perhaps the most overlooked advantage of modern card program management is the wealth of data it generates. Every transaction becomes a data point that can inform business decisions, reveal spending patterns, and identify opportunities for optimisation. This business intelligence becomes increasingly valuable as programs scale.

Scalability and flexibility

As your business grows, your card program can evolve alongside it. Whether you're expanding into new markets or adding new product lines, a well-designed card program adapts to changing requirements without requiring complete system overhauls.

The implementation process simplified

Implementing a card program doesn't have to be overwhelming. The process typically follows these key steps:

- Assessment and strategy development: Evaluate your current payment ecosystem and define clear objectives for your card program.

- Platform selection and integration: Choose a card program management solution that aligns with your technical requirements and business goals, then integrate it with your existing systems.

- Program launch and optimisation: Deploy your program with proper training and support, then continuously refine based on performance data and user feedback.

Real-World Impact

Across industries, businesses are leveraging card program management to solve specific challenges:

- Retail companies are implementing instant digital card issuance to capture sales opportunities.

- Healthcare providers are using specialised payment cards to simplify patient financial assistance.

- Manufacturing firms are deploying corporate card programs with custom spending controls to streamline procurement.

The common thread? Each organisation is using card program management as a strategic tool rather than just a payment method.

How Tap can help

Navigating the complexities of card program management requires expertise and the right technology partner. Tap's comprehensive platform brings together cutting-edge technology with industry-specific knowledge to help businesses design, implement, and optimise card programs that deliver measurable results.

Our solution addresses common challenges like regulatory compliance, security concerns, and integration complexities, allowing you to focus on the strategic benefits rather than implementation hurdles.

Ready to explore how card program management could transform your business operations and drive growth? Connect with Tap's team of specialists for a personalised consultation and discover the potential of a tailored card program for your organisation.

Article Framework: Card Program Management

Tone & Perspective

- Tone: Professional, informative, and authoritative.

- Perspective: Written from an expert viewpoint, educating businesses on launching and managing a successful card program.

Priority Headings & Structure

1. Introduction

- What is card program management?

- Why businesses need effective card program management.

- Overview of key stakeholders (issuers, networks, processors, etc.).

2. How Card Program Management Works

- Key components: issuing, processing, compliance, and risk management.

- The role of a program manager (self-managed vs. outsourced).

- The relationship between issuing banks, networks, and program managers.

3. Core Elements of a Successful Card Program

- Program Design: Choosing card types (prepaid, debit, credit), network selection (Visa, Mastercard), and branding.

- Issuance & Account Management: BIN sponsorship, account setup, and customer onboarding.

- Compliance & Risk Management: KYC, AML, PCI DSS, and fraud prevention strategies.

- Transaction Processing & Settlement: How funds flow through the ecosystem.

- Customer Experience & Support: Ensuring smooth cardholder interactions.

4. Self-Managed vs. Partner-Managed Card Programs

- Benefits and challenges of managing in-house.

- When outsourcing makes sense.

- How third-party program managers add value.

5. Key Considerations Before Launching a Card Program

- Business goals and revenue model.

- Regulatory and security requirements.

- Time-to-market considerations.

6. Trends & Future of Card Program Management

- Embedded finance & BaaS (Banking-as-a-Service).

- AI-driven fraud detection and risk management.

- Open banking and API-driven solutions.

7. Conclusion & Next Steps

- Recap of key insights.

- How businesses can get started with a card program.

- Contact a program management expert.

There’s no denying that the recent surge in Bitcoin adoption has largely been fueled by the incredible bull run. With mainstream media, large corporations, and more retail investors taking notice, many merchants have followed suit and added the original cryptocurrency to their list of payment options. As the market erupts, let’s explore what can you buy with Bitcoin exactly.

Bitcoin’s Surge In Adoption

While 2020 was a challenge for most industries, the crypto markets saw unbelievable gains. Despite the universal market destruction that was witnessed across the board, Bitcoin flourished from $3,870 in March to an all time high of $20,000 by the end of the year. Just one week into the new year and the cryptocurrency had doubled reaching $41,515. By 21 February the cryptocurrency was worth $58,330, almost triple the previous all time high.

The extended bull run was due to large firms moving their company reserves from fiat to BTC, with Tesla bringing a lot of media attention to both this pattern but Bitcoin in general. As more people sought to enter the market, more vendors, businesses and retailers sought to offer it as an alternative payment option. According to a study conducted by HSB in 2020, 36% of small-medium businesses in the US accept Bitcoin. This is also likely to triple in coming months.

What Can You Buy With Bitcoin?

As you’ll see below, almost everything. While not every store offers Bitcoin payments, there are plenty of services which offer gift cards for such stores that can be bought with BTC. Where there’s a will, there’s a way. Let’s dive into all the things available for purchase with Bitcoin. To make things a bit simpler, we’ve broken it down into the following categories:

Tech

Consumers can purchase everything from a VPN service (ExpressVPN) to cloud storage space (Mega.nz) with the cryptocurrency. Microsoft, Wikipedia and AT&T also grace the list, having accepted Bitcoin as a payment method for some years now. Unsurprisingly, the gaming platform Twitch also features crypto payments (they disabled them and then brought them back). There is even a digital library in San Francisco providing the world with “universal access to all knowledge” that operates off of Bitcoin donations.

Sports

Tech you can understand, but sports? Yes, that’s right. A number of large sports clubs around the world have chosen to embrace the digital currency movement. In America, the most famous to do so are the Miami Dolphins and the Dallas Mavericks, while across the pond in the United Kingdom the following football clubs are all in: Tottenham Hotspur, Crystal Palace, Brighton & Hove Albion, Southampton, Leicester City, Newcastle United, and Cardiff City. S.L Benfica, one of the oldest and most popular sports clubs in Portugal, has also decided to accept Bitcoin for everything from merchandise to game tickets.

Retail

Most famously the American retailer dealing with home decor, Overstock, is one of the largest retailers to accept Bitcoin. Home Depot and Whole Foods also joined the ranks through the Winklevoss Flexa spending app ‘Spedn’ that allows for seamless crypto payments.

Then there are companies that provide a middle ground enabling you to purchase goods from stores that don’t necessarily accept the cryptocurrency directly. This includes Purse.io that is most famously used for Amazon purchase with Bitcoin, and Gyft, a company that sells gift cards for popular stores in exchange for crypto. Gyft can be used for everything from Starbucks to Sephora to iTunes.

Travel

You’d be surprised how many travel companies are now offering purchases with cryptocurrencies. One of the first to cross over was Latvia’s national airline, airBaltic, which announced in 2014 that they would be offering the payment option. Since then a number of leading travel companies including Expedia, CheapAir, and Destinia have followed suit. Alternatively, you could purchase a trip to space with Richard Branson’s Virgin Galactic. There is even a specially designed travel company catering solely to Bitcoin shoppers, Bitcoin.Travel.

Food

Another industry to embrace Bitcoin payments with a number of top fast food chains embracing the crypto life in various corners of the globe. Multiple Subways around the world, Pizza Hut in Venezuela, 40 international locations of Burger King, and KFC in Canada have all joined the forward driven club.

BTC Tapping Into The Future

And then of course just about anything in Japan. If you’re looking for goods to purchase with Bitcoin, you can usually see from an online stores’ homepage if it is an option, or in a brick-and-mortar store there will usually be QR code at the checkout counter indicating that Bitcoin is accepted there. If you’ve found that Bitcoin payments are definitely for you, buy, send and spend BTC directly from your Tap app. What can you buy with Bitcoin through your Tap app? Just about anything thanks to the seamless payments integration technology.

Bitcoin and Ethereum dominate headlines, but they represent just one approach to distributed ledger technology. While most projects iterate on blockchain's foundational concepts, Hedera Hashgraph (HBAR) takes a different approach, pursuing an entirely different architectural philosophy.

The result is a network engineered for enterprise-grade performance - processing thousands of transactions per second with deterministic fees and minimal energy consumption. Where many blockchain networks struggle with the scalability trilemma, Hedera's hashgraph consensus mechanism offers a compelling alternative that doesn't sacrifice security for speed.

What distinguishes Hedera in practice is its enterprise adoption trajectory. Major corporations across finance, healthcare, and supply chain management have moved beyond pilot programs to production deployments. This isn't theoretical adoption - it's measurable network activity from organizations with serious compliance and performance requirements.

Hedera has positioned itself as one of the most corporate-friendly distributed ledger technologies (DLTs) available today. But how exactly does it work, and why does it stand apart from the blockchain crowd?

The Basics: What Is Hedera Hashgraph?

Launched in 2018, Hedera Hashgraph is a distributed ledger technology that offers a genuine alternative to blockchain architecture. Instead of organizing transactions into sequential blocks like a digital filing cabinet, Hedera uses a directed acyclic graph (DAG) structure called the hashgraph. Think of it more like a web of interconnected transactions.

This design allows multiple transactions to be processed in parallel rather than waiting in a single-file line. The result? Hedera can handle over 10,000 transactions per second (TPS) with finality in just a few seconds, while Bitcoin manages about 6–8 TPS and Ethereum handles 12–15 TPS.

At its core, Hedera is engineered to tackle three persistent challenges that have plagued distributed ledger technology:

- Transactions settle in seconds, not the minutes or hours you might wait with other networks. This makes it possible to build applications where timing actually counts.

- Scalability without the usual trade-offs, The network can handle thousands of transactions simultaneously without slowing down or getting expensive when things get busy. Most blockchains struggle with this balancing act.

- Energy use that makes sense, unlike networks that consume as much electricity as small countries, Hedera runs efficiently enough that companies don't have to justify massive energy bills to their boards.

How Hedera Works: Gossip and Virtual Voting

Hedera's performance stems from its unique consensus mechanism, which combines two clever innovations that work together like a well-orchestrated dance.

Instead of broadcasting every transaction to the entire network simultaneously (imagine shouting news in a crowded room), nodes "gossip" by randomly sharing information with a few neighbors. Those nodes then pass it along to their neighbors, creating a ripple effect. Over time, the entire network organically learns about every transaction without the communication overhead. That is known as the “gossip-about-gossip protocol”.

Virtual voting is where things get interesting: once all nodes have the same historical record of gossip, they can independently calculate how the network would vote on each transaction. No actual vote messages need to be sent across the network. The outcome is mathematically deterministic based on the gossip history, saving significant time and bandwidth.

Together, these methods achieve asynchronous Byzantine fault tolerance (aBFT), which represents one of the highest levels of security available in distributed systems. This means the network can reach consensus and continue operating even if up to one-third of nodes act maliciously or fail completely.

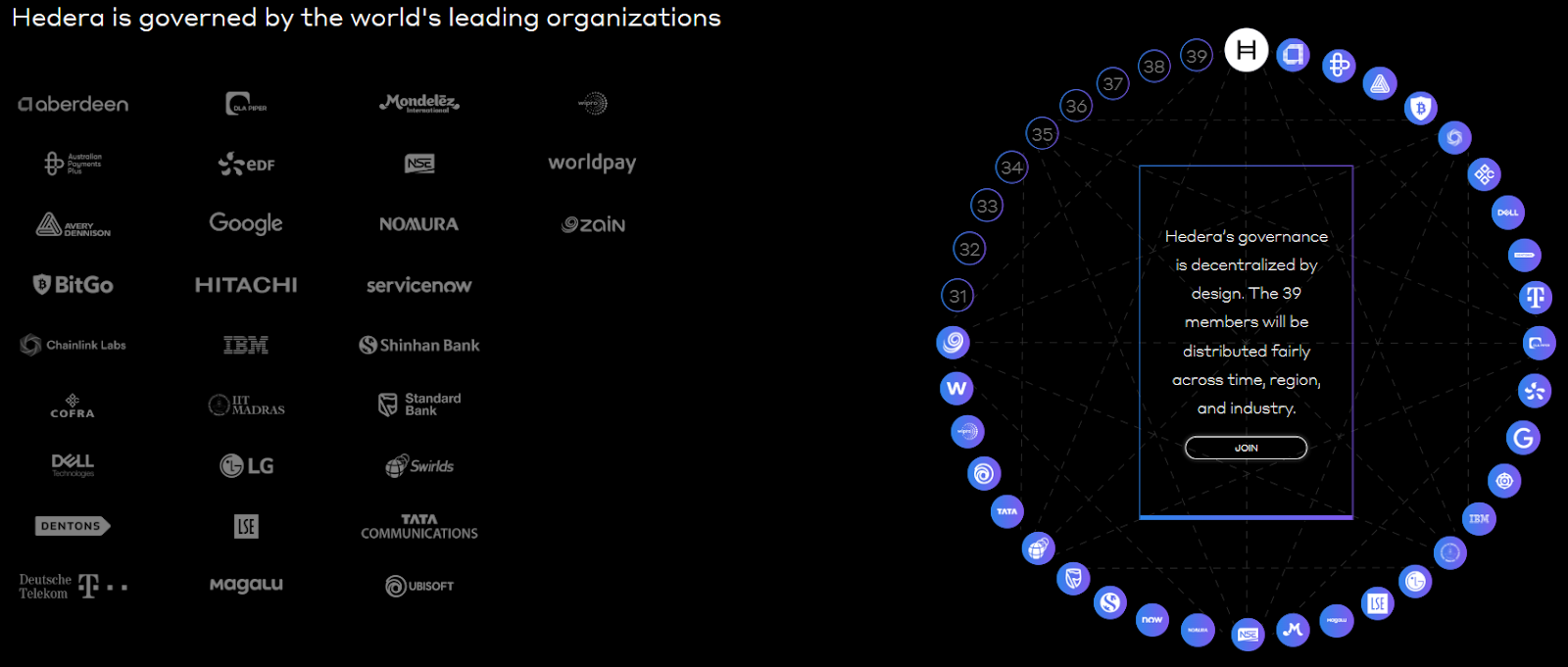

Governance: The Hedera Council

Perhaps the most controversial, and arguably the most distinctive, aspect of Hedera is its governance model. Instead of leaving critical network decisions to anonymous miners or distributed token holders, Hedera operates under a Governing Council of up to 39 well-known global organizations.

Current members include companies like Google, IBM, Dell, Boeing, Standard Bank, Ubisoft, and other established corporations. Each council member holds an equal vote on network decisions, including software upgrades, fee structures, and treasury management.

The rationale is straightforward: provide stability, accountability, and long-term strategic planning. However, this structure has sparked ongoing debate within the crypto community. Critics argue it reduces decentralization compared to blockchain networks where theoretically anyone can participate in governance, while supporters contend it offers the predictability that many enterprises require for serious adoption.

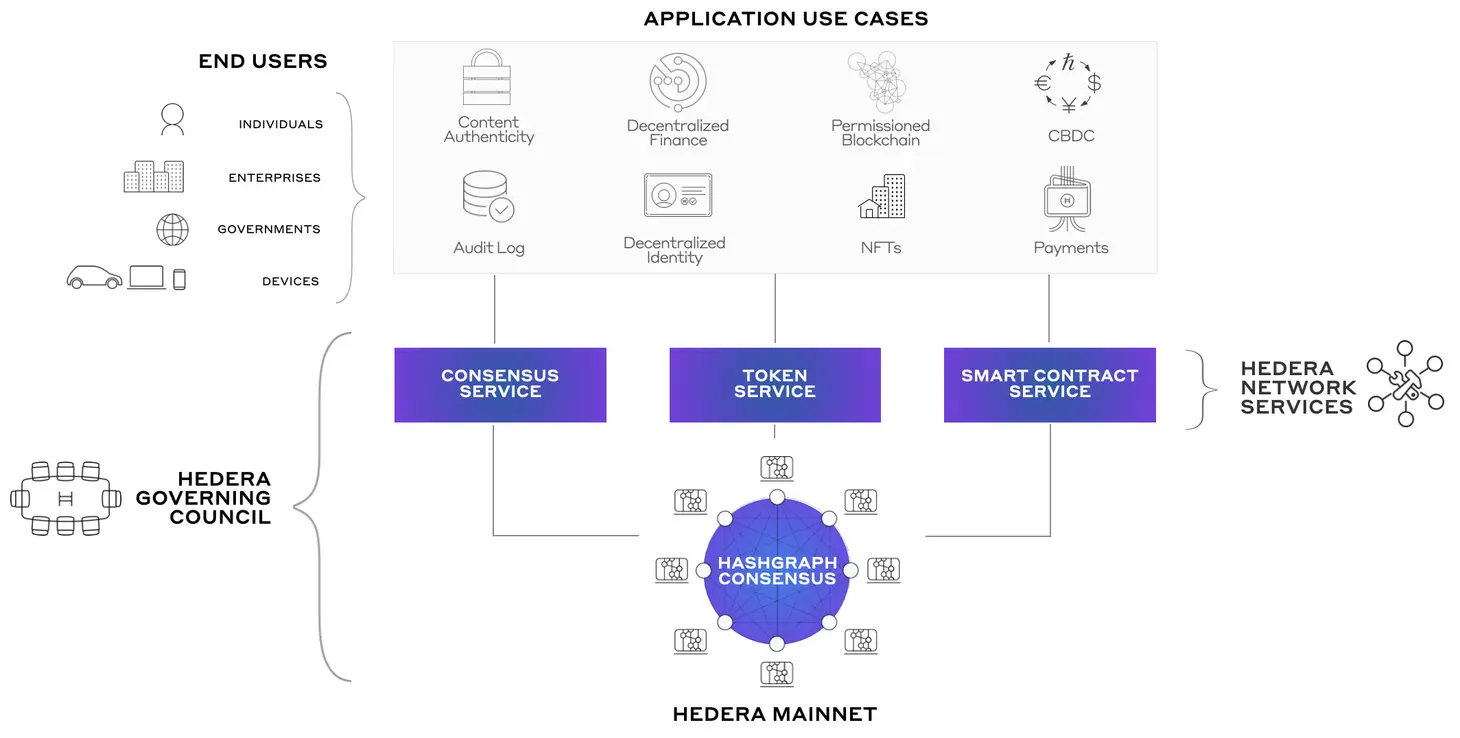

Key Services of Hedera

Hedera functions as more than just a payment network. The platform offers three core services that developers and enterprises can leverage to build decentralized applications:

Hedera Consensus Service (HCS): Provides secure, immutable logs of events and data. This proves particularly valuable for supply chain tracking, regulatory audits, and maintaining data integrity in heavily regulated industries like healthcare and finance.

Hedera Token Service (HTS): Enables the creation and management of various token types, including stablecoins, NFTs, and tokenized assets. Built-in features like account-level controls and compliance tools make it especially appealing for enterprises that need to meet regulatory requirements.

Hedera Smart Contract Service (HSCS): Supports Ethereum-compatible smart contracts, allowing developers to build DeFi applications, games, and automation tools while benefiting from Hedera's superior speed and substantially lower transaction fees.

Real-World Applications

Hedera's enterprise-focused approach has translated into practical implementations across multiple sectors:

- Finance: Standard Bank leverages Hedera's infrastructure for faster, more transparent cross-border payment processing.

- Supply chain: Companies like Suku and Avery Dennison use Hedera for product traceability and logistics management, providing end-to-end visibility.

- Healthcare: Safe Health Systems employs the network to securely log medical and clinical trial data while maintaining strict patient privacy standards.

- Gaming: Animoca Brands integrates Hedera's technology to create fair and tamper-proof in-game economies and digital asset management.

- Sustainability: Environmental organizations use Hedera's consensus service to track carbon credits and monitor environmental impact data with immutable records.

These implementations highlight Hedera's positioning as an enterprise-focused platform, creating a distinct contrast to networks that primarily serve DeFi protocols or retail trading activities.

Understanding HBAR: The Native Token

Like most distributed ledger technologies, Hedera operates with its own native cryptocurrency: HBAR. The token serves two fundamental purposes within the ecosystem:

- Network fuel: HBAR is required to pay transaction fees and access network services, including consensus operations, tokenization features, and smart contract execution.

- Network security: Node operators stake HBAR tokens to participate in consensus and help secure the network infrastructure.

One of Hedera's most practical advantages lies in its cost structure. A typical transaction costs approximately $0.0001, it’s economical enough to enable microtransactions and machine-to-machine payment scenarios that would be prohibitively expensive on other networks.

The total supply of HBAR is capped at 50 billion tokens. The distribution follows a controlled release schedule designed to avoid sudden market flooding while ensuring adequate liquidity for network operations.

How Hedera Compares to Other Networks

To understand Hedera's market position, it's helpful to consider how it stacks up against established blockchain models:

Proof-of-Work (PoW), exemplified by Bitcoin, is highly secure and battle-tested, but notoriously slow and energy-intensive.

Proof-of-Stake (PoS), used by Ethereum 2.0, is more energy-efficient than PoW, but can lead to wealth concentration among large token holders.

Lastly, Hedera Hashgraph uses gossip protocols and virtual voting to achieve speed, security, and efficiency simultaneously, while operating under corporate governance rather than anonymous network participants.

The trade-off is crystal-clear. Hedera prioritizes corporate trust, performance, and regulatory clarity, while accepting criticism that it may sacrifice some degree of decentralization compared to traditional blockchain networks.

The Challenges Ahead

Despite its technical strengths and enterprise adoption, Hedera faces some hurdles that could impact its long-term trajectory. The Governing Council model continues to raise questions about whether Hedera represents genuine decentralization or simply distributed corporate control, a debate that matters deeply to the broader crypto community's acceptance. Meanwhile, established networks like Solana, Avalanche, and Ethereum maintain their dominance over ecosystem development, making it challenging for Hedera to attract the vibrant developer communities that drive innovation.

The platform also faces an adoption challenge. While it excels in enterprise use cases, Hedera could broaden its appeal beyond corporate applications to achieve the kind of recognition that sustains long-term growth. Moreover, like all cryptocurrency projects, Hedera must navigate evolving regulatory frameworks across multiple jurisdictions, each with their own compliance requirements and restrictions.

Nevertheless, Hedera's focus on performance, enterprise-grade reliability, and regulatory compliance could provide resilience in certain market conditions where other projects would struggle to maintain institutional confidence.

HBAR ETF on the Horizon

Over the past several months, talk of a potential HBAR ETF has gained traction. An ETF would offer institutional and retail investors exposure to HBAR without needing to manage wallets, private keys, or direct custody. That kind of access lowers the entry-level barrier. Moreover, SEC approval of a Hedera ETF would imply a level of oversight, due diligence, and compliance that can help reduce perceived risks among cautious or regulated investors. It puts HBAR closer to the realm of mainstream finance instruments.

The U.S. Securities and Exchange Commission (SEC) recently pushed back the decision on the Canary HBAR ETF to November 8. The ETF was proposed by Nasdaq back in February; the SEC has delayed the decision twice already. Despite the most recent delay, however, market analysts remain optimistic. Bloomberg’s analysts, for instance, maintain a 90% likelihood of ETF approval in the near term.

The Future of Hedera

Hedera stands out in a crowded field by taking a completely different approach than most blockchain projects. Instead of following the usual playbook, they built something that actually works for businesses: fast transactions, costs you can predict, and energy usage that won't make your CFO cringe.

The real test isn't whether Hedera can keep doing what it's doing well. It's whether they can stay relevant as the whole distributed ledger world keeps evolving at breakneck speed. But here's the thing: while everyone else was busy trying to be the next Bitcoin, Hedera quietly built something that Fortune 500 companies actually want to use.

Whether that bet pays off long-term is anyone's guess. What's not up for debate is that they've proven there's more than one way to build a distributed ledger, and sometimes the road less traveled leads somewhere pretty interesting.

Why can't a fully compliant, regulated crypto business secure a bank account in 2025?

If you're operating in this space, you already know the answer. You've lived through it. You've submitted the documentation, walked through your AML procedures, and demonstrated your regulatory compliance… only to be rejected. Or worse still, waking up to find your existing account frozen, with no real explanation and no path forward.

This isn't about isolated cases or bad actors being weeded out. It's a pattern of systematic risk aversion that's creating real barriers to growth across the entire sector, and it's throttling one of the most significant financial innovations of our generation.

We're Tap, and we're building the infrastructure that traditional banks refuse to provide.

The Economics Behind the Blockade

Let's examine what's actually driving this exclusion, because it's rarely about the reasons banks cite publicly.

The European Banking Authority has explicitly warned against unwarranted de-risking, noting it causes "severe consequences" and financial exclusion of legitimate customers. Yet the practice continues, driven by two fundamental economic pressures that have nothing to do with your business's actual risk profile.

The compliance cost calculation

Financial crime compliance across EMEA costs organizations approximately $85 billion annually. For traditional banks, the math is simple: serving crypto businesses requires specialized expertise, enhanced monitoring, and ongoing due diligence. As a result, it's cheaper to reject the entire sector than to build the infrastructure needed to serve it properly.

The regulatory capital burden

New EU regulations impose a 1,250% risk weight on unbacked crypto assets such as Bitcoin and Ethereum. This isn't a compliance requirement; it's a capital penalty that makes crypto exposure commercially unviable for traditional institutions, regardless of the actual risk individual clients present.

In the UK, approximately 90% of crypto firm registration applications have been rejected or withdrawn, often citing inadequate AML controls. Whether those assessments are accurate or not, they've created the perfect justification for blanket rejection policies.

The result? Compliant businesses are being treated the same as bad actors; not because of what they've done, but because of the sector they're in.

The Real Cost of Financial Exclusion

Financial exclusion isn’t just an hiccup; it creates tangible operational barriers that ripple through every part of running a crypto business.

Firms that have secured MiCA authorization, built robust compliance programs, and met regulatory requirements can find themselves locked out of basic banking services. Essential fiat on-ramps and off-ramps remain inaccessible, slowing payments, limiting growth, and complicating cash flow management.

Individual cases illustrate the problem vividly as well. Accounts are closed because a business receives a payment from a regulated exchange. Others are dropped with vague references to “commercial decisions,” offering no substantive justification. Founders frequently struggle to separate personal and business finances, as both are considered too risky to serve.

The irony is striking. By refusing service to compliant businesses, traditional banks aren’t mitigating risk; they’re amplifying it. Forced to operate through less regulated channels, these legitimate firms face higher operational and compliance risks, slower transactions, and reduced investor confidence. Over time, this slows innovation, and raises the cost of doing business for firms that are legally and technically sound.

Debanking Beyond Europe: U.S. Crypto Firms Face Their Own Challenges

Limited access to banking services isn’t exclusive to Europe. Leading firms in the U.S. crypto industry have faced numerous challenges regarding the banking blockade. Alex Konanykhin, CEO of Unicoin, described repeated account closures by major banks such as Citi, JPMorgan, and Wells Fargo, noting that access was cut off without explanation. Unicoin’s experience echoes a broader sentiment among crypto executives who argue that traditional financial institutions remain wary of digital asset businesses despite recent policy shifts toward a more pro-innovation stance.

Jesse Powell, co-founder of Kraken, has also spoken out about being dropped by long-time banking partners, calling the practice “financial censorship in disguise.” Caitlin Long, founder of Custodia Bank, recounted how her institution was repeatedly denied services. Gemini founders Tyler Winklevoss and Cameron Winklevoss shared similar frustrations.

These experiences reveal a pattern many in the industry interpret as systemic risk aversion. Even in a market as large and mature as the United States, crypto-focused businesses continue to encounter obstacles in maintaining basic financial infrastructure. The issue became especially acute after the collapse of crypto-friendly banks such as Silvergate, Signature, and Moonstone; institutions that once served as key bridges between fiat and digital assets. Their exit left a gap few traditional players have been willing to fill.

Why Tap Exists

The crypto industry has reached an inflection point. Regulatory frameworks like MiCA are providing clarity. Institutional adoption is accelerating. The technology is proven and tested. But the fundamental infrastructure gap remains: access to business banking that actually works for digital asset businesses.

This is precisely why we built Tap for Business.

We provide business accounts with dedicated EUR and GBP IBANs specifically designed for crypto companies and businesses that interact with digital assets. This isn't a side offering or an experiment, it's our core focus.

Our approach is straightforward

We built our infrastructure for this sector

Rather than retrofitting traditional banking systems to reluctantly accommodate crypto businesses, we designed our compliance, monitoring, and operational frameworks specifically for digital asset flows. This means we can properly assess and serve businesses that others automatically reject.

We price in the actual risk, not the sector

Blanket rejection policies exist because they're cheap and simple. We take a different approach: evaluating each business based on their actual controls, compliance posture, and operational reality. It costs more, but it's the only way to serve this market properly.

We're committed to sector normalization

Every time a legitimate crypto business is forced to operate without proper banking infrastructure, it reinforces outdated stigmas. By providing professional financial services to compliant businesses, we're helping demonstrate what should be obvious: crypto companies can and should be served by the financial system.

It isn't about taking on risks that others won't. It's about properly evaluating risks that others refuse to understand.

Moving Forward

The industry is maturing. Regulatory clarity is emerging. Institutional adoption is accelerating. But you can't put your business on hold while traditional banks slowly catch up to reality.

That's not sustainable in the long run.

As a firm, you shouldn't have to beg for a bank account. You shouldn't have to downplay your crypto operations just to access basic financial services. And you certainly shouldn't have to accept that systematic exclusion with little to no explanation other than “It’s just how things are."

The crypto sector is building the future of finance. Your banking partner should believe in that future too. If you're ready to work with financial infrastructure built for your business, not in spite of it, here we are.

Talk today with one of our experts to understand how we can help your business access the banking infrastructure you need.

Το Tether, ένα από τα κορυφαία 5 κρυπτονομίσματα, έχει προκαλέσει έντονες συζητήσεις στον χώρο των κρυπτονομισμάτων και παραμένει το αγαπημένο stablecoin στην αγορά. Με συχνά τον μεγαλύτερο ημερήσιο όγκο συναλλαγών, το Tether έχει καθιερωθεί ως αναπόσπαστο κομμάτι της βιομηχανίας κρυπτονομισμάτων. Ας αναλύσουμε περισσότερα για το ψηφιακό νόμισμα Tether.

Από την εμφάνιση του ψηφιακού χρήματος, η χρήση του έχει αυξηθεί σημαντικά, αλλά έχει συνοδευτεί και από ανησυχίες σχετικά με τους κινδύνους που ενέχει. Ενώ οι παραδοσιακοί επενδυτές συχνά επικρίνουν τη μεταβλητότητα των αγορών κρυπτονομισμάτων, πολλές κοινότητες σε όλο τον κόσμο έχουν για πρώτη φορά πρόσβαση σε χρηματοοικονομικές υπηρεσίες, απαιτώντας μόνο σύνδεση στο διαδίκτυο, χωρίς την ανάγκη για χρονοβόρες διαδικασίες ανοίγματος τραπεζικών λογαριασμών.

Όταν μιλάμε για την ασφάλεια και τη διαφάνεια που μπορούν να παρέχουν τα ψηφιακά νομίσματα, αυτά αντιμετωπίζουν άμεσα προβλήματα που εμφανίζονται συχνά στις παραδοσιακές αγορές νομισμάτων. Παρόλο που πολλοί θεωρούν το Bitcoin και τα κρυπτονομίσματα γενικότερα ως "επικίνδυνα" ή "φούσκες", η αλήθεια είναι ότι αυτές οι νέες υπηρεσίες πληρωμών έχουν φέρει πολυάριθμα αποτελέσματα σε ένα παρωχημένο σύστημα.

Τι είναι το Tether (USDT);

Το Tether (USDT) είναι ένα κρυπτονόμισμα συνδεδεμένο με το δολάριο ΗΠΑ, γνωστό και ως stablecoin. Τα stablecoins διατηρούν την αξία του νομίσματος ή του εμπορεύματος με το οποίο είναι συνδεδεμένα σε αναλογία 1:1. Το Tether είναι το πρώτο stablecoin στον κόσμο, που λανσαρίστηκε αρχικά για συναλλαγές το 2014 με την ονομασία Realcoin.

Αν και το Tether λανσαρίστηκε αρχικά στο Omni Layer του blockchain του Bitcoin, πλέον είναι συμβατό με διάφορα άλλα blockchains, όπως Ethereum, TRON, EOS, Algorand, Solana και το OMG Network.

Ένα stablecoin απαιτεί η κυκλοφορούσα προσφορά του να αντιστοιχείται από κεφάλαια αποθηκευμένα σε λογαριασμό αποθεματικού. Το Tether χρησιμοποιεί έναν συνδυασμό εμπορικών χρεογράφων, καταθέσεων, μετρητών, συμφωνιών επαναγοράς και ομολόγων του Δημοσίου για να διατηρήσει την κυκλοφορούσα αξία. Παρά τις φήμες για την επάρκεια των αποθεμάτων του Tether, η δημοτικότητα και η αγοραστική του δύναμη συνεχίζουν να αυξάνονται.

Ο βασικός στόχος του Tether είναι να παρέχει ένα ψηφιακό περιουσιακό στοιχείο με σταθερή τιμή αγοράς, το οποίο αξιοποιεί τη δύναμη της τεχνολογίας blockchain και τα οφέλη των κρυπτονομισμάτων χωρίς να υφίσταται τη μεταβλητότητα που τα χαρακτηρίζει. Μπορείτε να επισκεφθείτε τον ιστότοπο του Tether για μια πιο λεπτομερή κατανόηση των χαρακτηριστικών του νομίσματος.

Ποια είναι η αξία του Tether;

Ενώ τα περισσότερα κρυπτονομίσματα αποκτούν αξία από την προσφορά και τη ζήτηση, τα stablecoins είναι συνδεδεμένα με ένα νόμισμα ή ένα εμπόρευμα. Αυτό σημαίνει ότι η αξία τους παραμένει σταθερή και συνδέεται άμεσα με την αξία του νομίσματος ή του εμπορεύματος που αντιπροσωπεύουν, συνήθως σε αναλογία 1:1.

Στην περίπτωση του Tether, η αξία του αντανακλά πάντα την αξία ενός δολαρίου ΗΠΑ. Αν και η αξία παραμένει αμετάβλητη, είναι σημαντικό να σημειωθεί ότι το stablecoin έχει καταφέρει να γίνει ένα από τα πιο διαπραγματεύσιμα κρυπτονομίσματα στην αγορά.

Ποιοι δημιούργησαν το Tether;

Όπως αναφέρθηκε, το Tether αρχικά ονομαζόταν Realcoin όταν λανσαρίστηκε το 2014 και δημιουργήθηκε από τον επενδυτή Bitcoin Brock Pierce, τον επιχειρηματία Reeve Collins και τον προγραμματιστή λογισμικού Craig Sellars. Αργότερα μετονομάστηκε σε USTether και τελικά πήρε το όνομα USDT.

Οι τρεις συνιδρυτές έχουν βαθιά εμπειρία στον τομέα των κρυπτονομισμάτων, ενώ όλοι έχουν συνιδρύσει και συμμετάσχει ενεργά σε διάφορα έργα σχετικά με blockchain και κρυπτονομίσματα.

Η εταιρεία έχει επίσης δημιουργήσει μια σειρά από άλλα stablecoins που λύνουν το πρόβλημα της μεταβλητότητας σε πολλές αγορές, συμπεριλαμβανομένου του Tether συνδεδεμένου με το ευρώ (EURT), του Tether συνδεδεμένου με το κινέζικο γουάν (CNHT) και του Tether συνδεδεμένου με τον χρυσό (XAUT).

Πώς Λειτουργεί το Tether;

Το Tether δεν διαθέτει δικό του blockchain για τη λειτουργία του. Αντίθετα, λειτουργεί ως ένα token δεύτερου επιπέδου πάνω σε ήδη καθιερωμένα blockchains, όπως το Bitcoin, το Ethereum, το EOS, το Tron, το Algorand, το Bitcoin Cash και το OMG.

Παρόλα αυτά, το Tether λειτουργεί όπως κάθε άλλο κρυπτονόμισμα, αποθηκεύεται και διαχειρίζεται μέσω wallets που είναι συμβατά με το blockchain στο οποίο έχει δημιουργηθεί. Σημειώστε ότι δεν μπορείτε να στείλετε USDT που βασίζεται στο Ethereum blockchain σε ένα wallet που βασίζεται στο Tron, καθώς πρέπει να παραμείνει στο αντίστοιχο blockchain. Το αποτέλεσμα μιας τέτοιας ενέργειας θα ήταν η απώλεια των νομισμάτων.

Η κυκλοφορούσα προσφορά του Tether απαιτείται να υποστηρίζεται πάντα από τον ίδιο αριθμό δολαρίων ΗΠΑ που διατηρούνται σε λογαριασμό αποθεματικού. Αυτά τα αποθέματα μπορούν επίσης να περιλαμβάνουν άλλα ισοδύναμα μετρητά, περιουσιακά στοιχεία και απαιτήσεις από δάνεια.

Παρέχοντας ένα σταθερό ψηφιακό νόμισμα σε μια κατά τα άλλα σχετικά ασταθή αγορά, το Tether επιτρέπει στους χρήστες να πραγματοποιούν συναλλαγές σε USD, τόσο διεθνώς όσο και τοπικά, χωρίς ανησυχίες για διακυμάνσεις τιμών. Επιπλέον, προσφέρει πολύτιμη προστασία σε αγορές που αντιμετωπίζουν ξαφνικές ή δραματικές πτώσεις τιμών.

Τι Είναι το USDT;

Το USDT είναι ένα stablecoin συνδεδεμένο με το δολάριο ΗΠΑ σε αναλογία 1:1. Δημιουργημένο υπό την επωνυμία Tether, το USDT είναι το πιο ευρέως χρησιμοποιούμενο stablecoin στην αγορά σήμερα. Υπάρχει θεωρητικά απεριόριστη προσφορά USDT, με περίπου 72,5 δισεκατομμύρια σε κυκλοφορία τη στιγμή της σύνταξης αυτού του άρθρου.

Το USDT προσφέρει ένα ασφαλές καταφύγιο για τους επενδυτές όταν οι αγορές υφίστανται σημαντικές πτωτικές τάσεις τιμών, προσφέροντας μια σταθερή αξία για τη μεταφορά των κεφαλαίων, χωρίς να απαιτείται ρευστοποίηση των ψηφιακών περιουσιακών στοιχείων σε μετρητά.

Πώς Μπορώ να Αγοράσω USDT;

Αν επιθυμείτε να εντάξετε το Tether (USDT) στο crypto χαρτοφυλάκιό σας, μπορείτε να το κάνετε εύκολα μέσω της εφαρμογής Tap για κινητά. Μετά την ολοκλήρωση μιας απλής διαδικασίας επαλήθευσης KYC, οι χρήστες αποκτούν πρόσβαση σε μια σειρά από αγορές κρυπτονομισμάτων και μπορούν να αποθηκεύσουν τα ψηφιακά περιουσιακά στοιχεία στα μοναδικά, ενσωματωμένα crypto wallets μας.

Η δυναμική του blockchain και των κρυπτονομισμάτων είναι τεράστια. Με τη βοήθεια της εφαρμογής Tap, μπορείτε να διαχειρίζεστε το crypto χαρτοφυλάκιό σας και τα fiat κεφάλαιά σας εν κινήσει, ενώ παράλληλα επωφελείστε από πραγματικές χρήσεις, όπως η Tap προπληρωμένη κάρτα, που παρέχει πρόσβαση σε πληρωμές σε περισσότερους από 40 εκατομμύρια εμπόρους παγκοσμίως.

Αποποίηση Ευθύνης

Αυτό το άρθρο προορίζεται αποκλειστικά για γενικούς ενημερωτικούς σκοπούς και δεν αποτελεί νομική, οικονομική ή άλλη επαγγελματική συμβουλή ή σύσταση οποιουδήποτε είδους και δεν πρέπει να θεωρείται ή να αντιμετωπίζεται ως υποκατάστατο για συγκεκριμένες συμβουλές που σχετίζονται με συγκεκριμένες περιστάσεις.

Δεν παρέχουμε καμία εγγύηση, δήλωση ή υπόσχεση σχετικά με το περιεχόμενο αυτού του άρθρου (συμπεριλαμβανομένων, ενδεικτικά, της ποιότητας, ακρίβειας, πληρότητας ή καταλληλότητας του περιεχομένου για οποιονδήποτε σκοπό) ή οποιοδήποτε άλλο περιεχόμενο που αναφέρεται ή αποκτάται μέσω υπερσυνδέσμων αυτού του άρθρου. Δεν παρέχουμε δηλώσεις, εγγυήσεις ή διαβεβαιώσεις, είτε ρητές είτε σιωπηρές, ότι το περιεχόμενο στον ιστότοπό μας είναι ακριβές, πλήρες ή ενημερωμένο.

Πιθανότατα έχετε συναντήσει τον όρο "token" στις κρυπτογραφικές σας περιπέτειες, ή έχετε ακούσει το Bitcoin και το Ethereum να περιγράφονται ως tokens, αλλά τι σημαίνουν όλα αυτά; Σε αυτό το άρθρο, θα αναλύσουμε τι είναι ένα token, πώς διακρίνεται από ένα νόμισμα και πώς μπορεί να χρησιμοποιηθεί ως εργαλείο αποθήκευσης αξίας.

Ορισμός του Token

Ένα token, στον κόσμο των κρυπτονομισμάτων, αντιπροσωπεύει ένα συγκεκριμένο περιουσιακό στοιχείο ή μια χρησιμότητα. Αξίζει να σημειωθεί ότι οι όροι "token" και "κρυπτονόμισμα" χρησιμοποιούνται συχνά εναλλακτικά, αλλά τεχνικά διαφέρουν. Τα tokens συνήθως εμπίπτουν σε μία από τις ακόλουθες τρεις κατηγορίες:

- Tokens πληρωμών Αυτά τα tokens επιτρέπουν στους χρήστες να αγοράζουν αγαθά και υπηρεσίες εκτός του blockchain, προσφέροντας ένα εναλλακτικό νόμισμα.

- Tokens ασφαλείας Παρόμοια με τις αρχικές δημόσιες προσφορές (IPOs) στο χρηματιστήριο, τα tokens ασφαλείας προσφέρουν στους χρήστες ένα μερίδιο ιδιοκτησίας ή δίνουν στον κάτοχο το δικαίωμα σε μερίσματα σε ένα έργο blockchain.

- Tokens χρησιμότητας Τα tokens χρησιμότητας προσφέρουν στους χρήστες πρόσβαση σε μια υπηρεσία εντός ενός συγκεκριμένου οικοσυστήματος, παρόμοια με τους πόντους πιστότητας σε μια κάρτα Starbucks. Αυτοί οι πόντοι έχουν αξία εντός του δικού τους οικοσυστήματος αλλά δεν μπορούν να χρησιμοποιηθούν εκτός αυτού.

Νομίσματα vs Tokens

Μπαίνοντας σε πιο τεχνικές λεπτομέρειες, όταν εξετάζουμε τα νομίσματα έναντι των tokens, τα tokens κατηγοριοποιούνται ως κρυπτογραφικά περιουσιακά στοιχεία που έχουν δημιουργηθεί πάνω σε ένα άλλο blockchain, ενώ τα νομίσματα έχουν το δικό τους blockchain. Το Ether, για παράδειγμα, είναι το εγγενές token του blockchain Ethereum, ωστόσο, η πλατφόρμα επιτρέπει στους προγραμματιστές να δημιουργούν μια σειρά από πρότυπα tokens πάνω σε αυτό. Με βάση αυτές τις πληροφορίες, όλα τα tokens ERC-20 κατηγοριοποιούνται επομένως ως tokens και όχι ως νομίσματα. Το USD Coin (USDC) και το Tether (USDT) είναι επομένως tokens καθώς είναι χτισμένα πάνω στο blockchain του Ethereum. Ενώ κάθε δίκτυο λειτουργεί από τη δική του ηγεσία, και τα δύο χρησιμοποιούν το blockchain του Ethereum για να διευκολύνουν όλες τις συναλλαγές.

Πώς γίνονται οι συναλλαγές με Tokens;

Όπως και τα νομίσματα, τα tokens μπορούν να αγοραστούν, να πωληθούν και να διαπραγματευτούν σε ανταλλακτήρια, ή να σταλούν απευθείας από ένα πορτοφόλι σε άλλο. Αυτό διευκολύνεται από την τεχνολογία blockchain, με τον ίδιο τρόπο που τα νομίσματα μεταφέρονται από μια τοποθεσία σε άλλη. Σε αντίθεση με τα νομίσματα, που είναι όλα ανταλλάξιμα από τη φύση τους, τα tokens μπορεί μερικές φορές να είναι μη ανταλλάξιμα, που σημαίνει ότι δεν είναι πανομοιότυπα σε αξία και λειτουργία.

Τα tokens αποστέλλονται χρησιμοποιώντας τη διεύθυνση του πορτοφολιού του παραλήπτη που είναι συμβατό με το blockchain. Η διεύθυνση συχνά αναπαρίσταται από ένα barcode σε μορφή QR κωδικού, ή μέσω ενός μακροσκελούς αλφαριθμητικού κωδικού. Όλες οι συναλλαγές πραγματοποιούνται από το πορτοφόλι που κατέχει τα tokens και αποστέλλονται απευθείας στο πορτοφόλι του παραλήπτη χωρίς την ανάγκη για μια κεντρική αρχή όπως μια τράπεζα. Τα tokens μπορούν συνήθως να αγοραστούν σε ανταλλακτήρια, συχνά με Visa ή Mastercard, ή να ανταλλαχθούν μεταξύ χρηστών.

Πώς διαφέρει ένα NFT από ένα Κρυπτονόμισμα;

Τα μη ανταλλάξιμα tokens (NFTs) είναι όλα διαφορετικά μεταξύ τους καθώς αντιπροσωπεύουν ένα πραγματικό αντικείμενο, είτε πρόκειται για ένα ψηφιακό έργο τέχνης είτε για ένα μπουκάλι εκλεκτού κρασιού. Το Bitcoin μπορεί να ανταλλαχθεί με οτιδήποτε σε όλο τον κόσμο, ενώ τα NFTs είναι μοναδικά στη φύση τους και ενώ έχουν αξία, δεν μπορούν να χρησιμοποιηθούν εναλλακτικά.

Για τι χρησιμοποιούνται τα NFTs;

Τα NFTs χρησιμοποιούνται για να αντιπροσωπεύσουν ένα συγκεκριμένο περιουσιακό στοιχείο, είτε φυσικό είτε ψηφιακό. Όταν δημιουργούνται, αυτά τα tokens θα αντιπροσωπεύουν μόνιμα αυτό το περιουσιακό στοιχείο και δεν μπορούν να αλλάξουν. Για παράδειγμα, ένα NFT θα μπορούσε να αντιπροσωπεύει ένα διαμέρισμα στο Λονδίνο ενώ ένα άλλο θα μπορούσε να αντιπροσωπεύει ένα τραγούδι των Kings of Leon. Οι δυνατότητες είναι απεριόριστες, και οι αγορές είναι τεράστιες.

Οι χρήστες μπορούν εύκολα να διαπραγματευτούν NFTs σε αγορές (μέσω ιστοσελίδας ή εφαρμογής για κινητά) όπως το OpenSea ή το Rarible. Μόλις αποκτήσετε ένα NFT, πιστώνεστε με τα δικαιώματα ιδιοκτησίας του περιουσιακού στοιχείου που αντιπροσωπεύει το NFT. Λόγω της φύσης της τεχνολογίας blockchain, αυτό εμφανίζεται μόνιμα στο δημόσιο καθολικό του δικτύου για να το δει οποιοσδήποτε. Αυτή η διαδικασία διασφαλίζει ότι η ιδιοκτησία ενός NFT δεν μπορεί να αλλάξει και οι πληροφορίες είναι διαθέσιμες για οποιονδήποτε να τις πιστοποιήσει.

Σημειώστε ότι αρκετά δίκτυα blockchain υποστηρίζουν επί του παρόντος τη δημιουργία NFTs, και ο κάτοχος θα χρειαστεί ένα πορτοφόλι ειδικό για αυτό το blockchain για να κατέχει το NFT.

Είναι τα Tokens Ρυθμισμένα;

Όσον αφορά τη ρύθμιση, χώρες σε όλο τον κόσμο σχεδιάζουν επί του παρόντος νομικά πλαίσια για την καλύτερη ενσωμάτωση των κρυπτονομισμάτων στο τρέχον οικονομικό μας σύστημα. Αυτό περιλαμβάνει και τα tokens.

Μόλις τα κρυπτονομίσματα ρυθμιστούν από κυβερνητικές αρχές, θα μπορούσαν να προσφέρουν στον κόσμο ανεξερεύνητες περιπτώσεις χρήσης, όπως η διαχείριση μιας συνταγής σε ένα φαρμακείο ή κλινικές υπηρεσίες ή η παροχή ανατροφοδότησης στην υποστήριξη πληροφορικής. Ενώ υπάρχουν πολλά tokens διαθέσιμα στην αγορά σήμερα, είναι πιθανό ότι αυτό είναι μόνο η κορυφή του παγόβουνου όσον αφορά τη δυνατότητά τους να βελτιώσουν ζητήματα που αντιμετωπίζονται σε όλο τον κόσμο.

TAP'S NEWS AND UPDATES

Έτοιμος για το πρώτο βήμα;

Γίνε μέρος της νέας γενιάς έξυπνων επενδυτών και όσων ξέρουν να διαχειρίζονται το χρήμα. Ξεκλείδωσε νέες δυνατότητες και ξεκίνα το δικό σου μονοπάτι προς την επιτυχία — σήμερα.

Ξεκίνα τώρα