Learning the friendly way

Dive into our resources, guides, and articles for all things money-related. Grow your financial confidence with our experts curated tips and articles for both experienced and new investors.

LATEST ARTICLEs

In today's digital-first economy, businesses across all sectors are seeking innovative financial solutions to drive efficiency, enhance customer experiences, and unlock new revenue streams. One compelling strategy is the implementation of co-branded credit cards, which have been shown to significantly boost customer loyalty and spending.

Notably, 75% of financially stable consumers prefer co-branded cards for their rewards and benefits, indicating a strong alignment between these card programs and consumer desires.

By collaborating with financial institutions to offer co-branded cards, businesses can create tailored payment solutions that meet customer expectations and reinforce brand loyalty. This approach transforms the payment infrastructure from a mere operational necessity into a strategic asset that fuels growth.

For instance, the co-branded credit card market is projected to grow from $13.41 billion in 2023 to $25.72 billion by 2030, reflecting a compound annual growth rate (CAGR) of 9.74%.

Whether you're in retail, SaaS, or manufacturing, a tailored card program could be the key to transforming how your business engages with customers—and how you scale.

What is card program management?

Card program management encompasses the end-to-end process of designing, implementing, and optimising payment card solutions tailored to your business. From corporate expense cards that streamline internal processes to branded payment cards that enhance customer loyalty, these programs offer versatility that can benefit virtually any organisation looking to modernise its financial operations.

As businesses continue to navigate increasingly complex markets, those equipped with flexible financial tools gain a significant competitive advantage. The right card program doesn't just process payments—it generates valuable data, reduces administrative burden, and creates opportunities for deeper engagement with both employees and customers.

Why it matters

At its core, card program management involves overseeing all aspects of a payment card ecosystem—from issuing and distribution to transaction processing, reporting, and compliance. Modern card program management platforms provide businesses with the infrastructure to create customised payment solutions while maintaining visibility and control.

This matters because traditional payment methods often create friction points that slow business growth. Manual expense reporting, limited payment visibility, and rigid financial systems can drain resources and limit innovation.

However, a well-managed card program addresses these pain points by automating processes, enhancing security, and providing greater flexibility.

Key benefits for businesses across sectors

Streamlined operations

Card programs dramatically reduce administrative overhead by automating expense tracking, simplifying reconciliation, and eliminating paper-based processes. This operational efficiency translates directly to cost savings and allows your team to focus on strategic initiatives rather than transaction management.

Enhanced Customer Experience

For businesses that implement customer-facing card programs, the benefits extend to experience enhancement. Branded payment cards can strengthen loyalty, while instant issuance capabilities meet modern expectations for immediacy.

From hospitality to healthcare, organisations are using card programs to differentiate their service offerings.

Data-driven insights

Perhaps the most overlooked advantage of modern card program management is the wealth of data it generates. Every transaction becomes a data point that can inform business decisions, reveal spending patterns, and identify opportunities for optimisation. This business intelligence becomes increasingly valuable as programs scale.

Scalability and flexibility

As your business grows, your card program can evolve alongside it. Whether you're expanding into new markets or adding new product lines, a well-designed card program adapts to changing requirements without requiring complete system overhauls.

The implementation process simplified

Implementing a card program doesn't have to be overwhelming. The process typically follows these key steps:

- Assessment and strategy development: Evaluate your current payment ecosystem and define clear objectives for your card program.

- Platform selection and integration: Choose a card program management solution that aligns with your technical requirements and business goals, then integrate it with your existing systems.

- Program launch and optimisation: Deploy your program with proper training and support, then continuously refine based on performance data and user feedback.

Real-World Impact

Across industries, businesses are leveraging card program management to solve specific challenges:

- Retail companies are implementing instant digital card issuance to capture sales opportunities.

- Healthcare providers are using specialised payment cards to simplify patient financial assistance.

- Manufacturing firms are deploying corporate card programs with custom spending controls to streamline procurement.

The common thread? Each organisation is using card program management as a strategic tool rather than just a payment method.

How Tap can help

Navigating the complexities of card program management requires expertise and the right technology partner. Tap's comprehensive platform brings together cutting-edge technology with industry-specific knowledge to help businesses design, implement, and optimise card programs that deliver measurable results.

Our solution addresses common challenges like regulatory compliance, security concerns, and integration complexities, allowing you to focus on the strategic benefits rather than implementation hurdles.

Ready to explore how card program management could transform your business operations and drive growth? Connect with Tap's team of specialists for a personalised consultation and discover the potential of a tailored card program for your organisation.

Article Framework: Card Program Management

Tone & Perspective

- Tone: Professional, informative, and authoritative.

- Perspective: Written from an expert viewpoint, educating businesses on launching and managing a successful card program.

Priority Headings & Structure

1. Introduction

- What is card program management?

- Why businesses need effective card program management.

- Overview of key stakeholders (issuers, networks, processors, etc.).

2. How Card Program Management Works

- Key components: issuing, processing, compliance, and risk management.

- The role of a program manager (self-managed vs. outsourced).

- The relationship between issuing banks, networks, and program managers.

3. Core Elements of a Successful Card Program

- Program Design: Choosing card types (prepaid, debit, credit), network selection (Visa, Mastercard), and branding.

- Issuance & Account Management: BIN sponsorship, account setup, and customer onboarding.

- Compliance & Risk Management: KYC, AML, PCI DSS, and fraud prevention strategies.

- Transaction Processing & Settlement: How funds flow through the ecosystem.

- Customer Experience & Support: Ensuring smooth cardholder interactions.

4. Self-Managed vs. Partner-Managed Card Programs

- Benefits and challenges of managing in-house.

- When outsourcing makes sense.

- How third-party program managers add value.

5. Key Considerations Before Launching a Card Program

- Business goals and revenue model.

- Regulatory and security requirements.

- Time-to-market considerations.

6. Trends & Future of Card Program Management

- Embedded finance & BaaS (Banking-as-a-Service).

- AI-driven fraud detection and risk management.

- Open banking and API-driven solutions.

7. Conclusion & Next Steps

- Recap of key insights.

- How businesses can get started with a card program.

- Contact a program management expert.

Fini les galères de solde au moment de payer. Activez une fois l’Auto Recharge, et votre carte Tap se recharge toute seule quand le solde est bas — avec vos euros ou même vos cryptos. Tranquille.

Vous nous l’avez demandée, on l’a fait. Cette nouvelle option est là pour vous simplifier la vie. Votre carte reste toujours prête, et vous pouvez penser à autre chose (comme à ce que vous allez commander ce midi 🍟).

Cerise sur le gâteau 🍒 : vous pouvez recharger avec vos cryptos.

Choisissez une de vos cryptos, rechargez, dépensez — aussi simple que ça.

Pourquoi vous allez l'adorer

Plus jamais de “solde insuffisant” 🙃

Votre carte se recharge toute seule, pile au bon moment.

Vous l’activez une fois, et c’est tout.

Plus besoin d’y penser, Tap s’occupe du reste.

Fiat, crypto, ou les deux.

C’est vous qui choisissez.

Toujours prêt à payer.

En ligne, en voyage, pour les courses— votre carte suit le rythme.

Comment ça marche ? ✨

C’est vous qui décidez :

- Du montant minimum avant déclenchement

- De combien recharger

- De la devise à utiliser

Comment l’activer ?

- Ouvrez l’app Tap

- Allez dans la section Carte

- Activez l’Auto Recharge

- Réglez vos préférences

Toujours là quand vous en avez besoin

L'auto recharge, c’est un coup de pouce pour votre quotidien. Moins de gestion, plus de tranquillité. Votre carte Tap s’adapte à votre rythme.

Besoin d’aide ? Notre équipe support est dispo pour vous aider à tout configurer.

Bitcoin and Ethereum dominate headlines, but they represent just one approach to distributed ledger technology. While most projects iterate on blockchain's foundational concepts, Hedera Hashgraph (HBAR) takes a different approach, pursuing an entirely different architectural philosophy.

The result is a network engineered for enterprise-grade performance - processing thousands of transactions per second with deterministic fees and minimal energy consumption. Where many blockchain networks struggle with the scalability trilemma, Hedera's hashgraph consensus mechanism offers a compelling alternative that doesn't sacrifice security for speed.

What distinguishes Hedera in practice is its enterprise adoption trajectory. Major corporations across finance, healthcare, and supply chain management have moved beyond pilot programs to production deployments. This isn't theoretical adoption - it's measurable network activity from organizations with serious compliance and performance requirements.

Hedera has positioned itself as one of the most corporate-friendly distributed ledger technologies (DLTs) available today. But how exactly does it work, and why does it stand apart from the blockchain crowd?

The Basics: What Is Hedera Hashgraph?

Launched in 2018, Hedera Hashgraph is a distributed ledger technology that offers a genuine alternative to blockchain architecture. Instead of organizing transactions into sequential blocks like a digital filing cabinet, Hedera uses a directed acyclic graph (DAG) structure called the hashgraph. Think of it more like a web of interconnected transactions.

This design allows multiple transactions to be processed in parallel rather than waiting in a single-file line. The result? Hedera can handle over 10,000 transactions per second (TPS) with finality in just a few seconds, while Bitcoin manages about 6–8 TPS and Ethereum handles 12–15 TPS.

At its core, Hedera is engineered to tackle three persistent challenges that have plagued distributed ledger technology:

- Transactions settle in seconds, not the minutes or hours you might wait with other networks. This makes it possible to build applications where timing actually counts.

- Scalability without the usual trade-offs, The network can handle thousands of transactions simultaneously without slowing down or getting expensive when things get busy. Most blockchains struggle with this balancing act.

- Energy use that makes sense, unlike networks that consume as much electricity as small countries, Hedera runs efficiently enough that companies don't have to justify massive energy bills to their boards.

How Hedera Works: Gossip and Virtual Voting

Hedera's performance stems from its unique consensus mechanism, which combines two clever innovations that work together like a well-orchestrated dance.

Instead of broadcasting every transaction to the entire network simultaneously (imagine shouting news in a crowded room), nodes "gossip" by randomly sharing information with a few neighbors. Those nodes then pass it along to their neighbors, creating a ripple effect. Over time, the entire network organically learns about every transaction without the communication overhead. That is known as the “gossip-about-gossip protocol”.

Virtual voting is where things get interesting: once all nodes have the same historical record of gossip, they can independently calculate how the network would vote on each transaction. No actual vote messages need to be sent across the network. The outcome is mathematically deterministic based on the gossip history, saving significant time and bandwidth.

Together, these methods achieve asynchronous Byzantine fault tolerance (aBFT), which represents one of the highest levels of security available in distributed systems. This means the network can reach consensus and continue operating even if up to one-third of nodes act maliciously or fail completely.

Governance: The Hedera Council

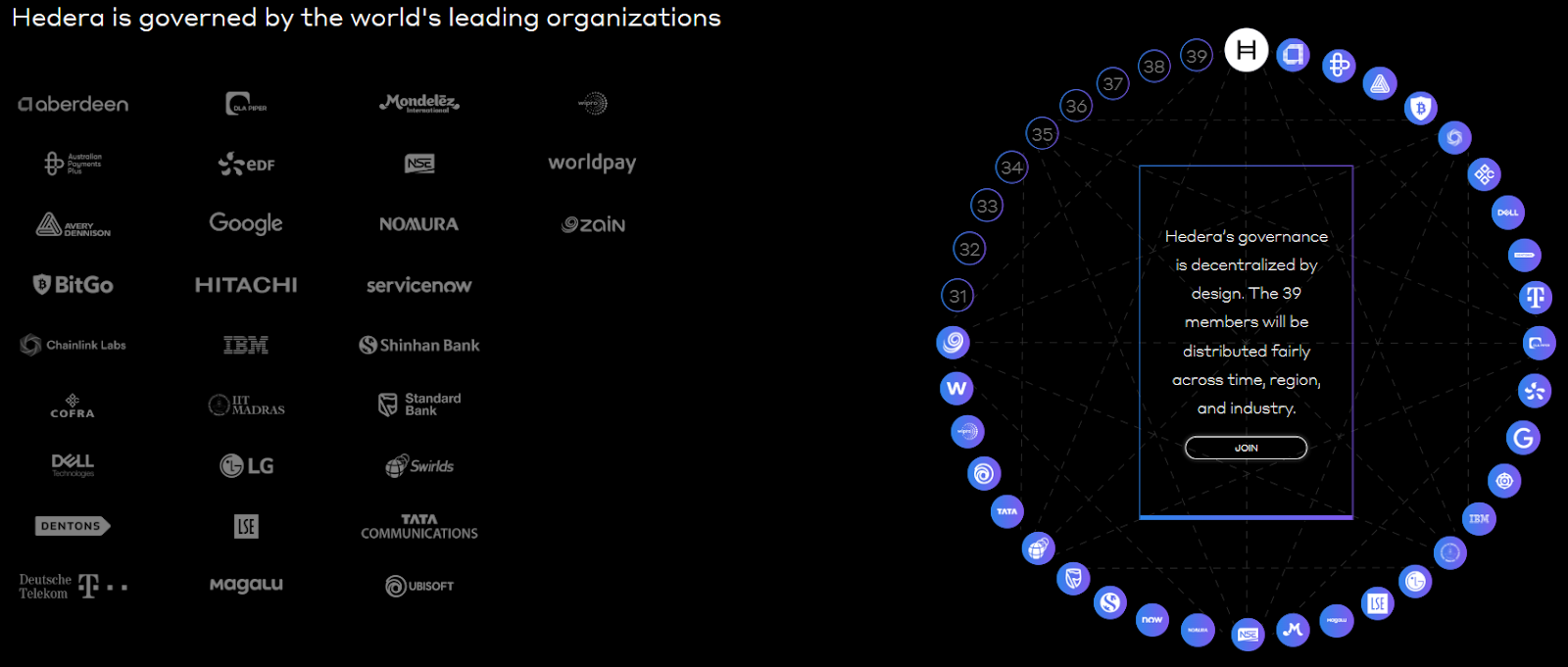

Perhaps the most controversial, and arguably the most distinctive, aspect of Hedera is its governance model. Instead of leaving critical network decisions to anonymous miners or distributed token holders, Hedera operates under a Governing Council of up to 39 well-known global organizations.

Current members include companies like Google, IBM, Dell, Boeing, Standard Bank, Ubisoft, and other established corporations. Each council member holds an equal vote on network decisions, including software upgrades, fee structures, and treasury management.

The rationale is straightforward: provide stability, accountability, and long-term strategic planning. However, this structure has sparked ongoing debate within the crypto community. Critics argue it reduces decentralization compared to blockchain networks where theoretically anyone can participate in governance, while supporters contend it offers the predictability that many enterprises require for serious adoption.

Key Services of Hedera

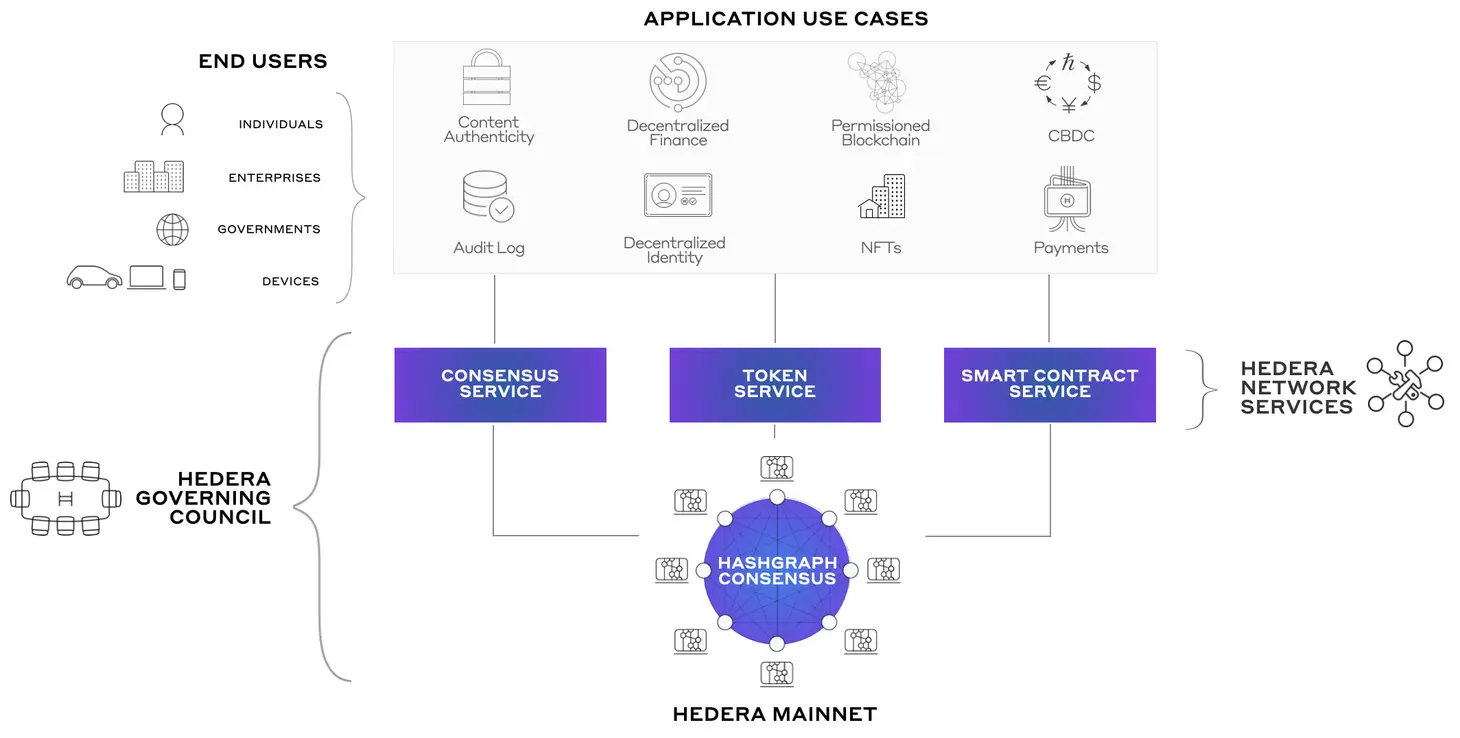

Hedera functions as more than just a payment network. The platform offers three core services that developers and enterprises can leverage to build decentralized applications:

Hedera Consensus Service (HCS): Provides secure, immutable logs of events and data. This proves particularly valuable for supply chain tracking, regulatory audits, and maintaining data integrity in heavily regulated industries like healthcare and finance.

Hedera Token Service (HTS): Enables the creation and management of various token types, including stablecoins, NFTs, and tokenized assets. Built-in features like account-level controls and compliance tools make it especially appealing for enterprises that need to meet regulatory requirements.

Hedera Smart Contract Service (HSCS): Supports Ethereum-compatible smart contracts, allowing developers to build DeFi applications, games, and automation tools while benefiting from Hedera's superior speed and substantially lower transaction fees.

Real-World Applications

Hedera's enterprise-focused approach has translated into practical implementations across multiple sectors:

- Finance: Standard Bank leverages Hedera's infrastructure for faster, more transparent cross-border payment processing.

- Supply chain: Companies like Suku and Avery Dennison use Hedera for product traceability and logistics management, providing end-to-end visibility.

- Healthcare: Safe Health Systems employs the network to securely log medical and clinical trial data while maintaining strict patient privacy standards.

- Gaming: Animoca Brands integrates Hedera's technology to create fair and tamper-proof in-game economies and digital asset management.

- Sustainability: Environmental organizations use Hedera's consensus service to track carbon credits and monitor environmental impact data with immutable records.

These implementations highlight Hedera's positioning as an enterprise-focused platform, creating a distinct contrast to networks that primarily serve DeFi protocols or retail trading activities.

Understanding HBAR: The Native Token

Like most distributed ledger technologies, Hedera operates with its own native cryptocurrency: HBAR. The token serves two fundamental purposes within the ecosystem:

- Network fuel: HBAR is required to pay transaction fees and access network services, including consensus operations, tokenization features, and smart contract execution.

- Network security: Node operators stake HBAR tokens to participate in consensus and help secure the network infrastructure.

One of Hedera's most practical advantages lies in its cost structure. A typical transaction costs approximately $0.0001, it’s economical enough to enable microtransactions and machine-to-machine payment scenarios that would be prohibitively expensive on other networks.

The total supply of HBAR is capped at 50 billion tokens. The distribution follows a controlled release schedule designed to avoid sudden market flooding while ensuring adequate liquidity for network operations.

How Hedera Compares to Other Networks

To understand Hedera's market position, it's helpful to consider how it stacks up against established blockchain models:

Proof-of-Work (PoW), exemplified by Bitcoin, is highly secure and battle-tested, but notoriously slow and energy-intensive.

Proof-of-Stake (PoS), used by Ethereum 2.0, is more energy-efficient than PoW, but can lead to wealth concentration among large token holders.

Lastly, Hedera Hashgraph uses gossip protocols and virtual voting to achieve speed, security, and efficiency simultaneously, while operating under corporate governance rather than anonymous network participants.

The trade-off is crystal-clear. Hedera prioritizes corporate trust, performance, and regulatory clarity, while accepting criticism that it may sacrifice some degree of decentralization compared to traditional blockchain networks.

The Challenges Ahead

Despite its technical strengths and enterprise adoption, Hedera faces some hurdles that could impact its long-term trajectory. The Governing Council model continues to raise questions about whether Hedera represents genuine decentralization or simply distributed corporate control, a debate that matters deeply to the broader crypto community's acceptance. Meanwhile, established networks like Solana, Avalanche, and Ethereum maintain their dominance over ecosystem development, making it challenging for Hedera to attract the vibrant developer communities that drive innovation.

The platform also faces an adoption challenge. While it excels in enterprise use cases, Hedera could broaden its appeal beyond corporate applications to achieve the kind of recognition that sustains long-term growth. Moreover, like all cryptocurrency projects, Hedera must navigate evolving regulatory frameworks across multiple jurisdictions, each with their own compliance requirements and restrictions.

Nevertheless, Hedera's focus on performance, enterprise-grade reliability, and regulatory compliance could provide resilience in certain market conditions where other projects would struggle to maintain institutional confidence.

HBAR ETF on the Horizon

Over the past several months, talk of a potential HBAR ETF has gained traction. An ETF would offer institutional and retail investors exposure to HBAR without needing to manage wallets, private keys, or direct custody. That kind of access lowers the entry-level barrier. Moreover, SEC approval of a Hedera ETF would imply a level of oversight, due diligence, and compliance that can help reduce perceived risks among cautious or regulated investors. It puts HBAR closer to the realm of mainstream finance instruments.

The U.S. Securities and Exchange Commission (SEC) recently pushed back the decision on the Canary HBAR ETF to November 8. The ETF was proposed by Nasdaq back in February; the SEC has delayed the decision twice already. Despite the most recent delay, however, market analysts remain optimistic. Bloomberg’s analysts, for instance, maintain a 90% likelihood of ETF approval in the near term.

The Future of Hedera

Hedera stands out in a crowded field by taking a completely different approach than most blockchain projects. Instead of following the usual playbook, they built something that actually works for businesses: fast transactions, costs you can predict, and energy usage that won't make your CFO cringe.

The real test isn't whether Hedera can keep doing what it's doing well. It's whether they can stay relevant as the whole distributed ledger world keeps evolving at breakneck speed. But here's the thing: while everyone else was busy trying to be the next Bitcoin, Hedera quietly built something that Fortune 500 companies actually want to use.

Whether that bet pays off long-term is anyone's guess. What's not up for debate is that they've proven there's more than one way to build a distributed ledger, and sometimes the road less traveled leads somewhere pretty interesting.

Why can't a fully compliant, regulated crypto business secure a bank account in 2025?

If you're operating in this space, you already know the answer. You've lived through it. You've submitted the documentation, walked through your AML procedures, and demonstrated your regulatory compliance… only to be rejected. Or worse still, waking up to find your existing account frozen, with no real explanation and no path forward.

This isn't about isolated cases or bad actors being weeded out. It's a pattern of systematic risk aversion that's creating real barriers to growth across the entire sector, and it's throttling one of the most significant financial innovations of our generation.

We're Tap, and we're building the infrastructure that traditional banks refuse to provide.

The Economics Behind the Blockade

Let's examine what's actually driving this exclusion, because it's rarely about the reasons banks cite publicly.

The European Banking Authority has explicitly warned against unwarranted de-risking, noting it causes "severe consequences" and financial exclusion of legitimate customers. Yet the practice continues, driven by two fundamental economic pressures that have nothing to do with your business's actual risk profile.

The compliance cost calculation

Financial crime compliance across EMEA costs organizations approximately $85 billion annually. For traditional banks, the math is simple: serving crypto businesses requires specialized expertise, enhanced monitoring, and ongoing due diligence. As a result, it's cheaper to reject the entire sector than to build the infrastructure needed to serve it properly.

The regulatory capital burden

New EU regulations impose a 1,250% risk weight on unbacked crypto assets such as Bitcoin and Ethereum. This isn't a compliance requirement; it's a capital penalty that makes crypto exposure commercially unviable for traditional institutions, regardless of the actual risk individual clients present.

In the UK, approximately 90% of crypto firm registration applications have been rejected or withdrawn, often citing inadequate AML controls. Whether those assessments are accurate or not, they've created the perfect justification for blanket rejection policies.

The result? Compliant businesses are being treated the same as bad actors; not because of what they've done, but because of the sector they're in.

The Real Cost of Financial Exclusion

Financial exclusion isn’t just an hiccup; it creates tangible operational barriers that ripple through every part of running a crypto business.

Firms that have secured MiCA authorization, built robust compliance programs, and met regulatory requirements can find themselves locked out of basic banking services. Essential fiat on-ramps and off-ramps remain inaccessible, slowing payments, limiting growth, and complicating cash flow management.

Individual cases illustrate the problem vividly as well. Accounts are closed because a business receives a payment from a regulated exchange. Others are dropped with vague references to “commercial decisions,” offering no substantive justification. Founders frequently struggle to separate personal and business finances, as both are considered too risky to serve.

The irony is striking. By refusing service to compliant businesses, traditional banks aren’t mitigating risk; they’re amplifying it. Forced to operate through less regulated channels, these legitimate firms face higher operational and compliance risks, slower transactions, and reduced investor confidence. Over time, this slows innovation, and raises the cost of doing business for firms that are legally and technically sound.

Debanking Beyond Europe: U.S. Crypto Firms Face Their Own Challenges

Limited access to banking services isn’t exclusive to Europe. Leading firms in the U.S. crypto industry have faced numerous challenges regarding the banking blockade. Alex Konanykhin, CEO of Unicoin, described repeated account closures by major banks such as Citi, JPMorgan, and Wells Fargo, noting that access was cut off without explanation. Unicoin’s experience echoes a broader sentiment among crypto executives who argue that traditional financial institutions remain wary of digital asset businesses despite recent policy shifts toward a more pro-innovation stance.

Jesse Powell, co-founder of Kraken, has also spoken out about being dropped by long-time banking partners, calling the practice “financial censorship in disguise.” Caitlin Long, founder of Custodia Bank, recounted how her institution was repeatedly denied services. Gemini founders Tyler Winklevoss and Cameron Winklevoss shared similar frustrations.

These experiences reveal a pattern many in the industry interpret as systemic risk aversion. Even in a market as large and mature as the United States, crypto-focused businesses continue to encounter obstacles in maintaining basic financial infrastructure. The issue became especially acute after the collapse of crypto-friendly banks such as Silvergate, Signature, and Moonstone; institutions that once served as key bridges between fiat and digital assets. Their exit left a gap few traditional players have been willing to fill.

Why Tap Exists

The crypto industry has reached an inflection point. Regulatory frameworks like MiCA are providing clarity. Institutional adoption is accelerating. The technology is proven and tested. But the fundamental infrastructure gap remains: access to business banking that actually works for digital asset businesses.

This is precisely why we built Tap for Business.

We provide business accounts with dedicated EUR and GBP IBANs specifically designed for crypto companies and businesses that interact with digital assets. This isn't a side offering or an experiment, it's our core focus.

Our approach is straightforward

We built our infrastructure for this sector

Rather than retrofitting traditional banking systems to reluctantly accommodate crypto businesses, we designed our compliance, monitoring, and operational frameworks specifically for digital asset flows. This means we can properly assess and serve businesses that others automatically reject.

We price in the actual risk, not the sector

Blanket rejection policies exist because they're cheap and simple. We take a different approach: evaluating each business based on their actual controls, compliance posture, and operational reality. It costs more, but it's the only way to serve this market properly.

We're committed to sector normalization

Every time a legitimate crypto business is forced to operate without proper banking infrastructure, it reinforces outdated stigmas. By providing professional financial services to compliant businesses, we're helping demonstrate what should be obvious: crypto companies can and should be served by the financial system.

It isn't about taking on risks that others won't. It's about properly evaluating risks that others refuse to understand.

Moving Forward

The industry is maturing. Regulatory clarity is emerging. Institutional adoption is accelerating. But you can't put your business on hold while traditional banks slowly catch up to reality.

That's not sustainable in the long run.

As a firm, you shouldn't have to beg for a bank account. You shouldn't have to downplay your crypto operations just to access basic financial services. And you certainly shouldn't have to accept that systematic exclusion with little to no explanation other than “It’s just how things are."

The crypto sector is building the future of finance. Your banking partner should believe in that future too. If you're ready to work with financial infrastructure built for your business, not in spite of it, here we are.

Talk today with one of our experts to understand how we can help your business access the banking infrastructure you need.

Classée parmi les cinq premières cryptomonnaies mondiales, Tether a su s’imposer comme la référence des stablecoins. Avec l’un des volumes d’échange les plus élevés chaque jour, elle occupe une place incontournable dans l’écosystème crypto. Plongeons ensemble dans les coulisses de cette monnaie numérique pas comme les autres.

Depuis l’émergence de l’argent numérique, son utilisation s’est considérablement développée, tout comme les débats autour des risques potentiels de ce nouveau modèle. Là où certains investisseurs traditionnels pointent du doigt la volatilité des cryptomonnaies, d’autres y voient une formidable opportunité. Dans de nombreuses régions du monde, l’accès aux services financiers est devenu beaucoup plus simple : une simple connexion internet suffit, là où les processus bancaires classiques sont souvent longs et contraignants.

En matière de sécurité et de transparence, les monnaies numériques viennent répondre à des problématiques que l’on retrouve dans les marchés traditionnels. Si certains qualifient encore le Bitcoin et les cryptos en général de "risqués" ou de "bulle", ces nouvelles solutions ont pourtant permis de moderniser des systèmes anciens, parfois dépassés.

Tether (USDT), c’est quoi exactement ?

Tether (USDT) est une cryptomonnaie adossée au dollar américain, que l’on appelle plus couramment un stablecoin. Les stablecoins sont conçus pour refléter la valeur d’une devise ou d’une matière première, dans ce cas précis à un ratio de 1:1 avec le dollar US.

Lancé en 2014 sous le nom de Realcoin, Tether est en fait le tout premier stablecoin au monde. Initialement hébergé sur le protocole Omni Layer de la blockchain Bitcoin, il est aujourd’hui compatible avec de nombreuses blockchains, telles qu’Ethereum, TRON, EOS, Algorand, Solana ou encore OMG Network.

Pour garantir la stabilité de sa valeur, Tether s’appuie sur des réserves équivalentes à la quantité de tokens en circulation. Ces réserves sont constituées d’une combinaison de billets de trésorerie, dépôts, espèces, opérations de pension livrée et bons du Trésor. Bien que des débats aient parfois émergé quant à la transparence de ces réserves, cela n’a pas freiné la popularité croissante de Tether.

L’objectif principal de Tether est clair : proposer un actif numérique stable qui exploite la puissance de la blockchain, tout en évitant les fortes fluctuations que l’on observe souvent sur les marchés des cryptomonnaies. Pour en savoir plus en détail sur le fonctionnement de Tether, n’hésitez pas à consulter leur site officiel.

Quelle est la valeur de Tether (USDT) ?

Contrairement à la majorité des cryptos dont la valeur dépend de l’offre et de la demande, les stablecoins sont rattachés à une devise ou une matière première de référence. Leur prix reste donc aligné avec celui de la valeur sous-jacente, en général selon un ratio 1:1. Dans le cas de Tether, cela signifie que sa valeur correspond à celle du dollar américain.

Même si sa valeur est constante, il est intéressant de noter que Tether figure parmi les cryptomonnaies les plus échangées au monde, témoignant de son rôle central sur le marché.

Qui est à l’origine de Tether ?

Comme évoqué plus tôt, Tether a vu le jour en 2014 sous le nom de Realcoin, grâce à l’initiative de Brock Pierce (investisseur Bitcoin), Reeve Collins (entrepreneur) et Craig Sellars (développeur). Rebaptisé ensuite USTether, le token a finalement adopté le nom que l’on connaît aujourd’hui : USDT.

Ces trois cofondateurs ont chacun une expérience solide dans l’univers des cryptos et sont impliqués dans plusieurs projets blockchain. Leur société a d’ailleurs élargi sa gamme de stablecoins pour répondre aux besoins de différents marchés, en lançant notamment un Tether adossé à l’euro (EURT), au yuan chinois (CNHT), ou encore à l’or (XAUT).

Comment fonctionne Tether ?

Tether n’a pas sa propre blockchain dédiée. À la place, il fonctionne comme un token de seconde couche, hébergé sur des blockchains déjà établies comme Bitcoin, Ethereum, EOS, Tron, Algorand, Bitcoin Cash ou encore OMG.

USDT s’utilise donc comme toute autre cryptomonnaie : il est stocké dans des portefeuilles compatibles avec la blockchain sur laquelle il est émis. Petite précision importante : il n’est pas possible de transférer des USDT émis sur Ethereum vers un portefeuille basé sur Tron, par exemple. Les transactions doivent rester sur la même blockchain pour éviter toute perte de fonds.

Chaque token USDT en circulation est censé être couvert par un montant équivalent en réserves, sous forme de dollars américains ou d’autres équivalents liquides et actifs financiers. Grâce à cette structure, Tether offre aux utilisateurs une stabilité dans un environnement de marché souvent imprévisible. Il permet notamment de réaliser des échanges en dollars, que ce soit à l’échelle locale ou internationale, sans craindre les variations de prix. C’est aussi un outil précieux pour ceux qui souhaitent limiter l’exposition aux baisses brutales des marchés.

Qu’est-ce que l’USDT ?

USDT est donc un stablecoin rattaché au dollar américain, avec un ratio de 1:1. Sous la marque Tether, il est aujourd’hui le stablecoin le plus utilisé dans le monde. Il n’existe pas de limite fixe d’émission, et on comptait environ 72,5 milliards de tokens en circulation au moment de la rédaction de cet article.

USDT offre un refuge numérique pour ceux qui souhaitent conserver la valeur de leurs actifs sans passer par la conversion en monnaie fiduciaire, en particulier lors des périodes de forte volatilité sur les marchés.

Comment acheter des USDT ?

Si vous souhaitez intégrer Tether (USDT) à votre portefeuille crypto, rien de plus simple. Via l’application mobile Tap, après avoir complété une vérification KYC, vous aurez accès à de nombreux marchés crypto et pourrez stocker vos actifs numériques dans des portefeuilles intégrés à l’application.

La technologie blockchain et les cryptomonnaies ouvrent un champ des possibles immense. Grâce à l’application Tap, vous pouvez gérer vos actifs numériques et traditionnels facilement, tout en profitant d’applications concrètes comme la carte Tap, qui vous permet d’effectuer des paiements auprès de plus de 40 millions de commerçants dans le monde.

Polkastarter represents one of the leading decentralised launchpad platforms in the blockchain ecosystem, focused on empowering early-stage crypto projects to raise funds and launch tokens. First launched in December 2020, it has established itself as a prominent player in the Initial DEX Offering (IDO) space, providing a secure and efficient environment for project launches.

The platform has facilitated the launch of over 100 projects, demonstrating its significant impact on the crypto funding landscape. Polkastarter also features a dedicated marketing team, including video production and design, providing support beyond just the technical infrastructure.

TLDR

Multi-chain launchpad: Polkastarter is a decentralised platform that enables crypto projects to conduct token sales and fundraising campaigns across multiple blockchain networks.

Fixed-price swaps: The platform's main offering is its fixed-swap smart contract, which allows projects to easily launch liquidity pools that execute orders at a fixed price, rather than using traditional AMM models.

Cross-chain support: Polkastarter currently supports Ethereum, BNB Chain, Polygon, Celo, and Avalanche, providing flexibility for projects across different ecosystems.

Native token (POLS): POLS serves as the platform's utility token, providing access to IDO participation, governance rights, and various platform benefits.

What is Polkastarter (POLS)?

Polkastarter is a decentralised launchpad platform designed to democratise access to early-stage crypto investments through Initial DEX Offerings (IDOs). The platform serves as a bridge between innovative blockchain projects seeking funding and investors looking for early access to promising tokens.

The platform's core innovation lies in its fixed-swap mechanism, which provides predictable pricing for token sales rather than the variable pricing models used by automated market makers. This approach offers greater transparency and certainty for both projects and investors during token launch events.

Beyond the launchpad functionality, Polkastarter runs an internal incubation and advisory program, bringing together experience and lessons learned from 100+ project launches to nurture and grow Web3 projects, helping to ensure that projects launched on the platform receive proper guidance and support.

The platform takes security seriously by carefully reviewing each project before allowing it to launch. This screening process helps ensure that only legitimate, high-quality projects reach investors, protecting users from scams and poorly developed tokens.

Who created Polkastarter?

Polkastarter was founded in 2020 by Daniel Stockhaus, Tiago Martins, and Miguel Leite. The founding team brought together diverse expertise in business development, technology, and product management to address the growing need for reliable fundraising infrastructure in the decentralised finance space.

Daniel Stockhaus serves as CEO and Co-founder, leading the platform's strategic direction and business development efforts. Under his leadership, the platform has grown from a startup concept to one of the most recognised launchpad platforms in the crypto industry.

The founding team recognised the challenges faced by early-stage crypto projects in accessing capital and the difficulties investors encountered in finding legitimate investment opportunities. Their solution was to create a platform that could serve both sides of this equation while maintaining high standards for security and project quality.

How does Polkastarter work?

Launchpad mechanism

To participate in token launches, users need to hold POLS tokens, with different amounts unlocking various access levels. The more POLS you hold, the better your chances of getting into popular launches and the more you can invest.

Projects set fixed prices for their tokens rather than using changing market prices. This means investors know exactly what they're paying and how many tokens they'll get before they invest.

Multi-chain infrastructure

Polkastarter works across several different blockchains, so projects can pick the one that best fits their needs. Some chains have lower fees, others are faster, and some have different user communities.

Project curation and support

As mentioned above, before any project can launch on Polkastarter, it goes through a thorough review process. The team checks the technology, verifies who's behind the project, and evaluates whether the business makes sense.

Projects also get help with marketing, strategy advice, and technical support to give them the best chance of success both during their launch and afterwards.

What Is POLS?

POLS is the native utility token of the Polkastarter ecosystem, serving a range of functions within the ecosystem:

- Tier access: Users must hold and stake POLS tokens to access different participation tiers in IDO launches, with higher holdings providing better benefits and guaranteed allocations.

- Governance rights: POLS holders can participate in platform governance decisions, voting on proposals that affect the platform's future development and policies.

- Staking rewards: Token holders can stake their POLS to earn rewards while maintaining their tier status for IDO participation.

- Platform fees: POLS can be used to pay for various platform services and may provide discounts on transaction fees.

How can I buy and sell POLS?

POLS tokens are available on Tap, allowing verified users to easily buy, sell, and trade the token. Before investing in POLS, we encourage you to consider how useful the token is on the Polkastarter platform and how much the launchpad space is growing. The token’s value depends largely on the platform’s success and how widely IDO fundraising is adopted.

TAP'S NEWS AND UPDATES

BOOSTEZ VOS FINANCES

Prêt à passer à l’action ? Rejoignez celles et ceux qui prennent une longueur d’avance. Débloquez de nouvelles opportunités et commencez à façonner votre avenir financier.

Commencer