Learning the friendly way

Dive into our resources, guides, and articles for all things money-related. Grow your financial confidence with our experts curated tips and articles for both experienced and new investors.

LATEST ARTICLEs

L’essor d’internet a complètement transformé la manière de gagner sa vie. Que vous cherchiez à arrondir vos fins de mois ou à lancer un vrai business en ligne, les opportunités ne manquent pas.

Des petits boulots ponctuels aux sources de revenus passifs sur le long terme, chacun peut y trouver son compte.

Mais ne vous attendez pas à devenir riche du jour au lendemain (et si quelqu’un vous promet ça, fuyez : c’est sûrement une arnaque).

Avec un peu de méthode, de régularité et de bon sens, il est possible de se construire un revenu durable depuis chez soi.

Voici un tour d’horizon des façons les plus fiables de gagner de l’argent en ligne, certaines sans aucun investissement de départ, d’autres plus orientées long terme. À vous de choisir ce qui correspond à votre temps, vos compétences et vos objectifs.

1. Gagner de l’argent rapidement (peu de compétences, retour immédiat)

Si vous débutez ou avez besoin d’un complément rapide, voici des options simples, accessibles à tous. Ce ne sont pas des revenus fixes, mais c’est un bon point de départ.

Sondages en ligne rémunérés

Des entreprises paient pour connaître votre avis. Aucune compétence nécessaire, juste un peu de temps libre.

Plateformes recommandées : Swagbucks, Branded Surveys, YouGov, Prolific

Gains typiques : entre 0,50 € et 3 € par sondage de 10 à 20 minutes

Astuce : il faut souvent atteindre un seuil (10–20 €) avant de pouvoir retirer l’argent

Être payé pour cliquer, regarder ou chercher

Des micro-tâches comme regarder des vidéos, tester des moteurs de recherche ou répondre à des quiz.

À essayer : Qmee, InboxPounds, Swagbucks

Gains : quelques centimes par tâche, cumulables facilement

Microservices et petites missions

Tâches rapides nécessitant une intervention humaine (entrer des données, faire des recherches, etc.)

Plateformes : Clickworker, Amazon Mechanical Turk, Lionbridge

Rémunération : environ 2 à 10 € de l’heure

Tester des sites ou des applications

Vous donnez votre avis sur l’ergonomie d’un site web ou d’une appli.

Sites : UserTesting, Userlytics, TryMyUI

Rémunération : 8 à 12 € pour 20 minutes

Pré-requis : parler clairement et avoir une bonne connexion internet

Jeux-concours et tirages au sort

Pas garanti, mais certains « compers » gagnent des prix toute l’année (voyages, bons d'achat, tech...).

Conseil : suivez les marques sur les réseaux sociaux et consultez des agrégateurs comme LoquaxTM ou la section « Concours » de MoneySavingExpert.

2. Revenus réguliers avec un peu plus d’effort

Ces méthodes demandent plus de temps ou de compétences, mais peuvent générer un revenu plus stable et plus intéressant.

Rédaction et relecture freelance

La demande explose. Si vous avez une bonne plume, c’est un bon levier.

Pour commencer : Upwork, Intch, Freelancer

Tarifs : débutants 10–20 €/article, expérimentés 30–100 €/heure

Astuce : spécialisez-vous dans un domaine et constituez un portfolio

Vendre des photos ou vidéos

Monétisez vos contenus sur des plateformes comme Shutterstock ou Adobe Stock.

Devenir assistant virtuel (VA)

Aide administrative, gestion d’e-mails, réseaux sociaux, support client, etc.

Rémunération : 8 à 25 €/heure

Atout : des relations à long terme avec les clients

Vendre des produits faits main

Utilisez Etsy, Amazon Handmade ou Folksy pour transformer vos créations en revenus.

Vendre des produits numériques

Pas de stock, marges intéressantes. Exemples : templates Notion, designs Canva, prompts ChatGPT, planners...

Plateformes : Gumroad, Etsy, Creative Market

3. Revenu passif ou évolutif (effort initial élevé, gains sur le long terme)

Ces méthodes demandent un vrai investissement de départ, mais peuvent générer des revenus durables avec peu d’efforts une fois en place.

Dropshipping

Vendez sans stock grâce à Shopify ou WooCommerce.

Marge moyenne : 3 à 7 % après pub

Compétences requises : marketing, relation client

Print-on-demand

Vous créez un design, il est imprimé à la commande (t-shirts, mugs...).

Sites : Printful, Printify, Redbubble, Merch by Amazon

Lancer un blog ou site de niche

Revenus via pubs, liens d’affiliation, contenus sponsorisés, produits numériques.

Comptez 6 à 18 mois pour des résultats significatifs.

Créer et vendre une formation en ligne

Partagez vos connaissances via Udemy, Teachable, Skillshare ou Coursera.

Écrire et publier un ebook

Auto-publiez via Kindle Direct Publishing ou Smashwords. Un bon marketing fait la différence.

Lancer une chaîne YouTube

Monétisation via pubs, abonnements, partenariats et liens affiliés.

4. Astuces pour monétiser ce que vous avez déjà

Et si vous faisiez de l’argent avec ce que vous possédez déjà ?

- Louez votre logement (Airbnb, Booking)

- Louez vos objets (voiture via Turo, matos via Fat Llama, parking via JustPark)

- Vendez ce que vous n’utilisez plus (Facebook Marketplace, Vinted, eBay)

- Utilisez des apps de cashback comme Shoppix, TopCashback, ou même votre carte Tap (jusqu’à 8 % de cashback !)

Ces astuces sont idéales en ville et demandent très peu d’investissement.

À quoi faire attention

Il existe de vraies opportunités en ligne, mais aussi beaucoup d’arnaques.

Méfiez-vous de :

- Promesses de gains rapides sans effort

- Sites qui demandent de l’argent pour commencer

- Schémas pyramidaux ou MLM déguisés

Informez-vous sur vos obligations fiscales

En France, comme au Royaume-Uni, au-delà d’un certain seuil, les revenus doivent être déclarés. Tenez vos comptes à jour et renseignez-vous sur la législation en vigueur.

Lisez les règles des plateformes

Seuils de paiement, frais, délais, méthodes de retrait... prenez toujours le temps de lire les conditions.

Conseils simples pour bien démarrer

Voici 5 astuces pour maximiser vos gains en ligne :

- Utilisez une adresse mail dédiée pour séparer vos activités

- Suivez vos gains avec un tableau Excel ou Google Sheets

- Concentrez-vous sur les plateformes qui paient le mieux

- Commencez petit et développez ce qui fonctionne

- Formez-vous en continu (SEO, rédaction, design, réseaux sociaux…)

Conclusion

Gagner de l’argent en ligne, c’est de la liberté. Mais aussi de la patience. Il n’y a pas de méthode magique, certains réussissent avec un blog, d’autres avec des sondages ou du micro-travail.

Commencez petit, testez, ajustez. Et surtout, soyez prudent, documentez tout et cherchez toujours à apporter de la valeur.

Si vous êtes arrivé jusqu’ici, c’est que vous êtes prêt à prendre le contrôle de votre parcours numérique. Bon courage !

Qu’est-ce qu’Etherscan ?

Etherscan est un explorateur de blockchain gratuit et largement utilisé qui permet à n’importe qui de consulter les transactions effectuées sur le réseau Ethereum. Mais pas seulement : vous pouvez aussi y voir les blocs, les frais de gas, les adresses de portefeuilles, les smart contracts et d’autres données on-chain.

En résumé, Etherscan agit comme un moteur de recherche pour la blockchain Ethereum. Il donne un aperçu clair de l’activité du réseau tout en illustrant les avantages de la transparence propre à cette technologie.

Aucun compte n’est requis pour consulter les données sur Etherscan. Cependant, en créant un compte, vous pouvez accéder à des fonctionnalités supplémentaires comme des alertes sur les transactions entrantes, des outils pour développeurs ou encore des flux de données personnalisés.

Que vous investissiez dans une dapp, suiviez une adresse de portefeuille, ou vérifiiez un dépôt dans un jeu basé sur la blockchain, Etherscan vous permet de visualiser tout cela facilement.

Pourquoi Etherscan est-il si populaire ?

Etherscan est l’explorateur Ethereum le plus utilisé dans l’écosystème crypto. Il est particulièrement apprécié pour sa simplicité et sa fiabilité.

Même s’il ne permet pas de stocker ou d’échanger des tokens, Etherscan offre une vue transparente de l’activité sur Ethereum : transactions, contrats intelligents, frais, historiques… c’est une vraie vitrine de ce qui se passe sur le réseau.

Il permet aussi de mieux comprendre le fonctionnement de la blockchain, et peut aider à repérer des mouvements suspects – comme la vente massive de tokens par un projet ou les déplacements de fonds importants (whales).

Comment utiliser Etherscan

Que vous cherchiez à vérifier une transaction ou à consulter les détails d’un smart contract, Etherscan est là pour ça. Voici comment suivre une transaction.

Comment trouver une transaction sur Etherscan

Comprendre comment suivre une transaction peut s’avérer très utile, notamment pour savoir combien de confirmations elle a reçues ou quels frais ont été payés.

Chaque transaction sur la blockchain est associée à un identifiant unique, appelé TXID ou hash de transaction – l’équivalent numérique d’un numéro d'identité. Cela ressemble à ceci :

0x3349ea4144aed83291f87b3904b02f8f1e76c3b5bfed0d95a000fafddaed01bc

Pour suivre une transaction en temps réel, il vous suffit de copier ce TXID et de le coller dans la barre de recherche sur le site d’Etherscan.

Vous verrez alors tous les détails liés à cette transaction.

Vocabulaire utile sur Etherscan

Voici les principaux termes à connaître lorsque vous consultez une transaction :

- Transaction Hash : identifiant unique de la transaction

- Status : état actuel (en attente, échouée ou réussie)

- Block : numéro du bloc contenant la transaction

- Timestamp : date et heure d’exécution

- From : adresse de l’expéditeur

- To : adresse du destinataire ou du smart contract

- Value : montant transféré

- Transaction Fee : frais de transaction (ou frais de gas)

- Gas Price : coût unitaire du gas au moment de la transaction (en ETH et en Gwei)

Comment trouver les frais de gas sur Etherscan

Lorsque vous interagissez avec le réseau Ethereum, vous devez payer des frais de gas, qui varient en fonction de l’activité sur le réseau.

Etherscan propose un Gas Tracker qui vous montre les prix actuels du gas et l’état de congestion du réseau. Cela peut vous aider à choisir le bon moment pour envoyer une transaction avec des frais optimisés.

En conclusion

Etherscan est un outil indispensable pour tous ceux qui utilisent Ethereum ou des tokens liés à son écosystème. Qu’il s’agisse de confirmer une transaction, d’analyser un contrat ou de consulter les frais de gas, Etherscan vous donne une vue complète et transparente du réseau.

Un incontournable pour mieux comprendre vos opérations et explorer l’univers d’Ethereum en toute clarté.

In today's digital-first economy, businesses across all sectors are seeking innovative financial solutions to drive efficiency, enhance customer experiences, and unlock new revenue streams. One compelling strategy is the implementation of co-branded credit cards, which have been shown to significantly boost customer loyalty and spending.

Notably, 75% of financially stable consumers prefer co-branded cards for their rewards and benefits, indicating a strong alignment between these card programs and consumer desires.

By collaborating with financial institutions to offer co-branded cards, businesses can create tailored payment solutions that meet customer expectations and reinforce brand loyalty. This approach transforms the payment infrastructure from a mere operational necessity into a strategic asset that fuels growth.

For instance, the co-branded credit card market is projected to grow from $13.41 billion in 2023 to $25.72 billion by 2030, reflecting a compound annual growth rate (CAGR) of 9.74%.

Whether you're in retail, SaaS, or manufacturing, a tailored card program could be the key to transforming how your business engages with customers—and how you scale.

What is card program management?

Card program management encompasses the end-to-end process of designing, implementing, and optimising payment card solutions tailored to your business. From corporate expense cards that streamline internal processes to branded payment cards that enhance customer loyalty, these programs offer versatility that can benefit virtually any organisation looking to modernise its financial operations.

As businesses continue to navigate increasingly complex markets, those equipped with flexible financial tools gain a significant competitive advantage. The right card program doesn't just process payments—it generates valuable data, reduces administrative burden, and creates opportunities for deeper engagement with both employees and customers.

Why it matters

At its core, card program management involves overseeing all aspects of a payment card ecosystem—from issuing and distribution to transaction processing, reporting, and compliance. Modern card program management platforms provide businesses with the infrastructure to create customised payment solutions while maintaining visibility and control.

This matters because traditional payment methods often create friction points that slow business growth. Manual expense reporting, limited payment visibility, and rigid financial systems can drain resources and limit innovation.

However, a well-managed card program addresses these pain points by automating processes, enhancing security, and providing greater flexibility.

Key benefits for businesses across sectors

Streamlined operations

Card programs dramatically reduce administrative overhead by automating expense tracking, simplifying reconciliation, and eliminating paper-based processes. This operational efficiency translates directly to cost savings and allows your team to focus on strategic initiatives rather than transaction management.

Enhanced Customer Experience

For businesses that implement customer-facing card programs, the benefits extend to experience enhancement. Branded payment cards can strengthen loyalty, while instant issuance capabilities meet modern expectations for immediacy.

From hospitality to healthcare, organisations are using card programs to differentiate their service offerings.

Data-driven insights

Perhaps the most overlooked advantage of modern card program management is the wealth of data it generates. Every transaction becomes a data point that can inform business decisions, reveal spending patterns, and identify opportunities for optimisation. This business intelligence becomes increasingly valuable as programs scale.

Scalability and flexibility

As your business grows, your card program can evolve alongside it. Whether you're expanding into new markets or adding new product lines, a well-designed card program adapts to changing requirements without requiring complete system overhauls.

The implementation process simplified

Implementing a card program doesn't have to be overwhelming. The process typically follows these key steps:

- Assessment and strategy development: Evaluate your current payment ecosystem and define clear objectives for your card program.

- Platform selection and integration: Choose a card program management solution that aligns with your technical requirements and business goals, then integrate it with your existing systems.

- Program launch and optimisation: Deploy your program with proper training and support, then continuously refine based on performance data and user feedback.

Real-World Impact

Across industries, businesses are leveraging card program management to solve specific challenges:

- Retail companies are implementing instant digital card issuance to capture sales opportunities.

- Healthcare providers are using specialised payment cards to simplify patient financial assistance.

- Manufacturing firms are deploying corporate card programs with custom spending controls to streamline procurement.

The common thread? Each organisation is using card program management as a strategic tool rather than just a payment method.

How Tap can help

Navigating the complexities of card program management requires expertise and the right technology partner. Tap's comprehensive platform brings together cutting-edge technology with industry-specific knowledge to help businesses design, implement, and optimise card programs that deliver measurable results.

Our solution addresses common challenges like regulatory compliance, security concerns, and integration complexities, allowing you to focus on the strategic benefits rather than implementation hurdles.

Ready to explore how card program management could transform your business operations and drive growth? Connect with Tap's team of specialists for a personalised consultation and discover the potential of a tailored card program for your organisation.

Article Framework: Card Program Management

Tone & Perspective

- Tone: Professional, informative, and authoritative.

- Perspective: Written from an expert viewpoint, educating businesses on launching and managing a successful card program.

Priority Headings & Structure

1. Introduction

- What is card program management?

- Why businesses need effective card program management.

- Overview of key stakeholders (issuers, networks, processors, etc.).

2. How Card Program Management Works

- Key components: issuing, processing, compliance, and risk management.

- The role of a program manager (self-managed vs. outsourced).

- The relationship between issuing banks, networks, and program managers.

3. Core Elements of a Successful Card Program

- Program Design: Choosing card types (prepaid, debit, credit), network selection (Visa, Mastercard), and branding.

- Issuance & Account Management: BIN sponsorship, account setup, and customer onboarding.

- Compliance & Risk Management: KYC, AML, PCI DSS, and fraud prevention strategies.

- Transaction Processing & Settlement: How funds flow through the ecosystem.

- Customer Experience & Support: Ensuring smooth cardholder interactions.

4. Self-Managed vs. Partner-Managed Card Programs

- Benefits and challenges of managing in-house.

- When outsourcing makes sense.

- How third-party program managers add value.

5. Key Considerations Before Launching a Card Program

- Business goals and revenue model.

- Regulatory and security requirements.

- Time-to-market considerations.

6. Trends & Future of Card Program Management

- Embedded finance & BaaS (Banking-as-a-Service).

- AI-driven fraud detection and risk management.

- Open banking and API-driven solutions.

7. Conclusion & Next Steps

- Recap of key insights.

- How businesses can get started with a card program.

- Contact a program management expert.

Fini les galères de solde au moment de payer. Activez une fois l’Auto Recharge, et votre carte Tap se recharge toute seule quand le solde est bas — avec vos euros ou même vos cryptos. Tranquille.

Vous nous l’avez demandée, on l’a fait. Cette nouvelle option est là pour vous simplifier la vie. Votre carte reste toujours prête, et vous pouvez penser à autre chose (comme à ce que vous allez commander ce midi 🍟).

Cerise sur le gâteau 🍒 : vous pouvez recharger avec vos cryptos.

Choisissez une de vos cryptos, rechargez, dépensez — aussi simple que ça.

Pourquoi vous allez l'adorer

Plus jamais de “solde insuffisant” 🙃

Votre carte se recharge toute seule, pile au bon moment.

Vous l’activez une fois, et c’est tout.

Plus besoin d’y penser, Tap s’occupe du reste.

Fiat, crypto, ou les deux.

C’est vous qui choisissez.

Toujours prêt à payer.

En ligne, en voyage, pour les courses— votre carte suit le rythme.

Comment ça marche ? ✨

C’est vous qui décidez :

- Du montant minimum avant déclenchement

- De combien recharger

- De la devise à utiliser

Comment l’activer ?

- Ouvrez l’app Tap

- Allez dans la section Carte

- Activez l’Auto Recharge

- Réglez vos préférences

Toujours là quand vous en avez besoin

L'auto recharge, c’est un coup de pouce pour votre quotidien. Moins de gestion, plus de tranquillité. Votre carte Tap s’adapte à votre rythme.

Besoin d’aide ? Notre équipe support est dispo pour vous aider à tout configurer.

Bitcoin and Ethereum dominate headlines, but they represent just one approach to distributed ledger technology. While most projects iterate on blockchain's foundational concepts, Hedera Hashgraph (HBAR) takes a different approach, pursuing an entirely different architectural philosophy.

The result is a network engineered for enterprise-grade performance - processing thousands of transactions per second with deterministic fees and minimal energy consumption. Where many blockchain networks struggle with the scalability trilemma, Hedera's hashgraph consensus mechanism offers a compelling alternative that doesn't sacrifice security for speed.

What distinguishes Hedera in practice is its enterprise adoption trajectory. Major corporations across finance, healthcare, and supply chain management have moved beyond pilot programs to production deployments. This isn't theoretical adoption - it's measurable network activity from organizations with serious compliance and performance requirements.

Hedera has positioned itself as one of the most corporate-friendly distributed ledger technologies (DLTs) available today. But how exactly does it work, and why does it stand apart from the blockchain crowd?

The Basics: What Is Hedera Hashgraph?

Launched in 2018, Hedera Hashgraph is a distributed ledger technology that offers a genuine alternative to blockchain architecture. Instead of organizing transactions into sequential blocks like a digital filing cabinet, Hedera uses a directed acyclic graph (DAG) structure called the hashgraph. Think of it more like a web of interconnected transactions.

This design allows multiple transactions to be processed in parallel rather than waiting in a single-file line. The result? Hedera can handle over 10,000 transactions per second (TPS) with finality in just a few seconds, while Bitcoin manages about 6–8 TPS and Ethereum handles 12–15 TPS.

At its core, Hedera is engineered to tackle three persistent challenges that have plagued distributed ledger technology:

- Transactions settle in seconds, not the minutes or hours you might wait with other networks. This makes it possible to build applications where timing actually counts.

- Scalability without the usual trade-offs, The network can handle thousands of transactions simultaneously without slowing down or getting expensive when things get busy. Most blockchains struggle with this balancing act.

- Energy use that makes sense, unlike networks that consume as much electricity as small countries, Hedera runs efficiently enough that companies don't have to justify massive energy bills to their boards.

How Hedera Works: Gossip and Virtual Voting

Hedera's performance stems from its unique consensus mechanism, which combines two clever innovations that work together like a well-orchestrated dance.

Instead of broadcasting every transaction to the entire network simultaneously (imagine shouting news in a crowded room), nodes "gossip" by randomly sharing information with a few neighbors. Those nodes then pass it along to their neighbors, creating a ripple effect. Over time, the entire network organically learns about every transaction without the communication overhead. That is known as the “gossip-about-gossip protocol”.

Virtual voting is where things get interesting: once all nodes have the same historical record of gossip, they can independently calculate how the network would vote on each transaction. No actual vote messages need to be sent across the network. The outcome is mathematically deterministic based on the gossip history, saving significant time and bandwidth.

Together, these methods achieve asynchronous Byzantine fault tolerance (aBFT), which represents one of the highest levels of security available in distributed systems. This means the network can reach consensus and continue operating even if up to one-third of nodes act maliciously or fail completely.

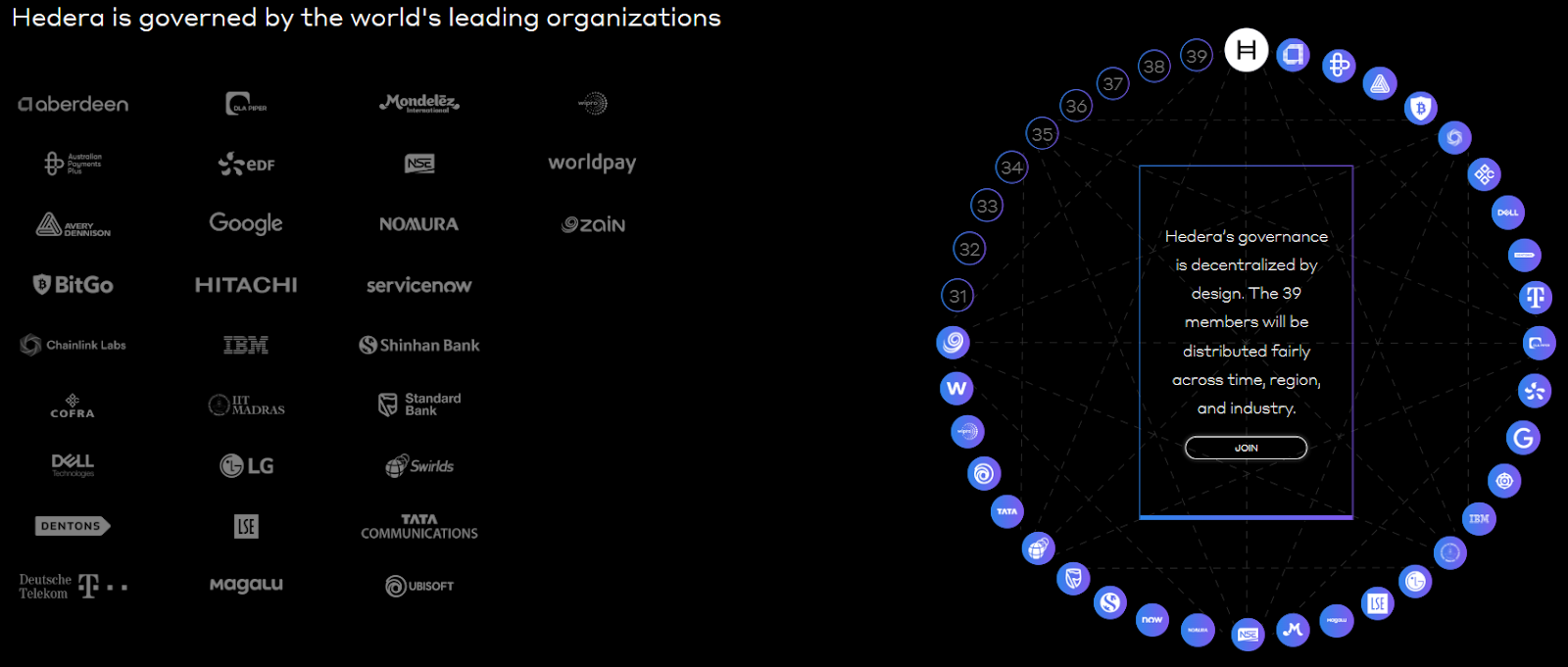

Governance: The Hedera Council

Perhaps the most controversial, and arguably the most distinctive, aspect of Hedera is its governance model. Instead of leaving critical network decisions to anonymous miners or distributed token holders, Hedera operates under a Governing Council of up to 39 well-known global organizations.

Current members include companies like Google, IBM, Dell, Boeing, Standard Bank, Ubisoft, and other established corporations. Each council member holds an equal vote on network decisions, including software upgrades, fee structures, and treasury management.

The rationale is straightforward: provide stability, accountability, and long-term strategic planning. However, this structure has sparked ongoing debate within the crypto community. Critics argue it reduces decentralization compared to blockchain networks where theoretically anyone can participate in governance, while supporters contend it offers the predictability that many enterprises require for serious adoption.

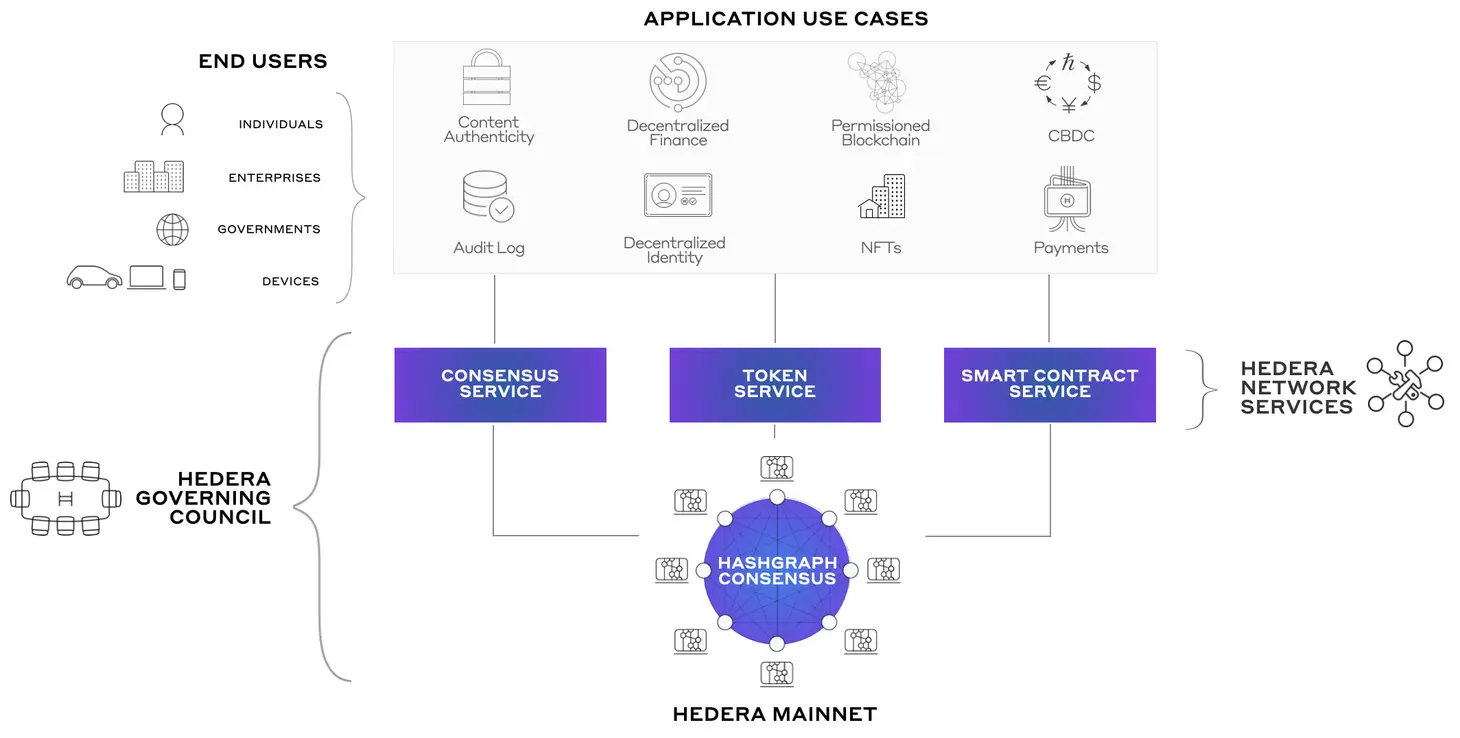

Key Services of Hedera

Hedera functions as more than just a payment network. The platform offers three core services that developers and enterprises can leverage to build decentralized applications:

Hedera Consensus Service (HCS): Provides secure, immutable logs of events and data. This proves particularly valuable for supply chain tracking, regulatory audits, and maintaining data integrity in heavily regulated industries like healthcare and finance.

Hedera Token Service (HTS): Enables the creation and management of various token types, including stablecoins, NFTs, and tokenized assets. Built-in features like account-level controls and compliance tools make it especially appealing for enterprises that need to meet regulatory requirements.

Hedera Smart Contract Service (HSCS): Supports Ethereum-compatible smart contracts, allowing developers to build DeFi applications, games, and automation tools while benefiting from Hedera's superior speed and substantially lower transaction fees.

Real-World Applications

Hedera's enterprise-focused approach has translated into practical implementations across multiple sectors:

- Finance: Standard Bank leverages Hedera's infrastructure for faster, more transparent cross-border payment processing.

- Supply chain: Companies like Suku and Avery Dennison use Hedera for product traceability and logistics management, providing end-to-end visibility.

- Healthcare: Safe Health Systems employs the network to securely log medical and clinical trial data while maintaining strict patient privacy standards.

- Gaming: Animoca Brands integrates Hedera's technology to create fair and tamper-proof in-game economies and digital asset management.

- Sustainability: Environmental organizations use Hedera's consensus service to track carbon credits and monitor environmental impact data with immutable records.

These implementations highlight Hedera's positioning as an enterprise-focused platform, creating a distinct contrast to networks that primarily serve DeFi protocols or retail trading activities.

Understanding HBAR: The Native Token

Like most distributed ledger technologies, Hedera operates with its own native cryptocurrency: HBAR. The token serves two fundamental purposes within the ecosystem:

- Network fuel: HBAR is required to pay transaction fees and access network services, including consensus operations, tokenization features, and smart contract execution.

- Network security: Node operators stake HBAR tokens to participate in consensus and help secure the network infrastructure.

One of Hedera's most practical advantages lies in its cost structure. A typical transaction costs approximately $0.0001, it’s economical enough to enable microtransactions and machine-to-machine payment scenarios that would be prohibitively expensive on other networks.

The total supply of HBAR is capped at 50 billion tokens. The distribution follows a controlled release schedule designed to avoid sudden market flooding while ensuring adequate liquidity for network operations.

How Hedera Compares to Other Networks

To understand Hedera's market position, it's helpful to consider how it stacks up against established blockchain models:

Proof-of-Work (PoW), exemplified by Bitcoin, is highly secure and battle-tested, but notoriously slow and energy-intensive.

Proof-of-Stake (PoS), used by Ethereum 2.0, is more energy-efficient than PoW, but can lead to wealth concentration among large token holders.

Lastly, Hedera Hashgraph uses gossip protocols and virtual voting to achieve speed, security, and efficiency simultaneously, while operating under corporate governance rather than anonymous network participants.

The trade-off is crystal-clear. Hedera prioritizes corporate trust, performance, and regulatory clarity, while accepting criticism that it may sacrifice some degree of decentralization compared to traditional blockchain networks.

The Challenges Ahead

Despite its technical strengths and enterprise adoption, Hedera faces some hurdles that could impact its long-term trajectory. The Governing Council model continues to raise questions about whether Hedera represents genuine decentralization or simply distributed corporate control, a debate that matters deeply to the broader crypto community's acceptance. Meanwhile, established networks like Solana, Avalanche, and Ethereum maintain their dominance over ecosystem development, making it challenging for Hedera to attract the vibrant developer communities that drive innovation.

The platform also faces an adoption challenge. While it excels in enterprise use cases, Hedera could broaden its appeal beyond corporate applications to achieve the kind of recognition that sustains long-term growth. Moreover, like all cryptocurrency projects, Hedera must navigate evolving regulatory frameworks across multiple jurisdictions, each with their own compliance requirements and restrictions.

Nevertheless, Hedera's focus on performance, enterprise-grade reliability, and regulatory compliance could provide resilience in certain market conditions where other projects would struggle to maintain institutional confidence.

HBAR ETF on the Horizon

Over the past several months, talk of a potential HBAR ETF has gained traction. An ETF would offer institutional and retail investors exposure to HBAR without needing to manage wallets, private keys, or direct custody. That kind of access lowers the entry-level barrier. Moreover, SEC approval of a Hedera ETF would imply a level of oversight, due diligence, and compliance that can help reduce perceived risks among cautious or regulated investors. It puts HBAR closer to the realm of mainstream finance instruments.

The U.S. Securities and Exchange Commission (SEC) recently pushed back the decision on the Canary HBAR ETF to November 8. The ETF was proposed by Nasdaq back in February; the SEC has delayed the decision twice already. Despite the most recent delay, however, market analysts remain optimistic. Bloomberg’s analysts, for instance, maintain a 90% likelihood of ETF approval in the near term.

The Future of Hedera

Hedera stands out in a crowded field by taking a completely different approach than most blockchain projects. Instead of following the usual playbook, they built something that actually works for businesses: fast transactions, costs you can predict, and energy usage that won't make your CFO cringe.

The real test isn't whether Hedera can keep doing what it's doing well. It's whether they can stay relevant as the whole distributed ledger world keeps evolving at breakneck speed. But here's the thing: while everyone else was busy trying to be the next Bitcoin, Hedera quietly built something that Fortune 500 companies actually want to use.

Whether that bet pays off long-term is anyone's guess. What's not up for debate is that they've proven there's more than one way to build a distributed ledger, and sometimes the road less traveled leads somewhere pretty interesting.

Why can't a fully compliant, regulated crypto business secure a bank account in 2025?

If you're operating in this space, you already know the answer. You've lived through it. You've submitted the documentation, walked through your AML procedures, and demonstrated your regulatory compliance… only to be rejected. Or worse still, waking up to find your existing account frozen, with no real explanation and no path forward.

This isn't about isolated cases or bad actors being weeded out. It's a pattern of systematic risk aversion that's creating real barriers to growth across the entire sector, and it's throttling one of the most significant financial innovations of our generation.

We're Tap, and we're building the infrastructure that traditional banks refuse to provide.

The Economics Behind the Blockade

Let's examine what's actually driving this exclusion, because it's rarely about the reasons banks cite publicly.

The European Banking Authority has explicitly warned against unwarranted de-risking, noting it causes "severe consequences" and financial exclusion of legitimate customers. Yet the practice continues, driven by two fundamental economic pressures that have nothing to do with your business's actual risk profile.

The compliance cost calculation

Financial crime compliance across EMEA costs organizations approximately $85 billion annually. For traditional banks, the math is simple: serving crypto businesses requires specialized expertise, enhanced monitoring, and ongoing due diligence. As a result, it's cheaper to reject the entire sector than to build the infrastructure needed to serve it properly.

The regulatory capital burden

New EU regulations impose a 1,250% risk weight on unbacked crypto assets such as Bitcoin and Ethereum. This isn't a compliance requirement; it's a capital penalty that makes crypto exposure commercially unviable for traditional institutions, regardless of the actual risk individual clients present.

In the UK, approximately 90% of crypto firm registration applications have been rejected or withdrawn, often citing inadequate AML controls. Whether those assessments are accurate or not, they've created the perfect justification for blanket rejection policies.

The result? Compliant businesses are being treated the same as bad actors; not because of what they've done, but because of the sector they're in.

The Real Cost of Financial Exclusion

Financial exclusion isn’t just an hiccup; it creates tangible operational barriers that ripple through every part of running a crypto business.

Firms that have secured MiCA authorization, built robust compliance programs, and met regulatory requirements can find themselves locked out of basic banking services. Essential fiat on-ramps and off-ramps remain inaccessible, slowing payments, limiting growth, and complicating cash flow management.

Individual cases illustrate the problem vividly as well. Accounts are closed because a business receives a payment from a regulated exchange. Others are dropped with vague references to “commercial decisions,” offering no substantive justification. Founders frequently struggle to separate personal and business finances, as both are considered too risky to serve.

The irony is striking. By refusing service to compliant businesses, traditional banks aren’t mitigating risk; they’re amplifying it. Forced to operate through less regulated channels, these legitimate firms face higher operational and compliance risks, slower transactions, and reduced investor confidence. Over time, this slows innovation, and raises the cost of doing business for firms that are legally and technically sound.

Debanking Beyond Europe: U.S. Crypto Firms Face Their Own Challenges

Limited access to banking services isn’t exclusive to Europe. Leading firms in the U.S. crypto industry have faced numerous challenges regarding the banking blockade. Alex Konanykhin, CEO of Unicoin, described repeated account closures by major banks such as Citi, JPMorgan, and Wells Fargo, noting that access was cut off without explanation. Unicoin’s experience echoes a broader sentiment among crypto executives who argue that traditional financial institutions remain wary of digital asset businesses despite recent policy shifts toward a more pro-innovation stance.

Jesse Powell, co-founder of Kraken, has also spoken out about being dropped by long-time banking partners, calling the practice “financial censorship in disguise.” Caitlin Long, founder of Custodia Bank, recounted how her institution was repeatedly denied services. Gemini founders Tyler Winklevoss and Cameron Winklevoss shared similar frustrations.

These experiences reveal a pattern many in the industry interpret as systemic risk aversion. Even in a market as large and mature as the United States, crypto-focused businesses continue to encounter obstacles in maintaining basic financial infrastructure. The issue became especially acute after the collapse of crypto-friendly banks such as Silvergate, Signature, and Moonstone; institutions that once served as key bridges between fiat and digital assets. Their exit left a gap few traditional players have been willing to fill.

Why Tap Exists

The crypto industry has reached an inflection point. Regulatory frameworks like MiCA are providing clarity. Institutional adoption is accelerating. The technology is proven and tested. But the fundamental infrastructure gap remains: access to business banking that actually works for digital asset businesses.

This is precisely why we built Tap for Business.

We provide business accounts with dedicated EUR and GBP IBANs specifically designed for crypto companies and businesses that interact with digital assets. This isn't a side offering or an experiment, it's our core focus.

Our approach is straightforward

We built our infrastructure for this sector

Rather than retrofitting traditional banking systems to reluctantly accommodate crypto businesses, we designed our compliance, monitoring, and operational frameworks specifically for digital asset flows. This means we can properly assess and serve businesses that others automatically reject.

We price in the actual risk, not the sector

Blanket rejection policies exist because they're cheap and simple. We take a different approach: evaluating each business based on their actual controls, compliance posture, and operational reality. It costs more, but it's the only way to serve this market properly.

We're committed to sector normalization

Every time a legitimate crypto business is forced to operate without proper banking infrastructure, it reinforces outdated stigmas. By providing professional financial services to compliant businesses, we're helping demonstrate what should be obvious: crypto companies can and should be served by the financial system.

It isn't about taking on risks that others won't. It's about properly evaluating risks that others refuse to understand.

Moving Forward

The industry is maturing. Regulatory clarity is emerging. Institutional adoption is accelerating. But you can't put your business on hold while traditional banks slowly catch up to reality.

That's not sustainable in the long run.

As a firm, you shouldn't have to beg for a bank account. You shouldn't have to downplay your crypto operations just to access basic financial services. And you certainly shouldn't have to accept that systematic exclusion with little to no explanation other than “It’s just how things are."

The crypto sector is building the future of finance. Your banking partner should believe in that future too. If you're ready to work with financial infrastructure built for your business, not in spite of it, here we are.

Talk today with one of our experts to understand how we can help your business access the banking infrastructure you need.

TAP'S NEWS AND UPDATES

BOOSTEZ VOS FINANCES

Prêt à passer à l’action ? Rejoignez celles et ceux qui prennent une longueur d’avance. Débloquez de nouvelles opportunités et commencez à façonner votre avenir financier.

Commencer