Learning the friendly way

Dive into our resources, guides, and articles for all things money-related. Grow your financial confidence with our experts curated tips and articles for both experienced and new investors.

Get ready to dive into a captivating fintech saga, where talent, determination, and community support lead us to 200K users!

Keep readingLatest posts

Athens, 09 April 2024

TAP'S ODYSSEY IN GLOBAL EXPANSION: ATHENS, GREECE OFFICES BEGIN OPERATIONS

Taking a significant step that embodies its global expansion goals and steadfast dedication to transforming the financial services industry, Tap is delighted to reveal the launch of its new offices in the historic city of Athens, Greece.

This move serves as a testament to the company's commitment to integrating the wisdom of ancient financial principles with the ingenuity of modern technology. Nestled in the city that birthed democracy, the new office is not just a physical space but a symbol of Tap's resolve to harmonise ancient financial wisdom with the innovations of today's fintech landscape.

This strategic expansion underscores Tap's commitment to democratise and innovate financial solutions across the globe, intertwining with the cultural and economic tapestry of Athens while still remaining true to the core principles that define Tap.

This expansion seamlessly aligns with Tap's global strategy, dedicated to reaching new markets and offering modern financial services to a diverse array of communities. This venture not only propels Tap's international presence but also actively contributes to Athens' economic progression, nurturing local talent, and enriching the city’s financial landscape.

This initiative represents far more than mere expansion; it marks the start of an exciting new chapter for Tap. As Tap embarks on this exciting new chapter, the company remains committed to its core values of innovation, transparency, and customer-centricity. With its presence in Athens, Tap is poised to make a lasting impact on the financial services landscape, empowering individuals and businesses with the tools they need to thrive in an increasingly digital world.

About Tap Global

Tap is a leading fintech company dedicated to making money management and cryptocurrency more accessible and user-friendly across the globe. With a focus on security, compliance, and user-friendliness, Tap offers a wide range of digital assets and innovative features to empower cryptocurrency enthusiasts. For more information, visit www.withtap.com.

Gear Up for Bitcoin's Next Big Moment: The 2024 Halving" - Discover what this event means for Bitcoin and how it could affect you.

Get ready for the next great Bitcoin halving: everything you need to know

Before Bitcoin was launched in 2009, Satoshi Nakamoto designed the cryptocurrency to have a maximum supply of 21 million coins. As part of the greater plan, the number of new Bitcoin that enter circulation decreases at regular intervals, thus maintaining the total supply. These intervals are known as halvings, which we’ll get more into below.

What is the Bitcoin halving?

Roughly every 4 years, or every 210,000 blocks that are mined, the network undergoes a halving where the block reward for miners is reduced by 50%. This reward is earned for verifying transactions and adding a new block to the blockchain.

The halvings process decreases the rate at which new Bitcoins enter circulation, gradually depleting the remaining supply until the final satoshi is mined, expected to be around 2140. After that, miners will solely rely on transaction fees as an incentive to validate blocks.

The next Bitcoin halving is expected to take place in April 2024, when the mining reward will reduce from 6.25 BTC to 3.125 BTC.

Why does the halving occur?

The Bitcoin halving is pre-programmed into Bitcoin's core code and is not something that can be changed - it's set in stone. Designed to control and slow down the release of new Bitcoins over time results in fewer and fewer Bitcoin being minted after each halving event.

This limited supply is a key part of what gives Bitcoin its deflationary nature and potential for increasing value. As the supply is capped at 21 million, the dwindling new supply hitting the market reinforces Bitcoin's artificial scarcity.

Previous Bitcoin halvings

Below we look at previous halvings and how these affected the price of Bitcoin. Historically, 12 - 18 months after halvings, Bitcoin has reached a record high. While this is not the rule of thumb, it has certainly been witnessed.

2009 - Bitcoin launches

Date: 3 January 2009

Block reward: 50 BTC

2012 - Bitcoin’s first halving

Date: 28 November 2012

Block: 210,000

Block reward: 25 BTC

Price before halving (November 2012): Around $12

Next all-time high after halving: $1,156 (November 2013)

2016 - Bitcoin’s second halving

Date: 9 July 2016

Block: 420,000

Block reward: 12.5 BTC

Price before halving (July 2016): Around $650

Next all-time High after halving: $19,891 (December 2017)

2020 - Bitcoin’s third halving

Date: 11 May 2020

Block: 630,000

Block reward: 6.25 BTC

Price before halving (May 2020): Around $8,800

Next all-time high after halving: $69,000 (November 2021)

Taking a look at the future dates, the next halving is expected to take place in 2024, when the block reward will be reduced to 3.125 BTC. Thereafter, in 2028 (block reward 1.5625 BTC) and 2032 (block reward 0.78125). This will continue until all Bitcoins have been mined, expected to be in 2140.

Potential impacts of the upcoming halving

The next Bitcoin halving event is expected to have several potential impacts on the cryptocurrency. First and foremost, it will reduce the supply of new Bitcoins entering circulation by 50%, substantially decreasing the inflation rate. This scheduled supply rate reduction enhances Bitcoin's hardcoded scarcity which could lead to increased demand if investors view reduced supply as more desirable. Higher demand coupled with tightened supply could potentially drive up Bitcoin's price.

However, the halving will also cut block rewards for miners by 50%, which could force some smaller mining operations to shut down if their expenses outweigh newly reduced revenues. This may result in mining becoming less decentralised as larger entities with greater economies of scale are able to continue operating profitably. This could lead to further consolidation of the mining hashrate among a smaller number of big players.

Regardless of price movement, the 2024 halving will continue Bitcoin's disinflationary issuance schedule until the final Bitcoin is mined around 2140. This systematically dwindling supply reinforces one of Bitcoin's key value propositions as a deflationary asset with absolute scarcity built in by design.

The bottom line

The Bitcoin halving is a highly significant event worth learning about as it enforces the cryptocurrency's hardcoded disinflationary monetary policy. While past halvings have led to powerful bull markets and substantial price appreciation, as illustrated above, it's important to understand that future price movements remain unpredictable and cannot be relied on.

Bitcoin's value is influenced by a complex array of factors beyond just supply dynamics, including adoption rates, regulatory developments, and overall market sentiment. Though artificially constrained supply can increase scarcity, demand is ultimately the driving force behind long-term valuations.

.png)

Learn about one of the fastest-growing DeFi projects. We break yearn.finance down into simple bite-sized pieces so you can learn and understand more effectively.

After its launch in 2020, Yearn.Finance (YFI) quickly became one of the fastest-growing DeFi projects, attracting over $800 million in digital assets in its first month. In eight months, the total value locked (TVL) on the platform had grown to $1 billion. Yearn.Finance offers a range of lending and trading services that allow individuals to optimise their profits through automation and yield farming.

What is the Yearn.Finance platform?

Yearn.Finance (YFI) is a decentralised finance platform consisting of a group of protocols built on the Ethereum blockchain. These protocols allow users to maximise their digital asset earning potential through staking, lending aggregation and yield generation services.

The aim of the Yearn.Finance project is to make DeFi (decentralised finance) trading less complicated and more accessible to less technically-minded traders. The platform utilises automation to allow traders to maximise profits from yield farming.

Yearn Finance consists of four core products:

- Earn - establishes the highest interest rates that users can earn from lending crypto assets.

- Zap - groups together several trades in one click, reducing costs and labour.

- APY - comprehensive data table that analyses interest rates across various lending protocols.

- Vaults - investment strategies developed to yield the highest returns from other DeFi projects.

Through locking supported cryptocurrencies in Yearn.Finance smart contracts integrated into the Curve DeFi and Balancer trading platforms, users earn YFI tokens and can engage in yield farming practices. The more crypto assets that users lock into these protocols, the more tokens they receive.

To operate efficiently in a decentralised manner, Yearn.Finance built an impressive system of automated incentives rewarding participants who act in accordance with the outlined governance proposals with its YFI tokens. These proposals are voted in by YFI holders.

Who created Yearn.Finance (YFI)?

Yearn.Finance was launched in February 2020 by a prominent contender in the crypto space, Andre Cronje. Cronje led the launch of the platform having received no funding or reserving any tokens for himself, an exceptionally rare occurrence in the crypto assets and DeFi projects space.

On top of that, he also holds important roles at smart contract ecosystem Fantom and CryptoBriefing - a premier go-to resource for anyone interested in Initial Coin Offerings (ICOs) or crypto media market.

How does the Yearn Finance (YFI) platform work?

Yearn Finance offers users custom-built tools that act as an aggregator for other DeFi projects such as Aave, Compound, and Curve DeFi trading platforms.

Built on the Ethereum blockchain, Yearn.Finance deploys contracts on other compatible decentralised exchanges such as Balancer and Curve to maximise the earning potential for its users.

These contracts can be categorised into the four core products mentioned above, with most of the platform's services centred around lending or trading digital assets, and generating a passive income.

Earn

The earn product acts as a lending aggregator and searches across a selection of reputable lending protocols to find the best interest rates, allowing users to tap into the best rates when lending cryptocurrencies. Users can then deposit USDT, USDC, DAI, sUSD, or TUSD into liquidity pools directly through the Yearn.Finance platform to tap into those interest rates.

Zap

Saving time, costs and transaction fees, the zap product allows users to conduct several transactions in one click. For example, a user can trade DAI for yCRV in one smooth transaction, as opposed to several transactions on other DeFi projects.

APY (annual percentage yield)

Aggregates the earning potential on an annualised basis based on how much capital is invested by searching across the various lending protocols utilised by the Earn product.

Vaults

The more complex of the services offered by Yearn.Finance, the Vaults product allows users to tap into active investment strategies designed by the platform's own self-executing code. These essentially work as actively managed mutual funds with Yearn Finance being the financial intermediary.

Users looking to engage in this product, noting that it is still in experimental stages, would need to have some technical know-how to investigate how these strategies work as they are presented in Solidity (a smart contract-oriented programming language). Utilising the product, however, is less complicated, simply requiring users to deposit USDC or DAI in each strategy which then invests the funds in various liquidity pools.

What is the YFI token?

Launched in July 2020, the YFI token is based on the ERC-20 token standard and operates as a utility and governance token across the ecosystem. While anyone can make a proposal, only YFI holders are able to vote on proposals put forward regarding the governance and future development of the platform. The higher one's YFI token holding, the more voting power the YFI holders have. A proposal requires more than 50% of the votes in order to be passed.

The maximum supply of YFI tokens was 30,000, however, YFI holders voted to increase this. Following the successful proposal, the total supply is now 36,666 YFI tokens.

Holders are able to earn YFI tokens through revenue received through fees charged on the platform. These are generated through the 0.5% fees charged for using the Earn feature and 5% for the Vault service.

Hey there, Community! ✨

We've got some exciting news to share, and it's all about making your life a little bit easier and a whole lot clearer. We're thrilled to announce our partnership with TapiX – and before you wonder what this is all about, let me break it down into plain English, just for you.

No More Guessing Games 🎲

Ever looked at your transaction history and thought, "Where on earth did I spend that money?" We've all been there, scratching our heads, trying to decipher cryptic names or puzzling out just which coffee shop that was.

Here's where TapiX comes in – and why we're so excited about it. TapiX turns those confusing codes and names into information you can actually understand. We're talking real names of stores, complete with local language and all the details to make it click instantly. Yes, that means no more guessing games!

A Picture Speaks a Thousand Words 📷

But why stop at names? When you look at your transactions, you can now see actual logos and images – making it even easier to spot at a glance where you've been shopping. It's like turning your transaction history into a colourful gallery of your spending habits.

Pinpoint Shopping Locations📍

Ever got a charge from a store and wondered, "When did I go there?”. Now, you won't just see the name; you'll get the exact location. We're talking street address, city, even zip codes – perfect for those "Aha!" moments.

Extra Details at Your Fingertips 🫰

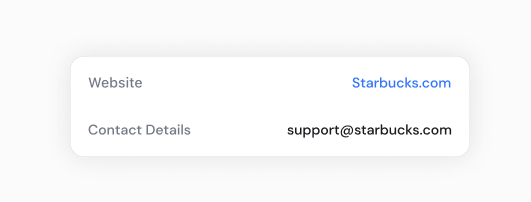

And there's more. Want to revisit a store but can't remember the name? You can now access additional details like website links, opening hours, and more for the store and companies that support it. It's like having a little assistant tucked away in your transaction history.

Why This Matters to You 👀

We believe managing your money should be as straightforward as shopping. That's why we partnered with TapiX – to transform your transaction list from a boring spreadsheet into a clear, understandable, and even helpful part of your daily life.

Here's what it boils down to: less time puzzling out your past spends and more time enjoying your present. Whether you're a budgeting pro or just trying to keep track of where your money's going, we think you'll love this new feature.

It's All About You 💙

At Tap, everything we do is aimed at giving you a better experience. We listen, we care, and we act on what you need. This partnership? It's all about making your financial life clearer and simpler.

We're here to help you make sense of your spending, save time, and maybe even discover some new favourite spots along the way. And this is just the beginning – we're always looking for ways to improve your experience.

So go ahead, take a look at your updated transaction history, and see the difference for yourself.

Here's to clearer, simpler, and more enjoyable finances.

Warmly,

The Tap Team.

Curious about what's in store for fintech this year? Get our Fintech market outlook 2024 ebook, we'll give you a glimpse into the trends and challenges shaping the industry this year.

To our esteemed Tap UK community members,

We are pleased to share some updates with you regarding the XTP locking feature and our premium plans. We're pleased to announce the reintroduction of the XTP locking feature, offering enhanced benefits to our EU/EEA users. However, we regret to inform you that our premium plans are still suspended in the UK due to regulatory restrictions, specifically the "financial promotion rule" enforced by the UK FCA.

While we acknowledge the temporary inconvenience experienced by our UK users due to this suspension, please be assured that our team is actively exploring some solutions to address this issue and bring back the premium plans for our UK community. We are dedicated to exploring potential resolutions that align with current regulatory requirements, while also ensuring that our premium plans can continue to offer valuable benefits to our users in the UK.

For more detailed information regarding the suspension, we invite you to review this article. We appreciate your understanding and patience as we work through this regulatory challenge.

-min.jpeg)